Question: Please answer letter N (22-25) only and provide solution. Thank you Chapter 26 Financial Statements (19) What is the amount of adjustment to the beginning

Please answer letter N (22-25) only and provide solution. Thank you

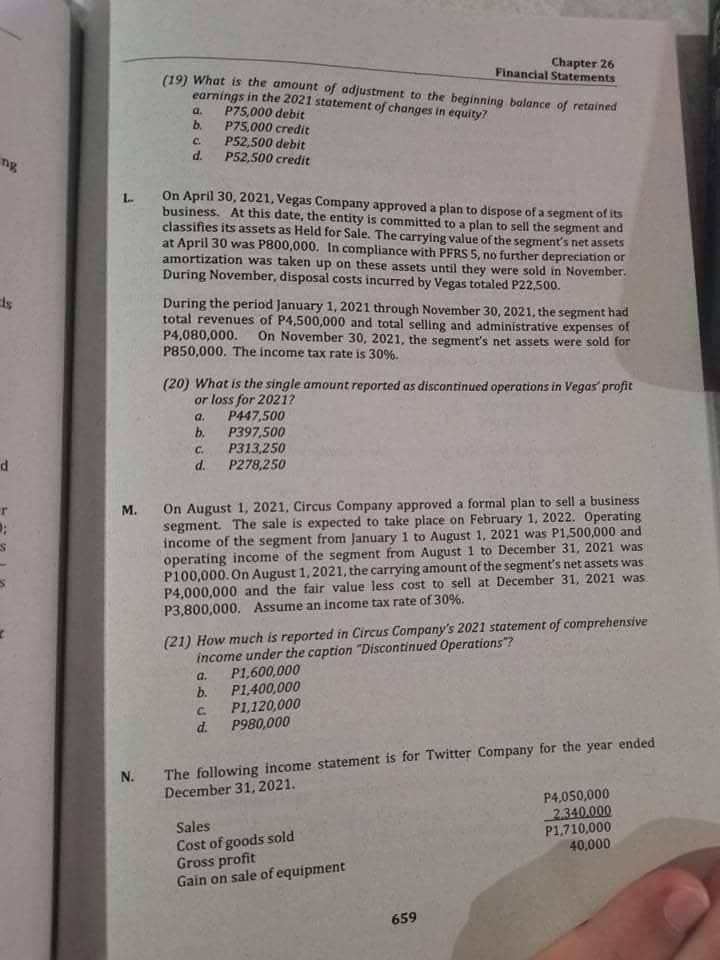

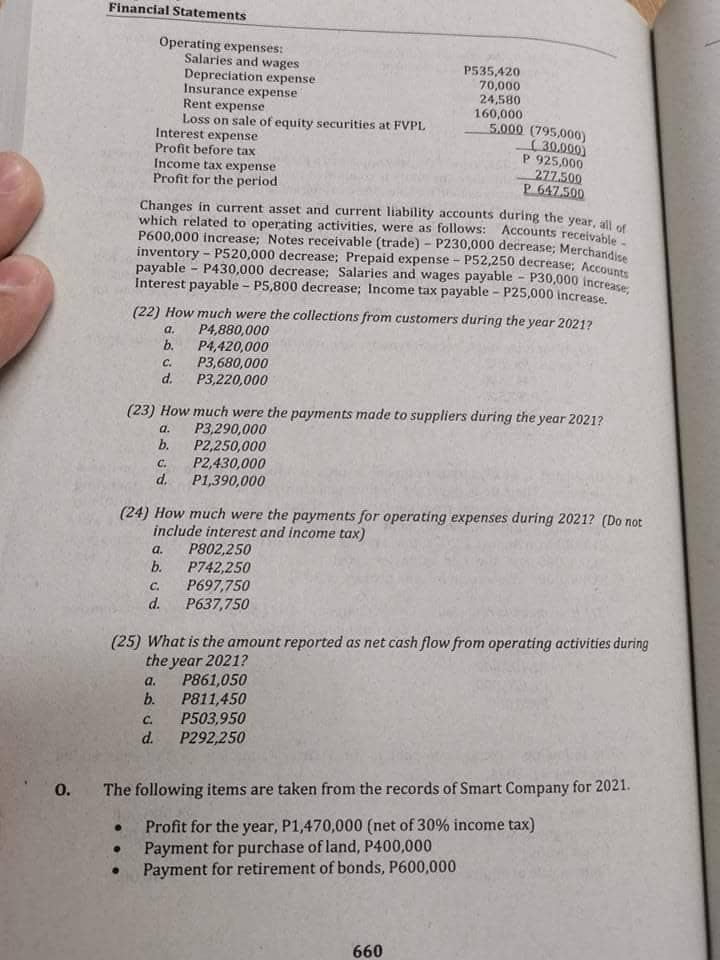

Chapter 26 Financial Statements (19) What is the amount of adjustment to the beginning balance of retained a. earnings in the 2021 statement of changes in equity? P75,000 debit b. P75,000 credit C. P52,500 debit d. P52,500 credit L On April 30, 2021, Vegas Company approved a plan to dispose of a segment of its business. At this date, the entity is committed to a plan to sell the segment and classifies its assets as Held for Sale. The carrying value of the segment's net assets at April 30 was P800,000. In compliance with PFRS 5, no further depreciation or amortization was taken up on these assets until they were sold in November. During November, disposal costs incurred by Vegas totaled P22,500. During the period January 1, 2021 through November 30, 2021, the segment had total revenues of P4,500,000 and total selling and administrative expenses of P4,080,000. On November 30, 2021, the segment's net assets were sold for P850,000. The income tax rate is 30%. (20) What is the single amount reported as discontinued operations in Vegas' profit or loss for 20217 a. P447,500 b. P397.500 C. P313,250 d. P278,250 M. On August 1, 2021. Circus Company approved a formal plan to sell a business segment. The sale is expected to take place on February 1, 2022. Operating income of the segment from January 1 to August 1, 2021 was P1,500,000 and operating income of the segment from August 1 to December 31, 2021 was P100,000. On August 1, 2021, the carrying amount of the segment's net assets was P4,000,000 and the fair value less cost to sell at December 31, 2021 was P3,800,000. Assume an income tax rate of 30%. (21) How much is reported in Circus Company's 2021 statement of comprehensive income under the caption "Discontinued Operations"? a. P1,600,000 b. P1,400,000 C. P1,120,000 P980,000 The following income statement is for Twitter Company for the year ended N. December 31, 2021. P4,050,000 _2.340.000 Sales P1,710,000 Cost of goods sold 40,000 Gross profit Gain on sale of equipment 659Financial Statements Operating expenses: Salaries and wages P535.420 Depreciation expense 70,000 Insurance expense 24,580 Rent expense 160,000 Loss on sale of equity securities at FVPL 5.000 (795,000) Interest expense ( 30.000) Profit before tax P 925,000 Income tax expense 277.500 Profit for the period P 647.500 Changes in current asset and current liability accounts during the year, all or which related to operating activities, were as follows: Accounts receivable - P600,000 Increase; Notes receivable (trade) - P230,000 decrease, Merchandise inventory - P520,000 decrease; Prepaid expense - P52,250 decrease; Accounts payable - P430,000 decrease; Salaries and wages payable - P30,000 increase. Interest payable - P5,800 decrease; Income tax payable - P25,000 increase. (22) How much were the collections from customers during the year 2021? a. P4,880,000 b. P4,420,000 C. P3,680,000 d. P3,220,000 (23) How much were the payments made to suppliers during the year 2021? a. P3,290,000 b . P2,250,000 C. P2,430,000 d. P1,390,000 (24) How much were the payments for operating expenses during 2021? (Do not include interest and income tax) a. P802,250 b. P742,250 C. P697,750 d. P637,750 (25) What is the amount reported as net cash flow from operating activities during the year 2021? a. P861,050 b. P811,450 C. P503,950 d. P292,250 O. The following items are taken from the records of Smart Company for 2021. Profit for the year, P1,470,000 (net of 30% income tax) Payment for purchase of land, P400,000 Payment for retirement of bonds, P600,000 660

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts