Question: please answer me asap Block, Hirt, Danielson and Short: 12ce Problem 16-30 (LO 6) Lease vs. borrow to purchase analysis Kumquat Farms Ltd. has decided

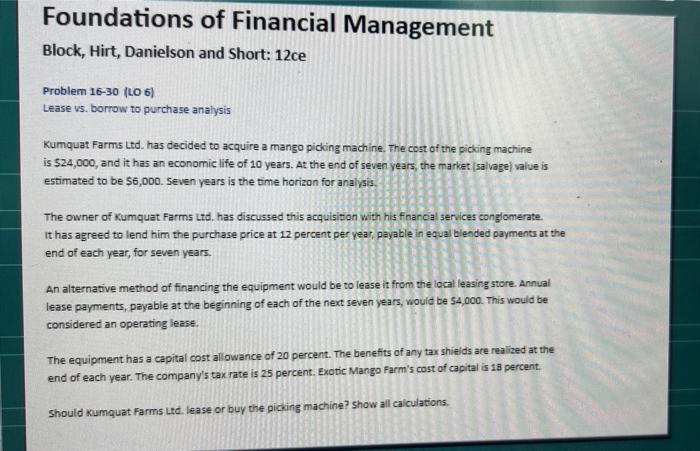

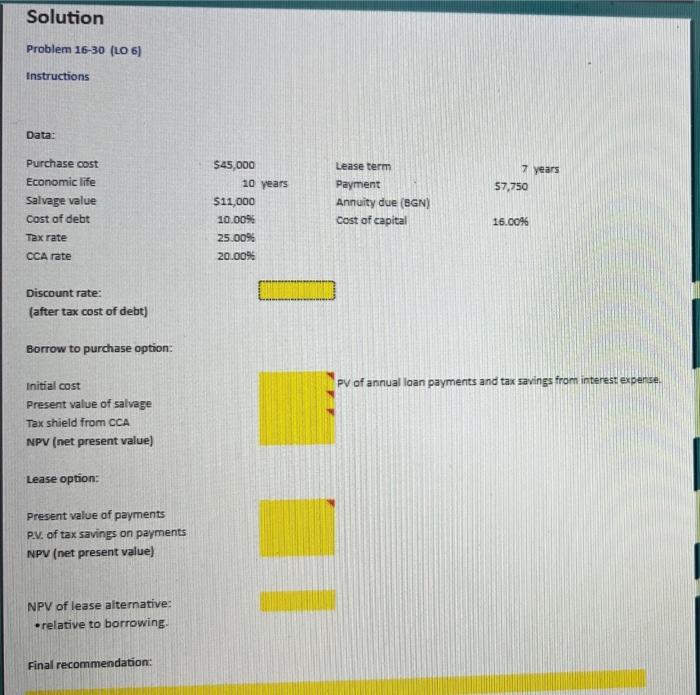

Block, Hirt, Danielson and Short: 12ce Problem 16-30 (LO 6) Lease vs. borrow to purchase analysis Kumquat Farms Ltd. has decided to acquire a mango picking machine. The cost of the picking machine is 524,000 , and it has an economic life of 10 years. At the end of seven years, the market (salvage) value is estimated to be $6,000. Seven years is the time horizon for analyis, The owner of Kumquat Farms Ltd. has discussed this acquisiton with his finanoal services conglomerate. It has agreed to lend him the purchase price at 12 percent per year, payable in equal blended payments at the end of each year, for seven years. An alternative method of financing the equipment would be to lease it from the local leasing store. Annual lease payments, payable at the beginning of each of the next seven years, would be 54,000 . This would be considered an operating lease. The equipment has a capital cost allowance of 20 percent. The benefits of any tar shields are realized at the end of each year. The company's tax rate is 25 percent. Exotic Mango farm's cost of capital is 18 percent. Should kumquat. Farms Ltd. lease or buy the picking machine? show all calculations. Solution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts