Question: Please answer! need formulas and steps Suppose you take a 7 year loan of $50,000 with an interest rate of 9% and annual payments starting

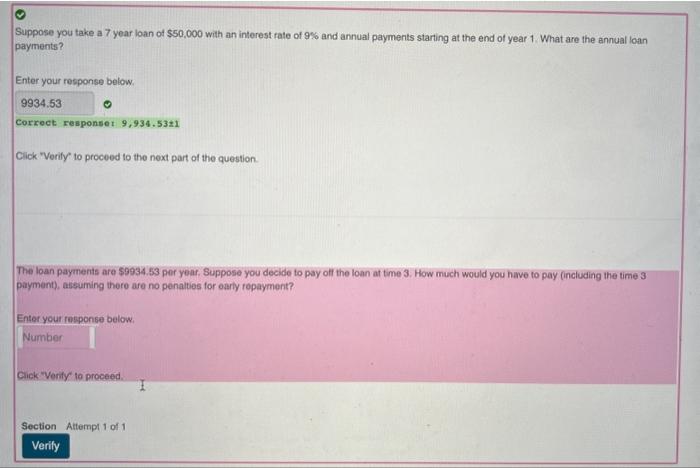

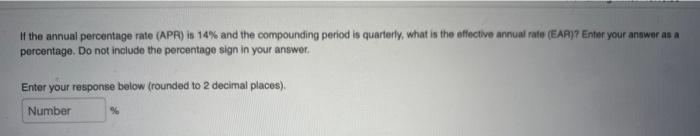

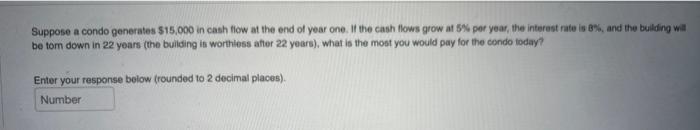

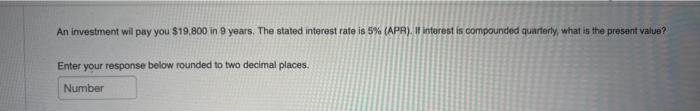

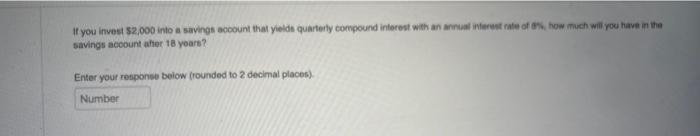

Suppose you take a 7 year loan of $50,000 with an interest rate of 9% and annual payments starting at the end of year 1 . What are the annual loan payments? Enter your response below. Correct responset 9,934.5321 Click "Verify" to proceed to the next part of the question. The loan payments are \$9934.53 per year. Suppose you decide to pay off the loan at time 3. How much would you have to pay (including the time 3 payment), assuming there are no penalties for oarly repayment? Enter your response below. Cick "Verity to proceed. Section If the annual percentage rate (APA) is 14% and the compounding period is quarterfy, what is the offective annual rate (EAP)? Enter your answer as a percentage. Do not include the percentage sign in your answor. Enter your response below (rounded to 2 decimal places). Suppose a condo generates $15.000 in cash flow at the end of year one. If the cash flows grow at 5% per year, the interast nate is 3%, and the building wil be torn down in 22 years (the building is worthiess after 22 years), what is the most you would pay for the condo today? Enter your response below (rounded to 2 decimal places). An investment wil pay you $19,800 in 9 years. The stated interest rate is 5% (APA) If inferest is compounded quarterly, what is the present value? Enter your response below rounded to two decimal places. savings account ahter 18 yoars? Enter you respones beiow (rounded to 2 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts