Question: please answer number 5. also please label each answer (eg. 5.a, 5b..) thank you so much! needed by tonight. 5:08 PM nexus.uwinnipeg.ca 0000 Bell 8996

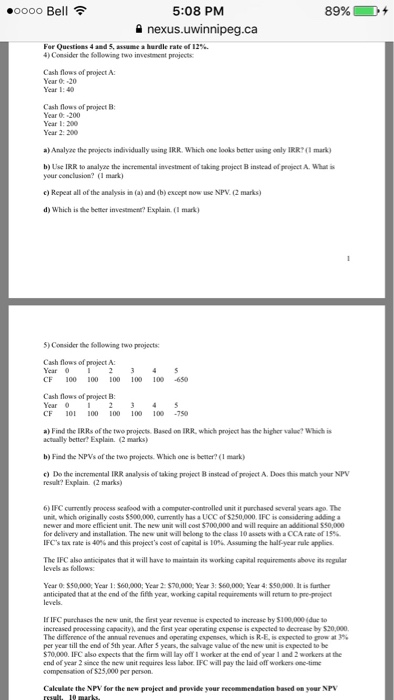

5:08 PM nexus.uwinnipeg.ca 0000 Bell 8996 + For Questioas 4 aad 5, assume a hurdle rate of 12%. 4) Consider the Sollowing two imvestment projects Cash flows of project A: Year 0 20 Cash flows of project B Year 0-200 Year I: 200 Year 2: 200 a) Analyze the peojects indinvidually ing IRR Which one looks better using only IRR(l mark) b) Use IRR 1o analyze the incremental investment of taking project B itilead of peyect A.Wh your conclusion?( mark) c) Repeat all of the analysts (a) and (b) except now use NPV. (2 marks) d) Which is the better investment? Explain. (I mark 5) Consider the Sollowing two projects Cash flows of project A: Year 2 3S CF 100 100 100 00 10 650 Cash flows of project B: Year CF 101 00 100 00 100 -750 a) Find the IRRs of the two projects Based on IR.R which project has the higher vales? Which is actually better? Explain. (2 marks) b) Fied the NPVs of the two projects. Which one is beter?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts