Question: please answer number 5. Please calculate each answer in handwriting and not excel so I can understand how each answer is achieved Your firm is

please answer number 5. Please calculate each answer in handwriting and not excel so I can understand how each answer is achieved

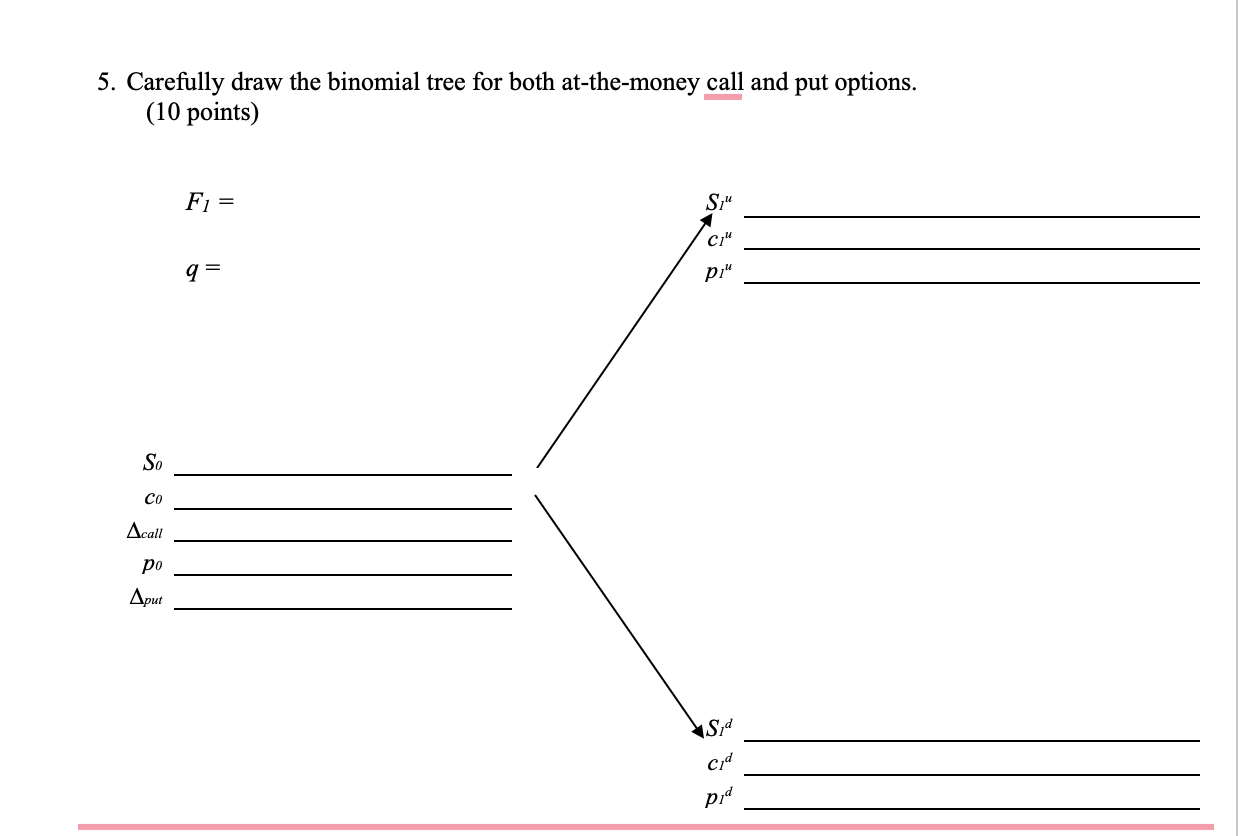

Your firm is a U.S.-based importer of Italian bicycles. AS AN IMPORTER, YOU ARE BUYING BICYCLES AND PAYING OUT EURO. You have placed an order with an Italian supplier for 60,000.00 worth of bicycles. Payment in ) is due in 12 months. One-year at-the-money put and call options on 10,000 exist. The spot exchange rate is $1.1500/. In the next period, the euro can increase in dollar value to $1.25/ or fall to $1.05/. The interest rate in dollars is is = 7.10%; the interest rate in the euro zone is ie = 5.00%. 1. Outline a strategy using spot exchange rates and borrowing or lending (i.e. a money market hedge) that that will redenominate this payable into USD. Your answer is a sentence. (5 points) Buy the PV of the payable today at the spot exchange rate $1.157, invest that at interest in a euro-denominated account. 2. Calculate the net future value of your money market hedge. (5 points) show your work re60,000.1 $70,380.00 = 1.05 $1.150 X1.071 1.00 This answer must agree with your answer to question 1. 3. Outline a strategy using the forward market that will hedge this payable into USD. Your answer is a sentence. (5 points) Golong in a forward contract on 60,000 at Fi($/) = $1.1730/. 4. Calculate the net future value of your forward market hedge. (5 points) show your work $1.1730 $70.380.00 =60,000x e1.00 $1.1730 1.00 $1.15 1.071 1.00 1.05 This answer has to agree with your answer to question 3 5. Carefully draw the binomial tree for both at-the-money call and put options. (10 points) F1 = Siu c" a= pi" SO Acall Aput S Cd pid Your firm is a U.S.-based importer of Italian bicycles. AS AN IMPORTER, YOU ARE BUYING BICYCLES AND PAYING OUT EURO. You have placed an order with an Italian supplier for 60,000.00 worth of bicycles. Payment in ) is due in 12 months. One-year at-the-money put and call options on 10,000 exist. The spot exchange rate is $1.1500/. In the next period, the euro can increase in dollar value to $1.25/ or fall to $1.05/. The interest rate in dollars is is = 7.10%; the interest rate in the euro zone is ie = 5.00%. 1. Outline a strategy using spot exchange rates and borrowing or lending (i.e. a money market hedge) that that will redenominate this payable into USD. Your answer is a sentence. (5 points) Buy the PV of the payable today at the spot exchange rate $1.157, invest that at interest in a euro-denominated account. 2. Calculate the net future value of your money market hedge. (5 points) show your work re60,000.1 $70,380.00 = 1.05 $1.150 X1.071 1.00 This answer must agree with your answer to question 1. 3. Outline a strategy using the forward market that will hedge this payable into USD. Your answer is a sentence. (5 points) Golong in a forward contract on 60,000 at Fi($/) = $1.1730/. 4. Calculate the net future value of your forward market hedge. (5 points) show your work $1.1730 $70.380.00 =60,000x e1.00 $1.1730 1.00 $1.15 1.071 1.00 1.05 This answer has to agree with your answer to question 3 5. Carefully draw the binomial tree for both at-the-money call and put options. (10 points) F1 = Siu c" a= pi" SO Acall Aput S Cd pid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts