Question: Q.1. Please answer the below six sub-questions with the core business of Starbucks in mind. Also, please watch the following video: https://www.youtube.com/watch?v=XUBeH7VQaFY and read the

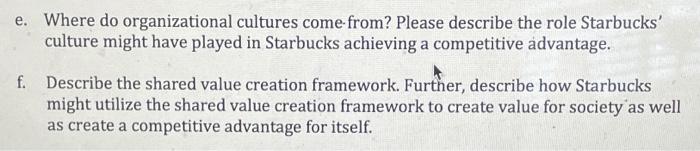

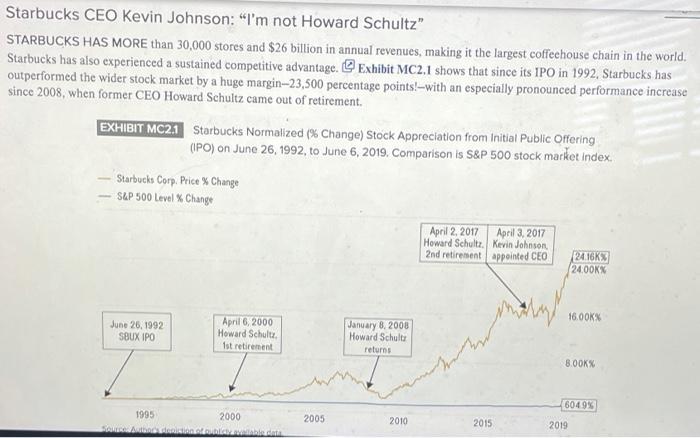

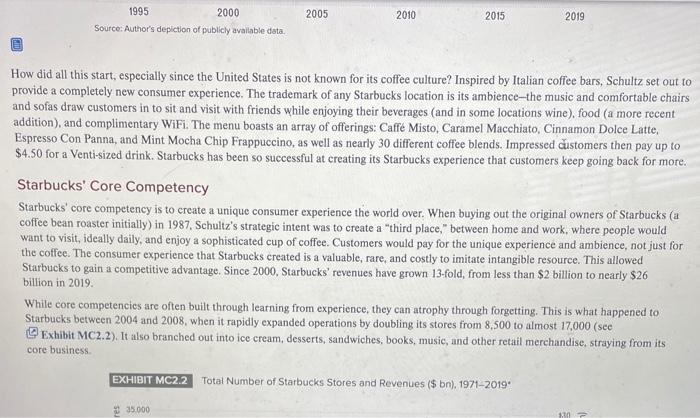

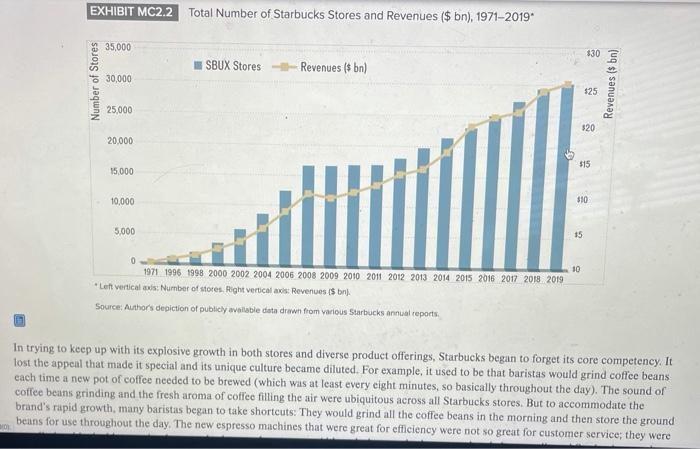

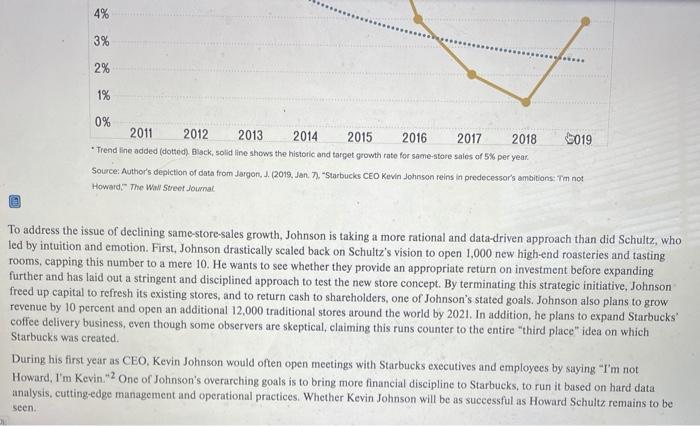

Q.1. Please answer the below six sub-questions with the core business of Starbucks in mind. Also, please watch the following video: https://www.youtube.com/watch?v=XUBeH7VQaFY and read the Starbucks mini-case on pages 475 to 479 in the textbook before you answer the below sub-questions. a. What type of innovation do you think Starbucks is utilizing? What might be some of the advantages and disadvantages of utilizing this type of innovation? b. Why does Starbucks pursue a high-growth strategy? Does Starbucks pursue vertical integration or corporate diversification or both? Please use one or more real-life Starbucks' examples to strengthen your answer. c. What are some other options (listed in chapters nine and ten in the textbook) that you believe might be appropriate for Starbucks' executives to further drive firm growth? How might the Build-Borrow-or-Buy Framework help Starbucks' executives decide which of these other options to pursue? d. Describe the two opposing forces that Starbucks might face when competing around the globe. Further, describe what you believe might be the best strategic position for Starbucks among all of the different strategic positions suggested by the Integration-Responsiveness Framework. Finally, please elaborate upon why your suggested strategic position would be the best strategic position for Starbucks when competing globally. e. Where do organizational cultures come from? Please describe the role Starbucks' culture might have played in Starbucks achieving a competitive advantage. f. Describe the shared value creation framework. Further, describe how Starbucks might utilize the shared value creation framework to create value for society as well as create a competitive advantage for itself. Starbucks CEO Kevin Johnson: "I'm not Howard Schultz" STARBUCKS HAS MORE than 30,000 stores and $26 billion in annual revenues, making it the largest coffeehouse chain in the world, Starbucks has also experienced a sustained competitive advantage. Exhibit MC2.1 shows that since its IPO in 1992, Starbucks has outperformed the wider stock market by a huge margin-23,500 percentage points!--with an especially pronounced performance increase since 2008, when former CEO Howard Schultz came out of retirement EXHIBIT MC2.1 Starbucks Normalized (% Change) Stock Appreciation from Initial Public Offering (IPO) on June 26, 1992, to June 6, 2019. Comparison is S&P 500 stock market index. Starbucks Corp. Price % Change S&P 500 Level % Change April 2, 2017 April 3, 2017 Howard Schult. Kevin Johnson 2nd retirement appointed CEO 24.16K 24.00K 16.00KX June 26, 1992 SBUX IPO April 6, 2000 Howard Schultz 1st retirement January 8, 2008 Howard Schultz returns 8.00KX 6049% 2000 1995 SARI 2005 2010 2015 2019 2005 2010 2015 1995 2000 Source: Author's depiction of publicly available data 2019 How did all this start, especially since the United States is not known for its coffee culture? Inspired by Italian coffee bars, Schultz set out to provide a completely new consumer experience. The trademark of any Starbucks location is its ambience-the music and comfortable chairs and sofas draw customers in to sit and visit with friends while enjoying their beverages (and in some locations wine), food (a more recent addition), and complimentary WiFi. The menu boasts an array of offerings: Caffe Misto, Caramel Macchiato, Cinnamon Dolce Latte, Espresso Con Panna, and Mint Mocha Chip Frappuccino, as well as nearly 30 different coffee blends. Impressed dustomers then pay up to $4.50 for a Venti-sized drink. Starbucks has been so successful at creating its Starbucks experience that customers keep going back for more. Starbucks' Core Competency Starbucks' core competency is to create a unique consumer experience the world over. When buying out the original owners of Starbucks (a coffee bean roaster initially) in 1987, Schultz's strategic intent was to create a "third place," between home and work, where people would want to visit, ideally daily, and enjoy a sophisticated cup of coffee. Customers would pay for the unique experience and ambience, not just for the coffee. The consumer experience that Starbucks created is a valuable, rare, and costly to imitate intangible resource. This allowed Starbucks to gain a competitive advantage. Since 2000, Starbucks' revenues have grown 13-fold, from less than $2 billion to nearly $26 billion in 2019. While core competencies are often built through learning from experience, they can atrophy through forgetting. This is what happened to Starbucks between 2004 and 2008, when it rapidly expanded operations by doubling its stores from 8,500 to almost 17,000 (see Exhibit MC2.2). It also branched out into ice cream, desserts, sandwiches, books, music, and other retail merchandise, straying from its core business EXHIBIT MC2.2 Total Number of Starbucks Stores and Revenues ($ bn), 1971-2019 335.000 EXHIBIT MC2.2 Total Number of Starbucks Stores and Revenues ($bn), 1971-2019* 35,000 $30 SBUX Stores Revenues (bn) Number of Stores 30,000 Revenues (bn) $25 25,000 $20 20,000 $15 15.000 10,000 $10 1000 15 10 0 1971 1996 1998 2000 2002 2004 2005 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 "Left vertical Number of stores. Right verticals: Revenues is on Source: Author's depiction of publicly available data drawn from various Starbucks annual reports In trying to keep up with its explosive growth in both stores and diverse product offerings, Starbucks began to forget its core competency. It lost the appeal that made it special and its unique culture became diluted. For example, it used to be that baristas would grind coffee beans each time a new pot of coffee needed to be brewed (which was at least every eight minutes, so basically throughout the day). The sound of coffee beans grinding and the fresh aroma of coffee filling the air were ubiquitous across all Starbucks stores. But to accommodate the brand's rapid growth, many baristas began to take shortcuts: They would grind all the coffee beans in the morning and then store the ground beans for use throughout the day. The new espresso machines that were great for efficiency were not so great for customer service; they were that were great conciency were not so great for customer Service, they were so tall, they blocked interaction between baristas and customers. Although these and other operational changes allowed Starbucks to reduce costs and improve efficiency, they undercut Starbucks' primary reason for success-going to Starbucks not simply for the quick cup of coffee, but for the whole Starbucks coffee experience. Losing a blind tastotest to fast food giant McDonald's further underscored the negative impact of cost-reduction measures. As one of among six coffees tested, Starbucks came in last. Even run-of-the-mill supermarket brands rated higher. Customers that were not fans of the Starbucks flavor had nicknamed the chain "Charbucks" to reflect what some critics claimed to be an apt description: overly roasted, dark, and bitter To make matters worse, the 2008 global financial crisis hit Starbucks hard. As is usually the case during a recession, the first items Page 476 consumers tend to sacrifice are luxury items-people were no longer ordering $4.50 Venti cups of Starbucks coffee (see revenue drop in Exhibit MC2.2). Howard Schultz's Return In January 2008, Howard Schultz came out of an eight-year retirement to once again take the reins as CEO of Starbucks. His mission was to ro create what had made Starbucks so special from the start. Upon his return, he immediately launched several strategic initiatives to turn the company around. Just a month after coming back. Schultz ordered more than 7,000 Starbucks stores across the United States to close for one day, so baristas could relearn the perfect way to prepare coffee. The company lost over $6 million in revenue that day, which heightened investor jitters. The financial hit and investor anxiety notwithstanding. Schultz knew it was critical for Starbucks employees to relearn what made the Starbucks experience so unique-he saw this as the key to restoring its corporate culture. Page 477 NEW STRATEGIC INITIATIVES In 2009, Starbucks introduced Via, its new instant coffee, a move that some worried might further dilute the brand. In 2010, Schultz rolled out new customer service guidelines: Baristas would no longer make multiple drinks at the same time, but, rather, concentrate on no more than two drinks at a time, starting a second one while finishing the first. Schultz also focused on readjusting store managers' goals. Before Schultz's return, managers had been mandated to focus on sales growth. Schultz, however, knowing that Starbucks' main differentiator was its special customer experience, instructed managers to shin their attention and efforts accordingly Although its earlier attempt to diversify away from its core business in the mid-2000s failed, it succeeded under Schultz. Late afternoons and early evenings were traditionally always the slowest times for Starbucks, so it became Schultz's goal to increase store traffic beyond the regular morning hours, when customers typically visited for their daily shots of caffeine Schultz started by adding baked goods, sandwiches, and other small food items to the menu. To invite an even later crowd, he then introduced fresh vegetable plates, flatbread pizza, cheese plates, and desserts. Eventually, he added alcoholic beverages such as wine and beer (to be served after 4 p.m. only) as part of Starbucks "Evenings" program Starbucks continued in these efforts by introducing new luxury items, catering to the wealthier customers within is existing customer base. It introduced limited-run, exclusive batches of varietal coffees for home use and sold them at high price points online and in stores. Some stores also included these same higher-priced roasts on their menus. By 2014, Starbucks had launched its new Starbucks Reserve Roastery and Tasting Room. The first of these super high-end stores-with more on the horizon-was opened in Starbucks' home city, Seattle. Indeed, Schultz's plan was to open as many as 1,000 of these large-format. high-end roasteries in both national and international locations with the hopes they would improve declining sales and refresh the brand. Schultz believed that customers would enjoy the experience of watching baristas brew speciality coffees using the latest techniques (and thus willing to pay $12 a cup), mixing cocktails, and serving artisanal baked goods and other food items. Schultz wanted these rousteries to be a new "third place" for people to visit between work and home. MODIFIED STRATEGIC INITIATIVES Many of the new initiatives just discussed have since been modified. For example, Starbucks has retooled its Evenings program, announcing in 2017 that it would serve alcohol only at its roastery locations. These modification have not dampened its ambitions. Over the next few years, Starbucks aims to double its food revenues and be recognized as an evening food and wine destination. To symbolize its transition from a traditional coffeehouse, Starbucks dropped the word coffee from its logo. Schultz also pushed the adoption of new technology to engage with customers more intimately and effectively. It now uses Facebook and Twitter to communicate with customers more or less in real time. In 2019, Starbucks had 26 million mobile payment users, more than that of Apple Pay (25 million), Google Pay (13 million), and Samsung Pay ( 12 million). Experts predict that by 2022, Starbucks will have 30 million users on its mobile ordering and payment app, and will continue to lead Apple, Google, and Samsung. Some 30 percent of all mationsstasca.wmdamin mobile devices. The Schicksam allowstomers.orderinfodrink and food With more than 14,000 stores in the U.S. market, Schultz started looking overseas for growth opportunities. Although traditionally a tea- drinking nation, coffee is catching on with urban professionals in China. In 2019, Starbucks had more than 3,500 stores in China, up from 1.500 in 2015. Starbucks plans to continue its rapid penetration of the Chinese market, aiming to operate 6,000 stores by 2022. Over the next few years, Starbucks also plans to double its presence in other areas of Asia (opening more than 4,000 cafs). Page 478 Kevin Johnson Is Not Howard Schultz In 2017, nine years after coming out of retirement to initiate a successful turnaround, Howard Schultz once again stepped down as Starbucks CEO in a second attempt at retirement (see Exhibit MC2.1). After his return, Starbucks' market valuation had appreciated approximately five-fold. Schultz's strategic leadership was clearly critical in turning Starbucks around. Some worry that Starbucks' success is uniquely dependent on Schultz, suggesting that Schultz (and Starbucks) may have a strategic weakness in executive leadership succession planning. The primary evidence of this is that Starbucks stagnated and even went into decline during Schultz's absence. Some argue that Starbucks' struggle after Schultz's first departure is similar to Microsoft's challenges after Bill Gates stepped down from day-to-day business, Dell Computer after the first retirement of Michael Dell (now back), Walmart after the retirement of Sam Walton, and Apple after Steve Jobs was forced out in 1985. Although technically speaking, Howard Schultz is not a founder of Starbucks, he is the one who created the company as we know it today. Schultz hopes that this second retirement from the company that he built from the ground up will be his last. In the meantime, new CEO Kevin Johnson, who transitioned from Microsoft, faces several challenges-in particular, how to maintain Starbucks' core competencies and how to achieve future growth-both domestically and internationally. The maturing sales of the more than 14,000 US-based stores is one of the biggest challenges facing Johnson today Exhibit MC2.3 displays the growth of same store salex (same-store sales is an important performance metric in the retail industry, it applies to stores that have been in existence for at least one year). Such sales have not only declined over the past decade, but have also fallen under its historic 5-percent growth threshold-a number that Starbucks has achieved for most of the past three decades. 4% 3% 2% 1% 2011 0% 2012 2013 2014 2015 2016 2017 2018 2019 Trendline added (dotted) Black, solid line shows the historic and target growth rate for same-store sales of 5% per year Source: Author's depletion of data from Jargon, J. (2019, Jan. 7). "Starbucks CEO Kevin Johnson reins in predecessor's ambitions: T'm not Howard." The Www Street Journal To address the issue of declining same-store-sales growth, Johnson is taking a more rational and data-driven approach than did Schultz, who led by intuition and emotion. First, Johnson drastically scaled back on Schultz's vision to open 1,000 new high-end roasteries and tasting rooms, capping this number to a mere 10. He wants to see whether they provide an appropriate return on investment before expanding further and has laid out a stringent and disciplined approach to test the new store concept. By terminating this strategic initiative, Johnson freed up capital to refresh its existing stores, and to return cash to shareholders, one of Johnson's stated goals. Johnson also plans to grow revenue by 10 percent and open an additional 12,000 traditional stores around the world by 2021. In addition, he plans to expand Starbucks coffee delivery business, even though some observers are skeptical, claiming this runs counter to the entire "third place" idea on which Starbucks was created During his first year as CEO, Kevin Johnson would often open meetings with Starbucks executives and employees by saying "I'm not Howard, I'm Kevin. One of Johnson's overarching goals is to bring more financial discipline to Starbucks, to run it based on hard data analysis, cutting-edge management and operational practices. Whether Kevin Johnson will be as successful as Howard Schultz remains to be seen. Q.1. Please answer the below six sub-questions with the core business of Starbucks in mind. Also, please watch the following video: https://www.youtube.com/watch?v=XUBeH7VQaFY and read the Starbucks mini-case on pages 475 to 479 in the textbook before you answer the below sub-questions. a. What type of innovation do you think Starbucks is utilizing? What might be some of the advantages and disadvantages of utilizing this type of innovation? b. Why does Starbucks pursue a high-growth strategy? Does Starbucks pursue vertical integration or corporate diversification or both? Please use one or more real-life Starbucks' examples to strengthen your answer. c. What are some other options (listed in chapters nine and ten in the textbook) that you believe might be appropriate for Starbucks' executives to further drive firm growth? How might the Build-Borrow-or-Buy Framework help Starbucks' executives decide which of these other options to pursue? d. Describe the two opposing forces that Starbucks might face when competing around the globe. Further, describe what you believe might be the best strategic position for Starbucks among all of the different strategic positions suggested by the Integration-Responsiveness Framework. Finally, please elaborate upon why your suggested strategic position would be the best strategic position for Starbucks when competing globally. e. Where do organizational cultures come from? Please describe the role Starbucks' culture might have played in Starbucks achieving a competitive advantage. f. Describe the shared value creation framework. Further, describe how Starbucks might utilize the shared value creation framework to create value for society as well as create a competitive advantage for itself. Starbucks CEO Kevin Johnson: "I'm not Howard Schultz" STARBUCKS HAS MORE than 30,000 stores and $26 billion in annual revenues, making it the largest coffeehouse chain in the world, Starbucks has also experienced a sustained competitive advantage. Exhibit MC2.1 shows that since its IPO in 1992, Starbucks has outperformed the wider stock market by a huge margin-23,500 percentage points!--with an especially pronounced performance increase since 2008, when former CEO Howard Schultz came out of retirement EXHIBIT MC2.1 Starbucks Normalized (% Change) Stock Appreciation from Initial Public Offering (IPO) on June 26, 1992, to June 6, 2019. Comparison is S&P 500 stock market index. Starbucks Corp. Price % Change S&P 500 Level % Change April 2, 2017 April 3, 2017 Howard Schult. Kevin Johnson 2nd retirement appointed CEO 24.16K 24.00K 16.00KX June 26, 1992 SBUX IPO April 6, 2000 Howard Schultz 1st retirement January 8, 2008 Howard Schultz returns 8.00KX 6049% 2000 1995 SARI 2005 2010 2015 2019 2005 2010 2015 1995 2000 Source: Author's depiction of publicly available data 2019 How did all this start, especially since the United States is not known for its coffee culture? Inspired by Italian coffee bars, Schultz set out to provide a completely new consumer experience. The trademark of any Starbucks location is its ambience-the music and comfortable chairs and sofas draw customers in to sit and visit with friends while enjoying their beverages (and in some locations wine), food (a more recent addition), and complimentary WiFi. The menu boasts an array of offerings: Caffe Misto, Caramel Macchiato, Cinnamon Dolce Latte, Espresso Con Panna, and Mint Mocha Chip Frappuccino, as well as nearly 30 different coffee blends. Impressed dustomers then pay up to $4.50 for a Venti-sized drink. Starbucks has been so successful at creating its Starbucks experience that customers keep going back for more. Starbucks' Core Competency Starbucks' core competency is to create a unique consumer experience the world over. When buying out the original owners of Starbucks (a coffee bean roaster initially) in 1987, Schultz's strategic intent was to create a "third place," between home and work, where people would want to visit, ideally daily, and enjoy a sophisticated cup of coffee. Customers would pay for the unique experience and ambience, not just for the coffee. The consumer experience that Starbucks created is a valuable, rare, and costly to imitate intangible resource. This allowed Starbucks to gain a competitive advantage. Since 2000, Starbucks' revenues have grown 13-fold, from less than $2 billion to nearly $26 billion in 2019. While core competencies are often built through learning from experience, they can atrophy through forgetting. This is what happened to Starbucks between 2004 and 2008, when it rapidly expanded operations by doubling its stores from 8,500 to almost 17,000 (see Exhibit MC2.2). It also branched out into ice cream, desserts, sandwiches, books, music, and other retail merchandise, straying from its core business EXHIBIT MC2.2 Total Number of Starbucks Stores and Revenues ($ bn), 1971-2019 335.000 EXHIBIT MC2.2 Total Number of Starbucks Stores and Revenues ($bn), 1971-2019* 35,000 $30 SBUX Stores Revenues (bn) Number of Stores 30,000 Revenues (bn) $25 25,000 $20 20,000 $15 15.000 10,000 $10 1000 15 10 0 1971 1996 1998 2000 2002 2004 2005 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 "Left vertical Number of stores. Right verticals: Revenues is on Source: Author's depiction of publicly available data drawn from various Starbucks annual reports In trying to keep up with its explosive growth in both stores and diverse product offerings, Starbucks began to forget its core competency. It lost the appeal that made it special and its unique culture became diluted. For example, it used to be that baristas would grind coffee beans each time a new pot of coffee needed to be brewed (which was at least every eight minutes, so basically throughout the day). The sound of coffee beans grinding and the fresh aroma of coffee filling the air were ubiquitous across all Starbucks stores. But to accommodate the brand's rapid growth, many baristas began to take shortcuts: They would grind all the coffee beans in the morning and then store the ground beans for use throughout the day. The new espresso machines that were great for efficiency were not so great for customer service; they were that were great conciency were not so great for customer Service, they were so tall, they blocked interaction between baristas and customers. Although these and other operational changes allowed Starbucks to reduce costs and improve efficiency, they undercut Starbucks' primary reason for success-going to Starbucks not simply for the quick cup of coffee, but for the whole Starbucks coffee experience. Losing a blind tastotest to fast food giant McDonald's further underscored the negative impact of cost-reduction measures. As one of among six coffees tested, Starbucks came in last. Even run-of-the-mill supermarket brands rated higher. Customers that were not fans of the Starbucks flavor had nicknamed the chain "Charbucks" to reflect what some critics claimed to be an apt description: overly roasted, dark, and bitter To make matters worse, the 2008 global financial crisis hit Starbucks hard. As is usually the case during a recession, the first items Page 476 consumers tend to sacrifice are luxury items-people were no longer ordering $4.50 Venti cups of Starbucks coffee (see revenue drop in Exhibit MC2.2). Howard Schultz's Return In January 2008, Howard Schultz came out of an eight-year retirement to once again take the reins as CEO of Starbucks. His mission was to ro create what had made Starbucks so special from the start. Upon his return, he immediately launched several strategic initiatives to turn the company around. Just a month after coming back. Schultz ordered more than 7,000 Starbucks stores across the United States to close for one day, so baristas could relearn the perfect way to prepare coffee. The company lost over $6 million in revenue that day, which heightened investor jitters. The financial hit and investor anxiety notwithstanding. Schultz knew it was critical for Starbucks employees to relearn what made the Starbucks experience so unique-he saw this as the key to restoring its corporate culture. Page 477 NEW STRATEGIC INITIATIVES In 2009, Starbucks introduced Via, its new instant coffee, a move that some worried might further dilute the brand. In 2010, Schultz rolled out new customer service guidelines: Baristas would no longer make multiple drinks at the same time, but, rather, concentrate on no more than two drinks at a time, starting a second one while finishing the first. Schultz also focused on readjusting store managers' goals. Before Schultz's return, managers had been mandated to focus on sales growth. Schultz, however, knowing that Starbucks' main differentiator was its special customer experience, instructed managers to shin their attention and efforts accordingly Although its earlier attempt to diversify away from its core business in the mid-2000s failed, it succeeded under Schultz. Late afternoons and early evenings were traditionally always the slowest times for Starbucks, so it became Schultz's goal to increase store traffic beyond the regular morning hours, when customers typically visited for their daily shots of caffeine Schultz started by adding baked goods, sandwiches, and other small food items to the menu. To invite an even later crowd, he then introduced fresh vegetable plates, flatbread pizza, cheese plates, and desserts. Eventually, he added alcoholic beverages such as wine and beer (to be served after 4 p.m. only) as part of Starbucks "Evenings" program Starbucks continued in these efforts by introducing new luxury items, catering to the wealthier customers within is existing customer base. It introduced limited-run, exclusive batches of varietal coffees for home use and sold them at high price points online and in stores. Some stores also included these same higher-priced roasts on their menus. By 2014, Starbucks had launched its new Starbucks Reserve Roastery and Tasting Room. The first of these super high-end stores-with more on the horizon-was opened in Starbucks' home city, Seattle. Indeed, Schultz's plan was to open as many as 1,000 of these large-format. high-end roasteries in both national and international locations with the hopes they would improve declining sales and refresh the brand. Schultz believed that customers would enjoy the experience of watching baristas brew speciality coffees using the latest techniques (and thus willing to pay $12 a cup), mixing cocktails, and serving artisanal baked goods and other food items. Schultz wanted these rousteries to be a new "third place" for people to visit between work and home. MODIFIED STRATEGIC INITIATIVES Many of the new initiatives just discussed have since been modified. For example, Starbucks has retooled its Evenings program, announcing in 2017 that it would serve alcohol only at its roastery locations. These modification have not dampened its ambitions. Over the next few years, Starbucks aims to double its food revenues and be recognized as an evening food and wine destination. To symbolize its transition from a traditional coffeehouse, Starbucks dropped the word coffee from its logo. Schultz also pushed the adoption of new technology to engage with customers more intimately and effectively. It now uses Facebook and Twitter to communicate with customers more or less in real time. In 2019, Starbucks had 26 million mobile payment users, more than that of Apple Pay (25 million), Google Pay (13 million), and Samsung Pay ( 12 million). Experts predict that by 2022, Starbucks will have 30 million users on its mobile ordering and payment app, and will continue to lead Apple, Google, and Samsung. Some 30 percent of all mationsstasca.wmdamin mobile devices. The Schicksam allowstomers.orderinfodrink and food With more than 14,000 stores in the U.S. market, Schultz started looking overseas for growth opportunities. Although traditionally a tea- drinking nation, coffee is catching on with urban professionals in China. In 2019, Starbucks had more than 3,500 stores in China, up from 1.500 in 2015. Starbucks plans to continue its rapid penetration of the Chinese market, aiming to operate 6,000 stores by 2022. Over the next few years, Starbucks also plans to double its presence in other areas of Asia (opening more than 4,000 cafs). Page 478 Kevin Johnson Is Not Howard Schultz In 2017, nine years after coming out of retirement to initiate a successful turnaround, Howard Schultz once again stepped down as Starbucks CEO in a second attempt at retirement (see Exhibit MC2.1). After his return, Starbucks' market valuation had appreciated approximately five-fold. Schultz's strategic leadership was clearly critical in turning Starbucks around. Some worry that Starbucks' success is uniquely dependent on Schultz, suggesting that Schultz (and Starbucks) may have a strategic weakness in executive leadership succession planning. The primary evidence of this is that Starbucks stagnated and even went into decline during Schultz's absence. Some argue that Starbucks' struggle after Schultz's first departure is similar to Microsoft's challenges after Bill Gates stepped down from day-to-day business, Dell Computer after the first retirement of Michael Dell (now back), Walmart after the retirement of Sam Walton, and Apple after Steve Jobs was forced out in 1985. Although technically speaking, Howard Schultz is not a founder of Starbucks, he is the one who created the company as we know it today. Schultz hopes that this second retirement from the company that he built from the ground up will be his last. In the meantime, new CEO Kevin Johnson, who transitioned from Microsoft, faces several challenges-in particular, how to maintain Starbucks' core competencies and how to achieve future growth-both domestically and internationally. The maturing sales of the more than 14,000 US-based stores is one of the biggest challenges facing Johnson today Exhibit MC2.3 displays the growth of same store salex (same-store sales is an important performance metric in the retail industry, it applies to stores that have been in existence for at least one year). Such sales have not only declined over the past decade, but have also fallen under its historic 5-percent growth threshold-a number that Starbucks has achieved for most of the past three decades. 4% 3% 2% 1% 2011 0% 2012 2013 2014 2015 2016 2017 2018 2019 Trendline added (dotted) Black, solid line shows the historic and target growth rate for same-store sales of 5% per year Source: Author's depletion of data from Jargon, J. (2019, Jan. 7). "Starbucks CEO Kevin Johnson reins in predecessor's ambitions: T'm not Howard." The Www Street Journal To address the issue of declining same-store-sales growth, Johnson is taking a more rational and data-driven approach than did Schultz, who led by intuition and emotion. First, Johnson drastically scaled back on Schultz's vision to open 1,000 new high-end roasteries and tasting rooms, capping this number to a mere 10. He wants to see whether they provide an appropriate return on investment before expanding further and has laid out a stringent and disciplined approach to test the new store concept. By terminating this strategic initiative, Johnson freed up capital to refresh its existing stores, and to return cash to shareholders, one of Johnson's stated goals. Johnson also plans to grow revenue by 10 percent and open an additional 12,000 traditional stores around the world by 2021. In addition, he plans to expand Starbucks coffee delivery business, even though some observers are skeptical, claiming this runs counter to the entire "third place" idea on which Starbucks was created During his first year as CEO, Kevin Johnson would often open meetings with Starbucks executives and employees by saying "I'm not Howard, I'm Kevin. One of Johnson's overarching goals is to bring more financial discipline to Starbucks, to run it based on hard data analysis, cutting-edge management and operational practices. Whether Kevin Johnson will be as successful as Howard Schultz remains to be seen