Question: please answer on excel and show the cell formulas. thank you just the excel formulas for these questions please This questions about what for Force

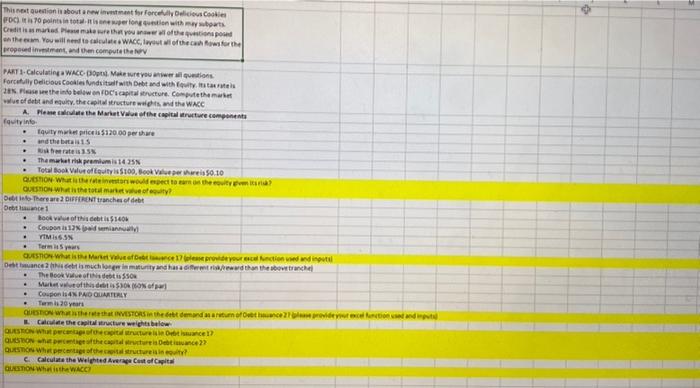

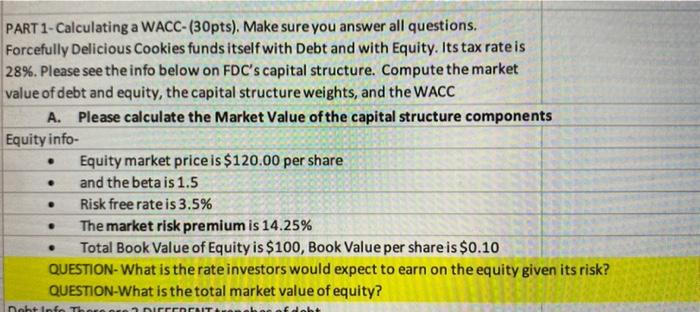

This questions about what for Force Odcious Cookies F70 points to seeing out with my wort Cismaa Pue of the pod on the cam. You will need to calculate WACC, lot of the forth proposedimentand the compute the PARTI-Calculatinga WACOBO Make sure you awer ni questions Forcally Delicious Coklesunds with Debt and with waters 20. see the info below on fb's capital structure. Comptethemet www of debt and equity. the capital structure was and the WACC Messee the Met Value of the capitaire components foutine Equity w prices $120.00 per the and the basis oberts The matrisk pramomis 1425 Total Book Value of equity is $100,ook Value per varia 50.10 QUESTION What there would expect to the cou? QUESTION What is the total marity? Debit There are 2 DIFFERENT tranches of debt Debate Book of this debitis 160 Coupons 10 min TIM ISSN Termsys QUESTION W Mere efter your collection wedding Dance muchongwin maturity and has a femrawd then the bow tranche The Book of debtis SSO Murter of this des MON Coupon 14 PAO QUARTERLY Terms 20 years QUESTION WE WESTORSIDE mandatum eft home 77 odlucional de Calcule the capital te weights below QUESTION W pecoepit rece! QUON Debiance QUESTION Whatecofthectares Calculate the Weighted Average cost of Capit QUESTION What is the WACC) . . . PART 1- Calculating a WACC-(30pts). Make sure you answer all questions. Forcefully Delicious Cookies funds itself with Debt and with Equity. Its tax rate is 28%. Please see the info below on FDC's capital structure. Compute the market value of debt and equity, the capital structure weights, and the WACC A. Please calculate the Market Value of the capital structure components Equity info- Equity market price is $120.00 per share and the beta is 1.5 . . Risk free rate is 3.5% . The market risk premium is 14.25% Total Book Value of Equity is $100, Book Value per share is $0.10 QUESTION-What is the rate investors would expect to earn on the equity given its risk? QUESTION-What is the total market value of equity? Doht Info There are nirreno

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts