Question: Problem 4, Dividend Discount Model: Use the dividend discount model to find expected return for your company's stock (20 points). Find its stock price on

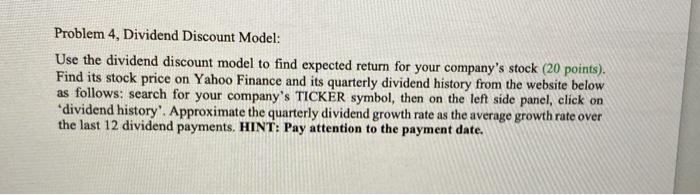

Problem 4, Dividend Discount Model: Use the dividend discount model to find expected return for your company's stock (20 points). Find its stock price on Yahoo Finance and its quarterly dividend history from the website below as follows: search for your company's TICKER symbol, then on the left side panel, click on dividend history'. Approximate the quarterly dividend growth rate as the average growth rate over the last 12 dividend payments. HINT: Pay attention to the payment date. Problem 4, Dividend Discount Model: Use the dividend discount model to find expected return for your company's stock (20 points). Find its stock price on Yahoo Finance and its quarterly dividend history from the website below as follows: search for your company's TICKER symbol, then on the left side panel, click on dividend history'. Approximate the quarterly dividend growth rate as the average growth rate over the last 12 dividend payments. HINT: Pay attention to the payment date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts