Question: please answer on microsoft excel spreadsheet. ch 11 estimating betas and the security market line. please show all formulas please answer questions 1,2,and 3 1.

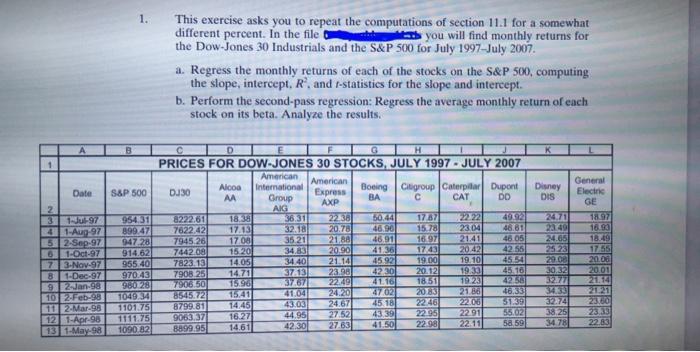

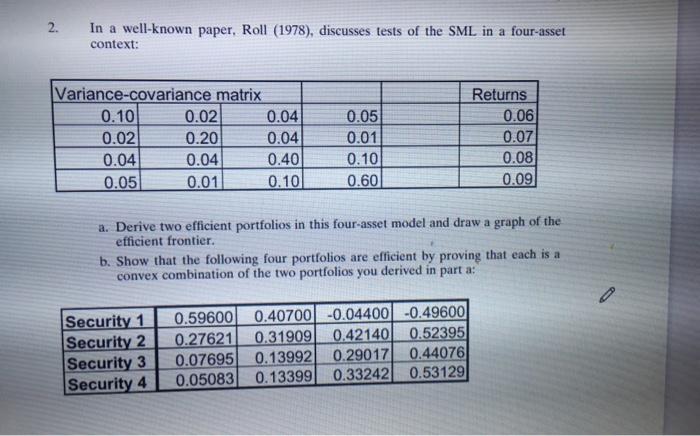

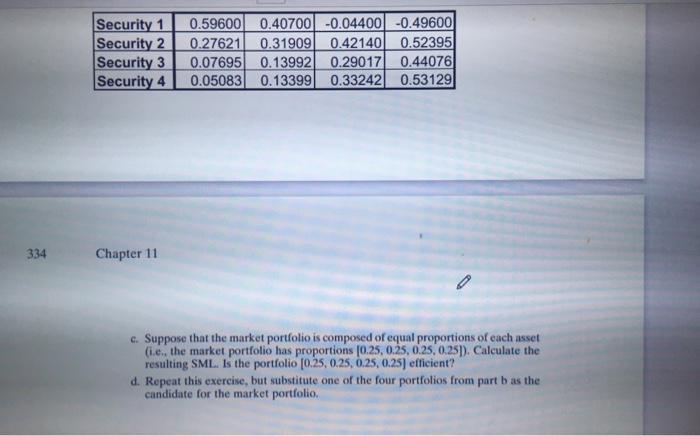

1. This exercise asks you to repeat the computations of section 11.1 for a somewhat different percent. In the file 6 . fort you will find monthly returns for the Dow-Jones 30 Industrials and the S\&P 500 for July 1997-July 2007. a. Regress the monthly returns of each of the stocks on the S\&P 500 , computing the slope, intercept, R2, and t-statistics for the slope and intercept. b. Perform the second-pass regression: Regress the average monthly return of each stock on its beta. Analyze the results. In a well-known paper, Roll (1978), discusses tests of the SML in a four-asset context: a. Derive two efficient portfolios in this four-asset model and draw a graph of the efficient frontier. b. Show that the following four portfolios are efficient by proving that each is a convex combination of the two portfolios you derived in part a: c. Suppose that the market portfolio is composed of equal proportions of each asset (i.c. the market portfolio has proportions [0.25,0.25,0.25,0.25] ). Calculate the resulting SML. Is the portfolio [0.25,0.25,0.25,0.25] efficient? d. Repeat this exercise, but substitute one of the four portfolios from part b as the candidate for the market portfolio. 1. This exercise asks you to repeat the computations of section 11.1 for a somewhat different percent. In the file 6 . fort you will find monthly returns for the Dow-Jones 30 Industrials and the S\&P 500 for July 1997-July 2007. a. Regress the monthly returns of each of the stocks on the S\&P 500 , computing the slope, intercept, R2, and t-statistics for the slope and intercept. b. Perform the second-pass regression: Regress the average monthly return of each stock on its beta. Analyze the results. In a well-known paper, Roll (1978), discusses tests of the SML in a four-asset context: a. Derive two efficient portfolios in this four-asset model and draw a graph of the efficient frontier. b. Show that the following four portfolios are efficient by proving that each is a convex combination of the two portfolios you derived in part a: c. Suppose that the market portfolio is composed of equal proportions of each asset (i.c. the market portfolio has proportions [0.25,0.25,0.25,0.25] ). Calculate the resulting SML. Is the portfolio [0.25,0.25,0.25,0.25] efficient? d. Repeat this exercise, but substitute one of the four portfolios from part b as the candidate for the market portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts