Question: Please, answer on my question below. I know the solution youll probably post, but I need the explanation on my question. The question is why

Please, answer on my question below.

I know the solution youll probably post, but I need the explanation on my question.

The question is why only portion of Gain recognized, but not the entire, see on the picture.

Thank you in advance!

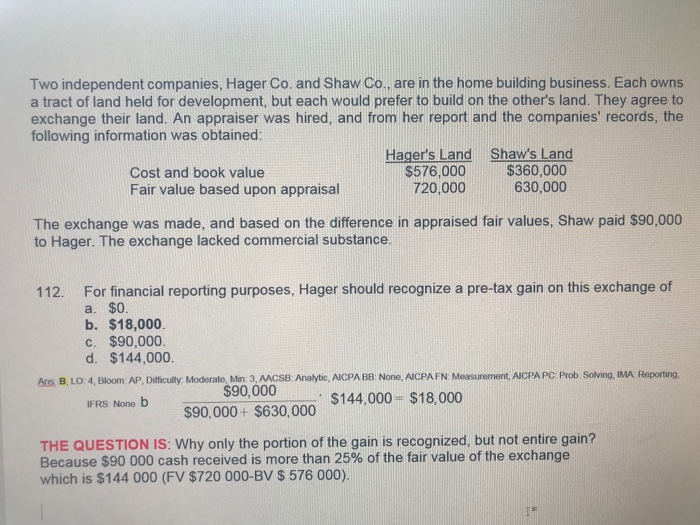

Two independent companies, Hager Co. and Shaw Co., are in the home building business. Each owns a tract of land held for development, but each would prefer to build on the other's land. They agree to exchange their land. An appraiser was hired, and from her report and the companies' records, the following information was obtained Cost and book value Fair value based upon appraisal Hager's Land Shaw's Land $576,000$360,000 630,000 720,000 The exchange was made, and based on the difference in appraised fair values, Shaw paid $90,000 to Hager. The exchange lacked commercial substance. For financial reporting purposes, Hager should recognize a pre-tax gain on this exchange of a. $0 b. $18,000 c. $90,000. d. $144,000. 112. Ans B, LO 4, Bloom AlP,Diffiuly Modorato Min 3 AACSB: Anabytic, A/CPA BB: None, AlCPA FN Masurement AlCPAPC: Prob Soking. IMA Reporting, $90,000 $90,000+ $630,000 IFRS Nono b $630,000 $144.000 $1 THE QUESTION IS: Why only the portion of the gain is recognized, but not entire gain? Because $90 000 cash received is more than 25% of the fair value of the exchange which is $144 000 (FV $720 000-BV $ 576 000). IF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts