Question: please answer only b) Question 2. Equities (a) The table below lists some partial information about a firm. Assume that the number of shares outstanding

please answer only b)

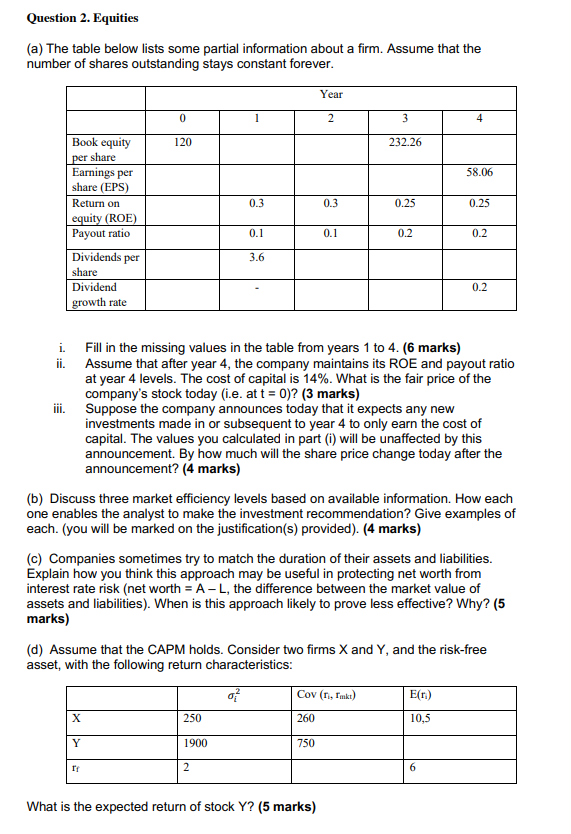

Question 2. Equities (a) The table below lists some partial information about a firm. Assume that the number of shares outstanding stays constant forever. Year 0 2 3 4 120 232.26 58.06 0.3 0.3 0.25 0.25 Book equity per share Earnings per share (EPS) Return on equity (ROE) Payout ratio Dividends per share Dividend growth rate 0.1 0.1 0.2 0.2 3.6 0.2 i Fill in the missing values in the table from years 1 to 4. (6 marks) ii. Assume that after year 4, the company maintains its ROE and payout ratio at year 4 levels. The cost of capital is 14%. What is the fair price of the company's stock today (i.e. at t = 0)? (3 marks) iii. Suppose the company announces today that it expects any new investments made in or subsequent to year 4 to only earn the cost of capital. The values you calculated in part (i) will be unaffected by this announcement. By how much will the share price change today after the announcement? (4 marks) (b) Discuss three market efficiency levels based on available information. How each one enables the analyst to make the investment recommendation? Give examples of each. (you will be marked on the justification(s) provided). (4 marks) (c) Companies sometimes try to match the duration of their assets and liabilities. Explain how you think this approach may be useful in protecting net worth from interest rate risk (net worth = A -L, the difference between the market value of assets and liabilities). When is this approach likely to prove less effective? Why? (5 marks) (d) Assume that the CAPM holds. Consider two firms X and Y, and the risk-free asset, with the following return characteristics: Cov (r, Imkt) E(1) X 250 260 10,5 Y 1900 750 11 2 6 What is the expected return of stock Y

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts