Question: Please Answer Only Question 4 - Mortgage-Backed Securities Question: >> Suppose instead that investors prepay $75 million in loans immediately after the payments in year

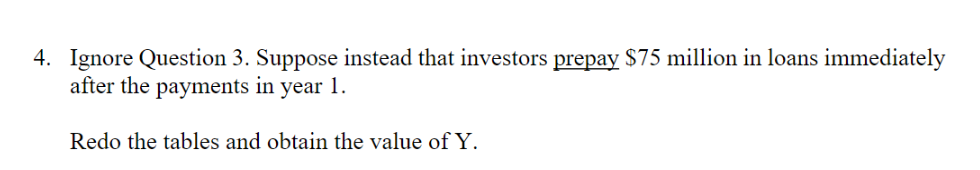

Please Answer Only Question 4 - Mortgage-Backed Securities Question: >> Suppose instead that investors prepay $75 million in loans immediately after the payments in year 1. - Redo the tables and obtain the value of Y.

Please Answer Only Question 4 - Mortgage-Backed Securities Question: >> Suppose instead that investors prepay $75 million in loans immediately after the payments in year 1. - Redo the tables and obtain the value of Y.

Please Answer Only Question 4 - Mortgage-Backed Securities Question: >> Suppose instead that investors prepay $75 million in loans immediately after the payments in year 1. - Redo the tables and obtain the value of Y.

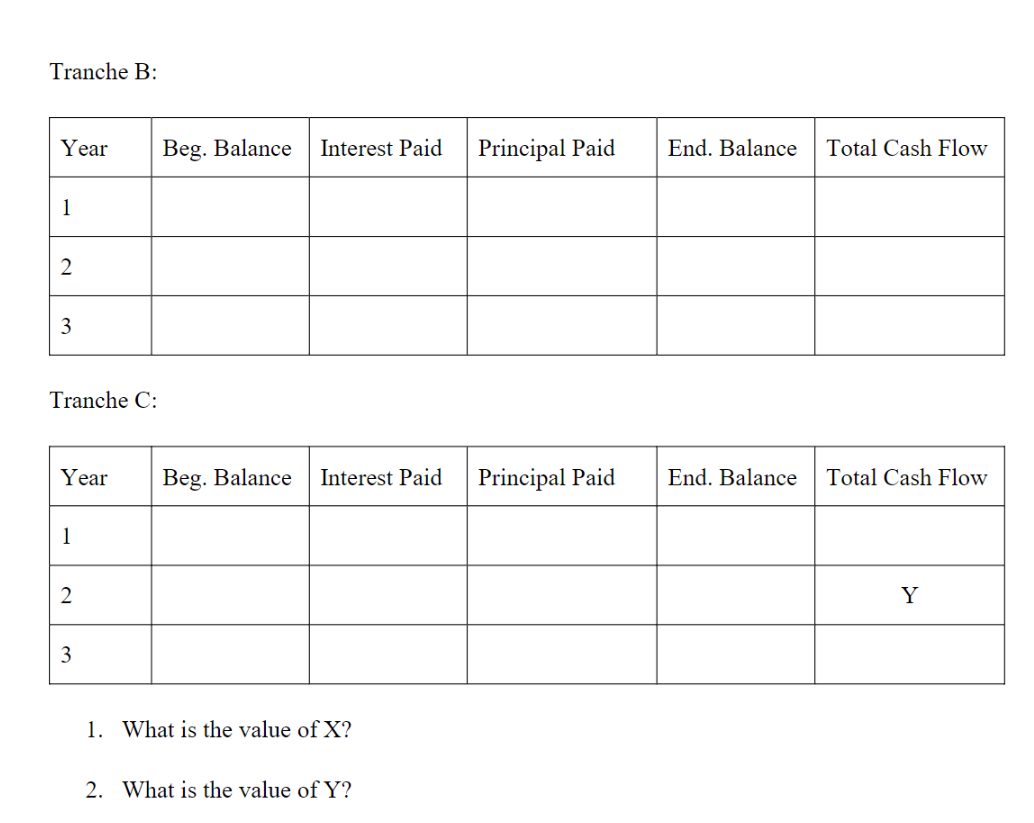

Use the following information on a mortgage-backed security for Problems 15. You are examining a mortgage-backed security with the following features: - $500 million in underlying mortgages (e.g., principal value =$500 million) - Three time tranches (or sequential tranches), A, B, and C where the par value of A is $200 million, the par value of B is $100 million, and the par value of C is $200 million. A is senior to B and B is senior to C. - The weighted average coupon (WAC) is 6%; the pass-through rate is 5% - The security has a weighted average maturity (WAM) of 3 years and payments are made annually (e.g., so it will only make 3 payments). - For Questions 1-2, assume that there is no default and no prepayment. Total MBS Issue: Tranche A: Tranche B: Tranche C: [F 1. What is the value of X ? 2. What is the value of Y ? 4. Ignore Question 3. Suppose instead that investors prepay $75 million in loans immediately after the payments in year 1. Redo the tables and obtain the value of Y. Use the following information on a mortgage-backed security for Problems 15. You are examining a mortgage-backed security with the following features: - $500 million in underlying mortgages (e.g., principal value =$500 million) - Three time tranches (or sequential tranches), A, B, and C where the par value of A is $200 million, the par value of B is $100 million, and the par value of C is $200 million. A is senior to B and B is senior to C. - The weighted average coupon (WAC) is 6%; the pass-through rate is 5% - The security has a weighted average maturity (WAM) of 3 years and payments are made annually (e.g., so it will only make 3 payments). - For Questions 1-2, assume that there is no default and no prepayment. Total MBS Issue: Tranche A: Tranche B: Tranche C: [F 1. What is the value of X ? 2. What is the value of Y ? 4. Ignore Question 3. Suppose instead that investors prepay $75 million in loans immediately after the payments in year 1. Redo the tables and obtain the value of Y

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts