Question: Please answer Only question 5 (Q5) if using excel pls show formulas. Q4.Stock A & B have the following returns: a)What are the expected returns

Please answer Only question 5 (Q5) if using excel pls show formulas.

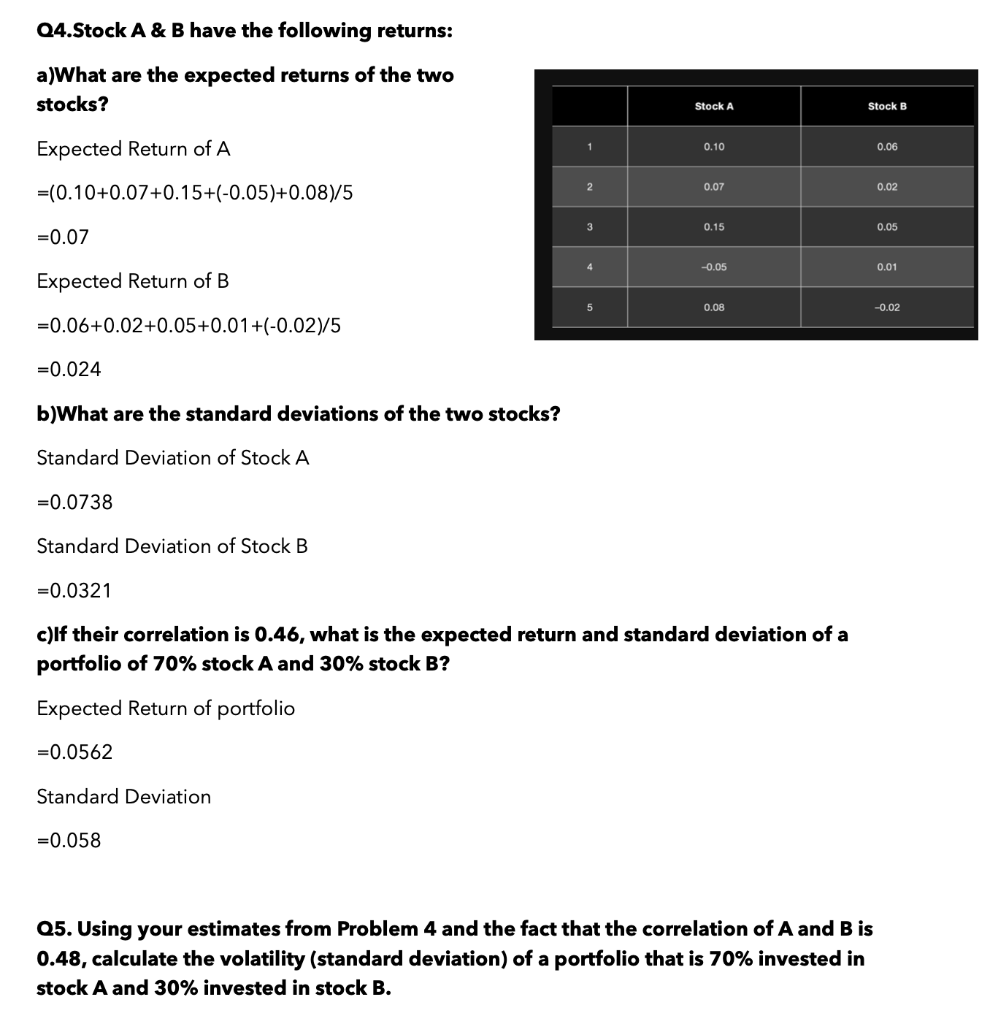

Q4.Stock A & B have the following returns: a)What are the expected returns of the two stocks? Stock A Stock B Expected Return of A 1 0.10 0.06 2 0.07 =(0.10+0.07+0.15+(-0.05)+0.08)/5 0.02 3 0.15 0.05 =0.07 4 -0.05 0.01 Expected Return of B 5 0.08 -0.02 =0.06+0.02 +0.05+0.01 +(-0.02)/5 =0.024 b)What are the standard deviations of the two stocks? Standard Deviation of Stock A =0.0738 Standard Deviation of Stock B =0.0321 c)If their correlation is 0.46, what is the expected return and standard deviation of a portfolio of 70% stock A and 30% stock B? Expected Return of portfolio =0.0562 Standard Deviation =0.058 Q5. Using your estimates from Problem 4 and the fact that the correlation of A and B is 0.48, calculate the volatility (standard deviation) of a portfolio that is 70% invested in stock A and 30% invested in stock B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts