Question: please answer only question C please. Both C1 and C2 14-15 OPTIMAL CAPITAL STRUCTURE Assume that you have just been hired as business manager of

please answer only question C please. Both C1 and C2

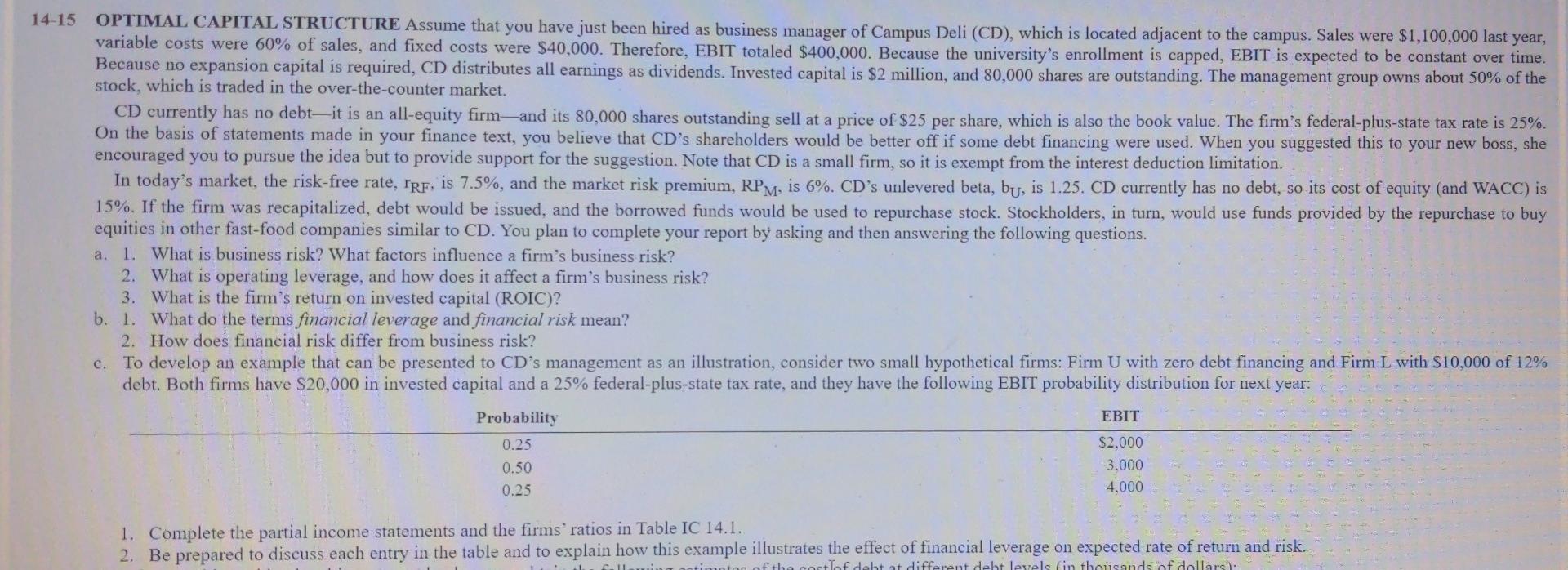

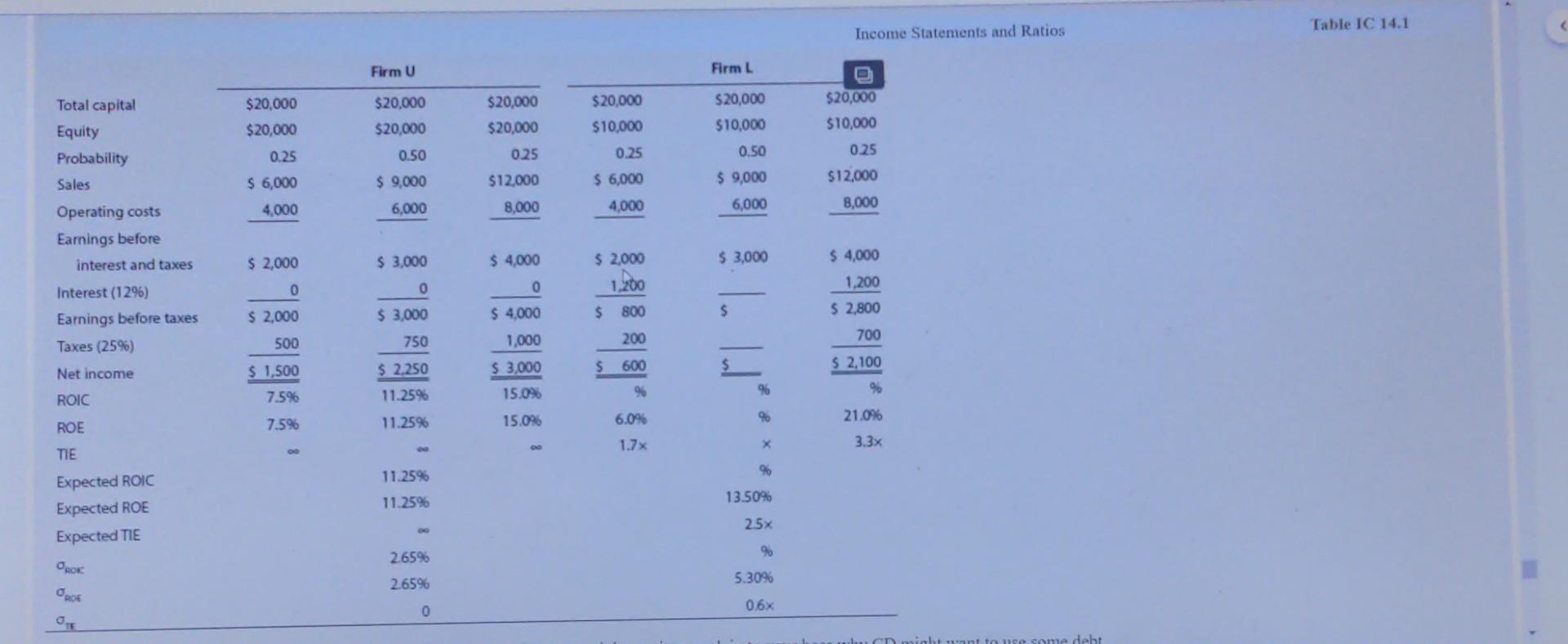

14-15 OPTIMAL CAPITAL STRUCTURE Assume that you have just been hired as business manager of Campus Deli (CD), which is located adjacent to the campus. Sales were $1,100,000 last year, variable costs were 60% of sales, and fixed costs were $40,000. Therefore, EBIT totaled $400,000. Because the university's enrollment is capped, EBIT is expected to be constant over time. Because no expansion capital is required, CD distributes all earnings as dividends. Invested capital is $2 million, and 80,000 shares are outstanding. The management group owns about 50% of the stock, which is traded in the over-the-counter market. CD currently has no debtit is an all-equity firm-and its 80,000 shares outstanding sell at a price of $25 per share, which is also the book value. The firm's federal-plus-state tax rate is 25%. On the basis of statements made in your finance text, you believe that CD's shareholders would be better off if some debt financing were used. When you suggested this to your new boss, she encouraged you to pursue the idea but to provide support for the suggestion. Note that CD is a small firm, so it is exempt from the interest deduction limitation. In today's market, the risk-free rate, FRF, is 7.5%, and the market risk premium, RPM, is 6%. CD's unlevered beta, bu, is 1.25. CD currently has no debt, so its cost of equity (and WACC) is 15%. If the firm was recapitalized, debt would be issued, and the borrowed funds would be used to repurchase stock. Stockholders, in turn, would use funds provided by the repurchase to buy equities in other fast-food companies similar to CD. You plan to complete your report by asking and then answering the following questions. a. 1. What is business risk? What factors influence a firm's business risk? 2. What is operating leverage, and how does it affect a firm's business risk? 3. What is the firm's return on invested capital (ROIC)? b. 1. What do the terms financial leverage and financial risk mean? 2. How does financial risk differ from business risk? c. To develop an example that can be presented to CD's management as an illustration, consider two small hypothetical firms: Firm U with zero debt financing and Firm L with $10,000 of 12% debt. Both firms have $20,000 in invested capital and a 25% federal-plus-state tax rate, and they have the following EBIT probability distribution for next year: Probability EBIT 0.25 $2.000 0.50 3.000 0.25 4,000 1. Complete the partial income statements and the firms ratios in Table IC 14.1. 2. Be prepared to discuss each entry in the table and to explain how this example illustrates the effect of financial leverage on expected rate of return and risk. fthectof debt at different debt levels in thousands of dollars. Table IC 14.1 Income Statements and Ratios Firm U Firm L $20,000 $20.000 $20,000 $10,000 $20,000 $10,000 Total capital Equity Probability Sales $20,000 $20,000 0.50 $ 9,000 $20,000 $20,000 025 $12.000 0.25 0.25 0.50 $20,000 $10,000 0.25 $12,000 8,000 $ 6,000 4,000 $ 6,000 4,000 $ 9,000 6,000 6,000 8,000 Operating costs Earnings before interest and taxes $ 2,000 $ 3,000 $ 4,000 $ 2.000 $ 3,000 0 0 0 $ 4,000 1,200 $ 2,800 1.200 $ 2,000 $ 3.000 $ $ 800 $ 4,000 1,000 Interest (1296) Earnings before taxes Taxes (25%) Net income ROIC 700 500 200 750 $ 2.250 $ 3.000 $ 600 $ 2,100 $ 1,500 7.5% 7.5% 96 11.2596 9 96 15.09 11.25% ROE 15.0% 6.09 % 21.0% 3.3x 1.7x X TIE 96 11.25% 11.2596 13.50% Expected ROIC Expected ROE Expected TIE 2.5x 265% 96 OROK 2.65% 5.30% ROE 0 06x ome deht 14-15 OPTIMAL CAPITAL STRUCTURE Assume that you have just been hired as business manager of Campus Deli (CD), which is located adjacent to the campus. Sales were $1,100,000 last year, variable costs were 60% of sales, and fixed costs were $40,000. Therefore, EBIT totaled $400,000. Because the university's enrollment is capped, EBIT is expected to be constant over time. Because no expansion capital is required, CD distributes all earnings as dividends. Invested capital is $2 million, and 80,000 shares are outstanding. The management group owns about 50% of the stock, which is traded in the over-the-counter market. CD currently has no debtit is an all-equity firm-and its 80,000 shares outstanding sell at a price of $25 per share, which is also the book value. The firm's federal-plus-state tax rate is 25%. On the basis of statements made in your finance text, you believe that CD's shareholders would be better off if some debt financing were used. When you suggested this to your new boss, she encouraged you to pursue the idea but to provide support for the suggestion. Note that CD is a small firm, so it is exempt from the interest deduction limitation. In today's market, the risk-free rate, FRF, is 7.5%, and the market risk premium, RPM, is 6%. CD's unlevered beta, bu, is 1.25. CD currently has no debt, so its cost of equity (and WACC) is 15%. If the firm was recapitalized, debt would be issued, and the borrowed funds would be used to repurchase stock. Stockholders, in turn, would use funds provided by the repurchase to buy equities in other fast-food companies similar to CD. You plan to complete your report by asking and then answering the following questions. a. 1. What is business risk? What factors influence a firm's business risk? 2. What is operating leverage, and how does it affect a firm's business risk? 3. What is the firm's return on invested capital (ROIC)? b. 1. What do the terms financial leverage and financial risk mean? 2. How does financial risk differ from business risk? c. To develop an example that can be presented to CD's management as an illustration, consider two small hypothetical firms: Firm U with zero debt financing and Firm L with $10,000 of 12% debt. Both firms have $20,000 in invested capital and a 25% federal-plus-state tax rate, and they have the following EBIT probability distribution for next year: Probability EBIT 0.25 $2.000 0.50 3.000 0.25 4,000 1. Complete the partial income statements and the firms ratios in Table IC 14.1. 2. Be prepared to discuss each entry in the table and to explain how this example illustrates the effect of financial leverage on expected rate of return and risk. fthectof debt at different debt levels in thousands of dollars. Table IC 14.1 Income Statements and Ratios Firm U Firm L $20,000 $20.000 $20,000 $10,000 $20,000 $10,000 Total capital Equity Probability Sales $20,000 $20,000 0.50 $ 9,000 $20,000 $20,000 025 $12.000 0.25 0.25 0.50 $20,000 $10,000 0.25 $12,000 8,000 $ 6,000 4,000 $ 6,000 4,000 $ 9,000 6,000 6,000 8,000 Operating costs Earnings before interest and taxes $ 2,000 $ 3,000 $ 4,000 $ 2.000 $ 3,000 0 0 0 $ 4,000 1,200 $ 2,800 1.200 $ 2,000 $ 3.000 $ $ 800 $ 4,000 1,000 Interest (1296) Earnings before taxes Taxes (25%) Net income ROIC 700 500 200 750 $ 2.250 $ 3.000 $ 600 $ 2,100 $ 1,500 7.5% 7.5% 96 11.2596 9 96 15.09 11.25% ROE 15.0% 6.09 % 21.0% 3.3x 1.7x X TIE 96 11.25% 11.2596 13.50% Expected ROIC Expected ROE Expected TIE 2.5x 265% 96 OROK 2.65% 5.30% ROE 0 06x ome deht

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts