Question: Please answer only the following question (e), thanks! I think you have to find maximum loan required first. e. If Bowers' customers began to pay

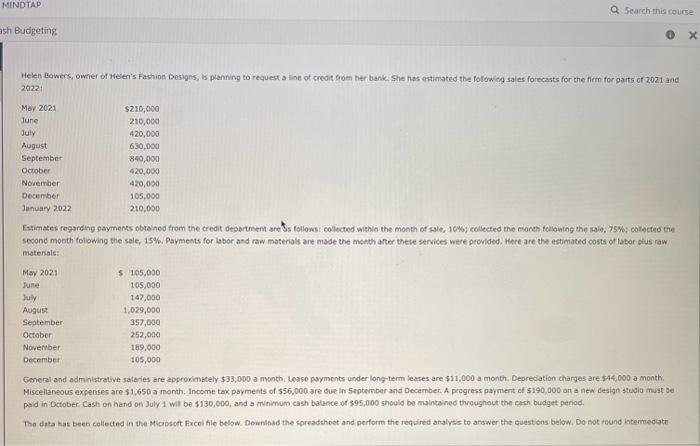

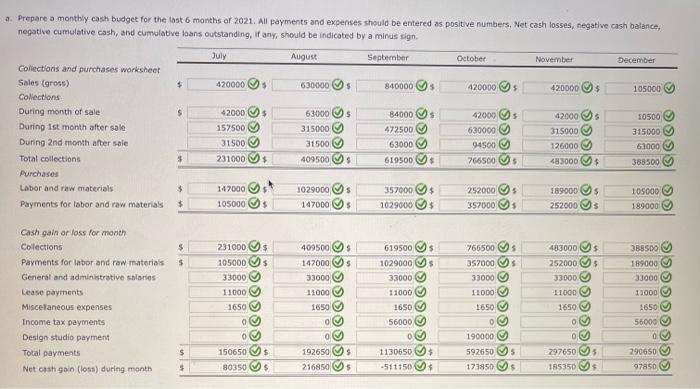

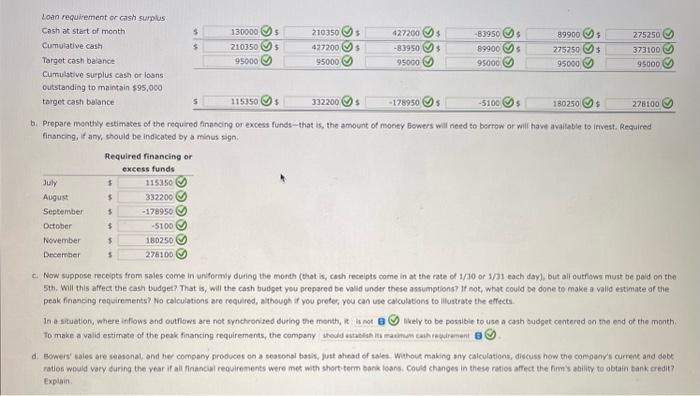

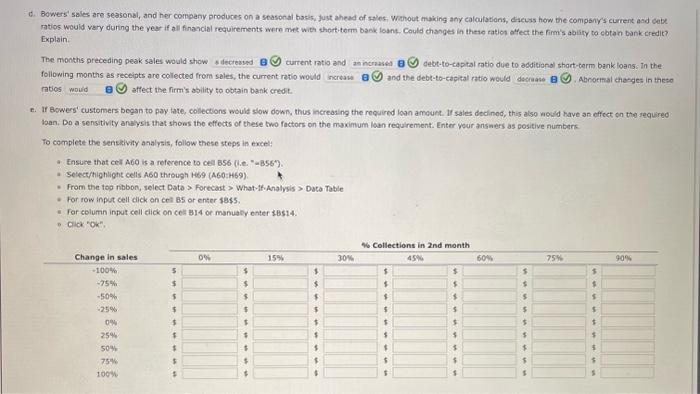

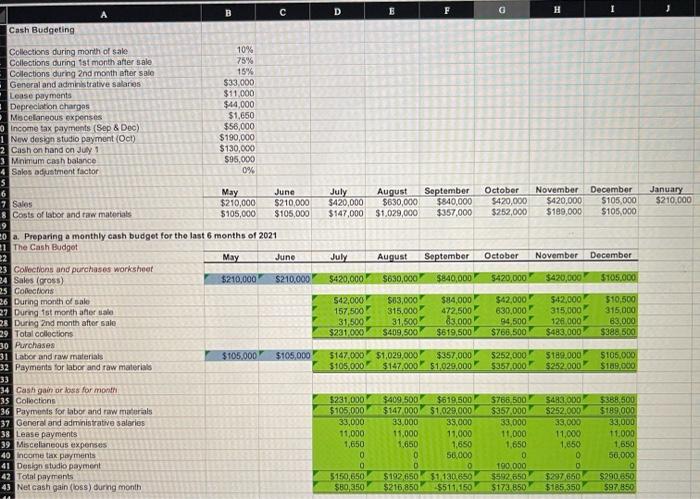

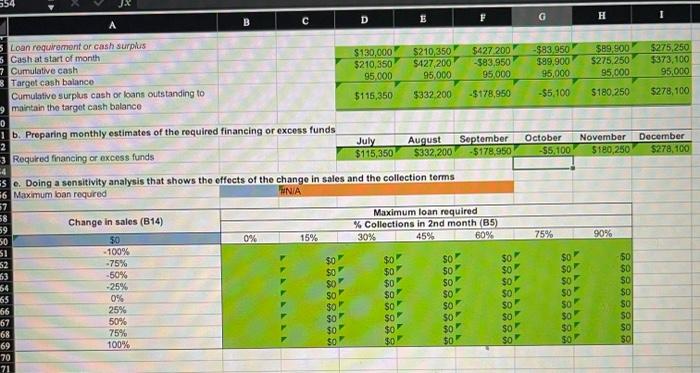

Heken Bowers, owner of Helen's Fachion Designs, is planning to request a ine of credit from her bank. She has estimated the followieg sales forecasts for the firm for parts of 2021 and second month folowing the sale, 15\%. Payments for laber and raw materals are made the moeth arter these services were provided, Here are the estimated costs of labor stus raw materials: Cmerai and administrative salaries are approwimbtely $33,000 a month: Lease puyments under long-term leases are $11,000 a month, Depreciation charges are 544,000 a month. Miscellaneous expenses are $1,650 a month. Income tax payments of $56,000 are due in 5 eptember and December. A peogress payment cf 5190,000 on a new cesign studio must be paid in October. Cash on band on July 1 wil be $130,000, and a minimum cash balance of $95,000 should be maintained throughout the cash budget period. The data kas been collected in the Moosof Excel file belsw. Downlaad the spreadthoet and perform the required analysis to answer the cuestions below. Do not reund intermedate Prepare a monthy cash budget for the last 6 months or 2021. All payments and expenses should be entered as positve numbers. Net cash losses, hegative cash balance. b. Prepare monusy estimates of the requred finanding or excess funds-that is, the amount of mocey bowers will need to berrow or will have avaifable to ifvest. Required finaneng, if any, should be indecated by a mitis sign. c. Now suppose recepts from sales come in uniformiy duriog the month (that is, cash receipts come in at the rate of 1/10 or 1/31. each day), but all outfows must be paid on th 5th. Wil this affect the cash budget? That is, will the cash budget you prepared be vald under these assumptions? If not, what could be done to make a valid estimate af the peak financing requirements? No calculations are required, athough if you prefer, you can ute calculations to illuatrate the effects In a sifuation, where infiows and outhisws are not synchronited during the month, Wikely to be possible to use a cash budget centered an the end of the mont! To make a valid ectimate of the peak finanding requirements, the company shodd astatha isi manum cath revirement. d. Bowers kales are seanonal, and her company produces on a seasotial basis, jutt ahinad of asles. Wathout making any calculations, discuss how the conganys current and deb ratios would vary during the vear if all financial reqairements were met with short-term bank loans. Could changes in these ratios affect the firm's ability to obtain tank credit Explain: Bowers' sales are seasonal, and her company produces on a seasonal bacis, just aheud of sales. Wohout making any calculations, disecess how the compeny's current asd cabe ratios would vary during the year if all financial requirements were met with shert-term bask foant, Could changes in theie ration atfect the firm's ability to cbtan bank eredit? Explain. The months preceding peak sales would show 1(0 current ratio and debt-to-capital milo due to additionol shart-term bank loans: in the following months as seseipts aro collected from sales, the current retio wosid raties affect the firm's ability to obtain bank credt. If Bowers' customers bogan to pay tate, collections would slow down, thus increasing the required loan amount. If sales decinod, this also aculd have an effect on the sequired Iaan. Do a sensithity analysis that shows the effects of these two factors on the maximum loan requirement. Enter yeur ansners as positive numbers To complete the sensaivity analysis, follow these steps in excely a Ensure that cell A60 is a reference to cell BS6 (i.e. "is567). - select/tighlight cells A60 through Hog (A60:H69). * From the tep nibbon, select Date > Forecaat > What-1f.Analysis > Daca Table - For row input cell cick on cet BS or enter 1845. - For column input cell click on celt BI4 or manuaby enter 18514. - cick "okn. A B C D Cash Budgeting a. Preparing a monthly cash budget for the last 6 months of 2021 The Cash Budgot May June July August September Oetober November December Callecfions and purchases worksheet Sales (rross) Cofoctions During month of sale Durng ist month after tiale During 2nd month after sale Total colloctions Purchases Labor and raw materiats Payments for labor and raw materials Cash gain or loss for month 35 Colbctions 36 Payments for labor and raw malarals 37. Genaral and administrative salaries. 38 Lease payments 39 Miscelaneous expenses. 40 income tax pajments 41 Desigo studio payment 42. Total payirants 43 Net cash gain (bss) durng month Loan requirement or cash surpius Cash at start of month Cumulative cash Targot cash balance Cumulative surplus cash or loans outstanding to maintain the target cash balance b. Preparing monthly estimates of the required financing or excess funds Required financing or excess funds \begin{tabular}{|c|c|c|c|r|r} \hline July & August & September & October & November & December \\ \hline$115,350 & $332,200 & $178,950 & 55,100 & $180,250 & $278,100 \\ \hline \end{tabular} e. Doing a sensitivity analysis that shows the effects of the change in sales and the collection terms Maximum ban reguired FiNiA Change in sales (B14) Heken Bowers, owner of Helen's Fachion Designs, is planning to request a ine of credit from her bank. She has estimated the followieg sales forecasts for the firm for parts of 2021 and second month folowing the sale, 15\%. Payments for laber and raw materals are made the moeth arter these services were provided, Here are the estimated costs of labor stus raw materials: Cmerai and administrative salaries are approwimbtely $33,000 a month: Lease puyments under long-term leases are $11,000 a month, Depreciation charges are 544,000 a month. Miscellaneous expenses are $1,650 a month. Income tax payments of $56,000 are due in 5 eptember and December. A peogress payment cf 5190,000 on a new cesign studio must be paid in October. Cash on band on July 1 wil be $130,000, and a minimum cash balance of $95,000 should be maintained throughout the cash budget period. The data kas been collected in the Moosof Excel file belsw. Downlaad the spreadthoet and perform the required analysis to answer the cuestions below. Do not reund intermedate Prepare a monthy cash budget for the last 6 months or 2021. All payments and expenses should be entered as positve numbers. Net cash losses, hegative cash balance. b. Prepare monusy estimates of the requred finanding or excess funds-that is, the amount of mocey bowers will need to berrow or will have avaifable to ifvest. Required finaneng, if any, should be indecated by a mitis sign. c. Now suppose recepts from sales come in uniformiy duriog the month (that is, cash receipts come in at the rate of 1/10 or 1/31. each day), but all outfows must be paid on th 5th. Wil this affect the cash budget? That is, will the cash budget you prepared be vald under these assumptions? If not, what could be done to make a valid estimate af the peak financing requirements? No calculations are required, athough if you prefer, you can ute calculations to illuatrate the effects In a sifuation, where infiows and outhisws are not synchronited during the month, Wikely to be possible to use a cash budget centered an the end of the mont! To make a valid ectimate of the peak finanding requirements, the company shodd astatha isi manum cath revirement. d. Bowers kales are seanonal, and her company produces on a seasotial basis, jutt ahinad of asles. Wathout making any calculations, discuss how the conganys current and deb ratios would vary during the vear if all financial reqairements were met with short-term bank loans. Could changes in these ratios affect the firm's ability to obtain tank credit Explain: Bowers' sales are seasonal, and her company produces on a seasonal bacis, just aheud of sales. Wohout making any calculations, disecess how the compeny's current asd cabe ratios would vary during the year if all financial requirements were met with shert-term bask foant, Could changes in theie ration atfect the firm's ability to cbtan bank eredit? Explain. The months preceding peak sales would show 1(0 current ratio and debt-to-capital milo due to additionol shart-term bank loans: in the following months as seseipts aro collected from sales, the current retio wosid raties affect the firm's ability to obtain bank credt. If Bowers' customers bogan to pay tate, collections would slow down, thus increasing the required loan amount. If sales decinod, this also aculd have an effect on the sequired Iaan. Do a sensithity analysis that shows the effects of these two factors on the maximum loan requirement. Enter yeur ansners as positive numbers To complete the sensaivity analysis, follow these steps in excely a Ensure that cell A60 is a reference to cell BS6 (i.e. "is567). - select/tighlight cells A60 through Hog (A60:H69). * From the tep nibbon, select Date > Forecaat > What-1f.Analysis > Daca Table - For row input cell cick on cet BS or enter 1845. - For column input cell click on celt BI4 or manuaby enter 18514. - cick "okn. A B C D Cash Budgeting a. Preparing a monthly cash budget for the last 6 months of 2021 The Cash Budgot May June July August September Oetober November December Callecfions and purchases worksheet Sales (rross) Cofoctions During month of sale Durng ist month after tiale During 2nd month after sale Total colloctions Purchases Labor and raw materiats Payments for labor and raw materials Cash gain or loss for month 35 Colbctions 36 Payments for labor and raw malarals 37. Genaral and administrative salaries. 38 Lease payments 39 Miscelaneous expenses. 40 income tax pajments 41 Desigo studio payment 42. Total payirants 43 Net cash gain (bss) durng month Loan requirement or cash surpius Cash at start of month Cumulative cash Targot cash balance Cumulative surplus cash or loans outstanding to maintain the target cash balance b. Preparing monthly estimates of the required financing or excess funds Required financing or excess funds \begin{tabular}{|c|c|c|c|r|r} \hline July & August & September & October & November & December \\ \hline$115,350 & $332,200 & $178,950 & 55,100 & $180,250 & $278,100 \\ \hline \end{tabular} e. Doing a sensitivity analysis that shows the effects of the change in sales and the collection terms Maximum ban reguired FiNiA Change in sales (B14)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts