Question: please answer operations management question above 1. What will be your recommendation for overbooking (see question a) 2.What is the expected profit per overbooking choice

please answer operations management question above

1. What will be your recommendation for overbooking (see question a)

2.What is the expected profit per overbooking choice (see question b)

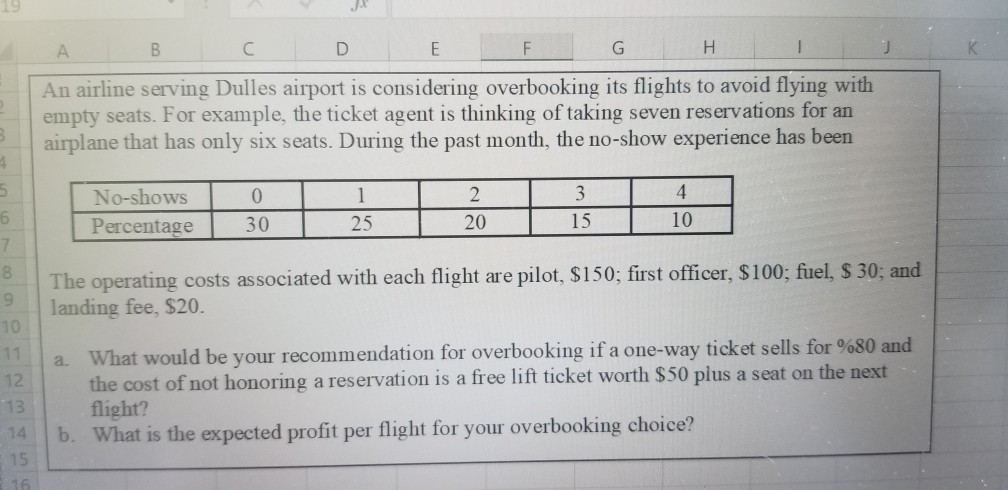

A B D E G H - K An airline serving Dulles airport is considering overbooking its flights to avoid flying with empty seats. For example, the ticket agent is thinking of taking seven reservations for an airplane that has only six seats. During the past month, the no-show experience has been 1 No-shows Percentage 0 30 2 20 3 15 4 10 25 6 7 8 9 10 The operating costs associated with each flight are pilot, $150; first officer, $100; fuel, $ 30; and landing fee, $20. 12 13 14 15 16 a. What would be your recommendation for overbooking if a one-way ticket sells for %80 and the cost of not honoring a reservation is a free lift ticket worth $50 plus a seat on the next flight? b. What is the expected profit per flight for your overbooking choiceStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts