Question: please answer part 1 type the answers with steps please Questions: Part I - Bond Valuation Q1: What is the price of a semi-annual coupon

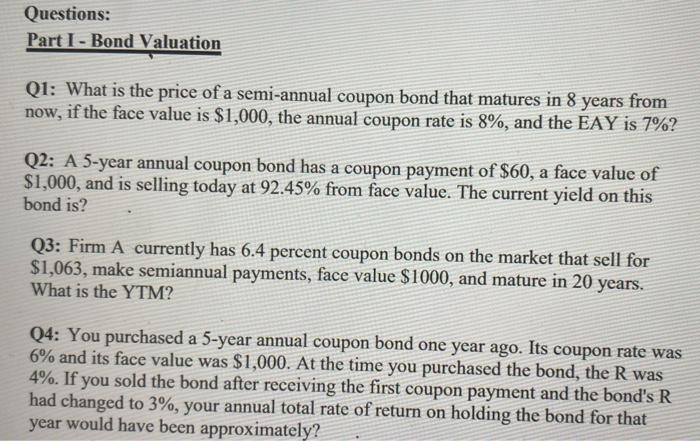

Questions: Part I - Bond Valuation Q1: What is the price of a semi-annual coupon bond that matures in 8 years from now, if the face value is $1,000, the annual coupon rate is 8%, and the EAY is 7%? Q2: A 5-year annual coupon bond has a coupon payment of $60, a face value of $1,000, and is selling today at 92.45% from face value. The current yield on this bond is? Q3: Firm A currently has 6.4 percent coupon bonds on the market that sell for $1,063, make semiannual payments, face value $1000, and mature in 20 years. What is the YTM? Q4: You purchased a 5-year annual coupon bond one year ago. Its coupon rate was 6% and its face value was $1,000. At the time you purchased the bond, the R was 4%. If you sold the bond after receiving the first coupon payment and the bond's R had changed to 3%, your annual total rate of return on holding the bond for that year would have been approximately

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts