Question: Please answer part a and b for the following question. PROBLEMS 3.13 E&P Computation. For its current taxable year. K Corporation, a manufactur of nuts

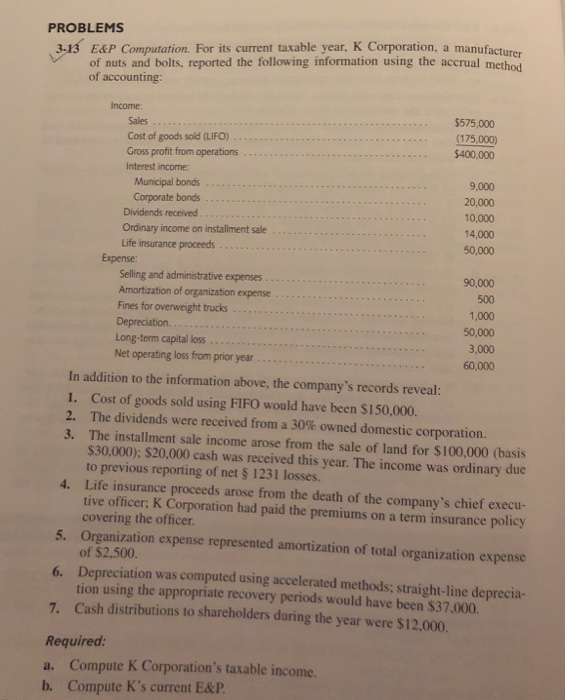

PROBLEMS 3.13 E&P Computation. For its current taxable year. K Corporation, a manufactur of nuts and bolts, reported the following information using the accrual method of accounting: Income: Sales .... $575,000 Cost of goods sold (LIFO) ... (175,000) Gross profit from operations $400,000 Interest income: Municipal bonds 9,000 Corporate bonds 20,000 Dividends received 10,000 Ordinary income on installment sale .. 14,000 Life insurance proceeds 50,000 Expense: Selling and administrative expenses ......... 90,000 Amortization of organization expense 500 Fines for overweight trucks ..... 1,000 Depreciation....... 50,000 Long-term capital loss ........... 3,000 Net operating loss from prior year... 60,000 In addition to the information above, the company's records reveal: 1. Cost of goods sold using FIFO would have been $150,000. 2. The dividends were received from a 30% owned domestic corporation. 3. The installment sale income arose from the sale of land for $100.000 (basis $30,000): $20,000 cash was received this year. The income was ordinary due to previous reporting of net 1231 losses. 4. Life insurance proceeds arose from the death of the company's chief execu- tive officer: K Corporation had paid the premiums on a term insurance policy covering the officer. 5. Organization expense represented amortization of total organization expense of $2,500. 6. Depreciation was computed using accelerated methods, straight-line deprecia tion using the appropriate recovery periods would have been $37,000. 7. Cash distributions to shareholders during the year were $12,000. Required: a. Compute K Corporation's taxable income. b. Compute K's current E&P

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts