Question: Please answer part a(3) - will rate thumbs up upon receiving correct answer thank u! You are analyzing the after-tax cost of debt for a

Please answer part a(3) - will rate thumbs up upon receiving correct answer thank u!

Please answer part a(3) - will rate thumbs up upon receiving correct answer thank u!

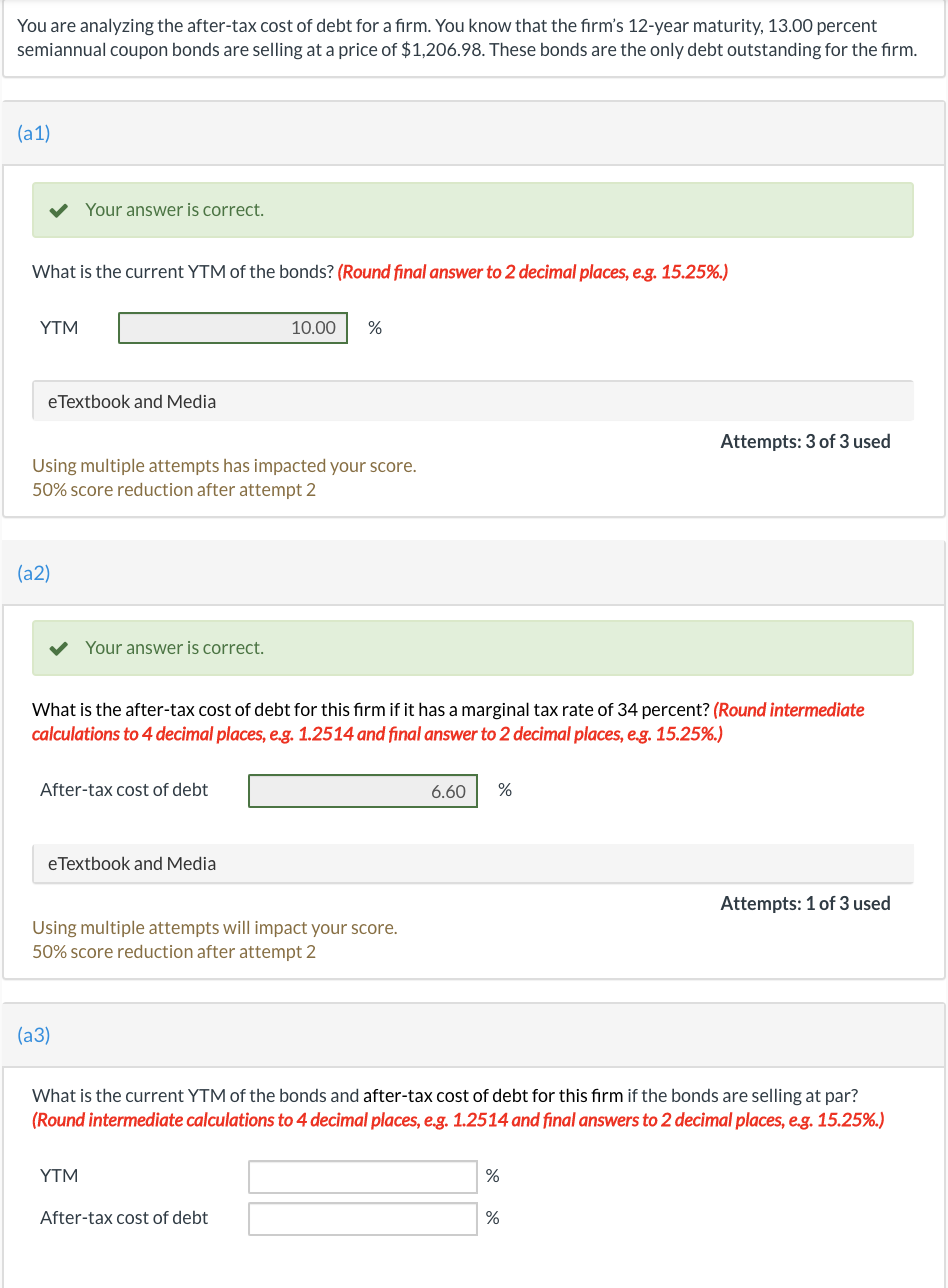

You are analyzing the after-tax cost of debt for a firm. You know that the firm's 12-year maturity, 13.00 percent semiannual coupon bonds are selling at a price of $1,206.98. These bonds are the only debt outstanding for the firm. (a1) Your answer is correct. What is the current YTM of the bonds? (Round final answer to 2 decimal places, e.g. 15.25%.) YTM 10.00 % e Textbook and Media Attempts: 3 of 3 used Using multiple attempts has impacted your score. 50% score reduction after attempt 2 (a2) Your answer is correct. What is the after-tax cost of debt for this firm if it has a marginal tax rate of 34 percent? (Round intermediate calculations to 4 decimal places, e.g. 1.2514 and final answer to 2 decimal places, e.g. 15.25%.) After-tax cost of debt 6.60 % e Textbook and Media Attempts: 1 of 3 used Using multiple attempts will impact your score. 50% score reduction after attempt 2 (a3) What is the current YTM of the bonds and after-tax cost of debt for this firm if the bonds are selling at par? (Round intermediate calculations to 4 decimal places, e.g. 1.2514 and final answers to 2 decimal places, e.g. 15.25%.) YTM % After-tax cost of debt %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts