Question: please answer part B A machine that produces cellphone components is purchased on January 1,2024 , for $196,000. It is expected to have a useful

please answer part B

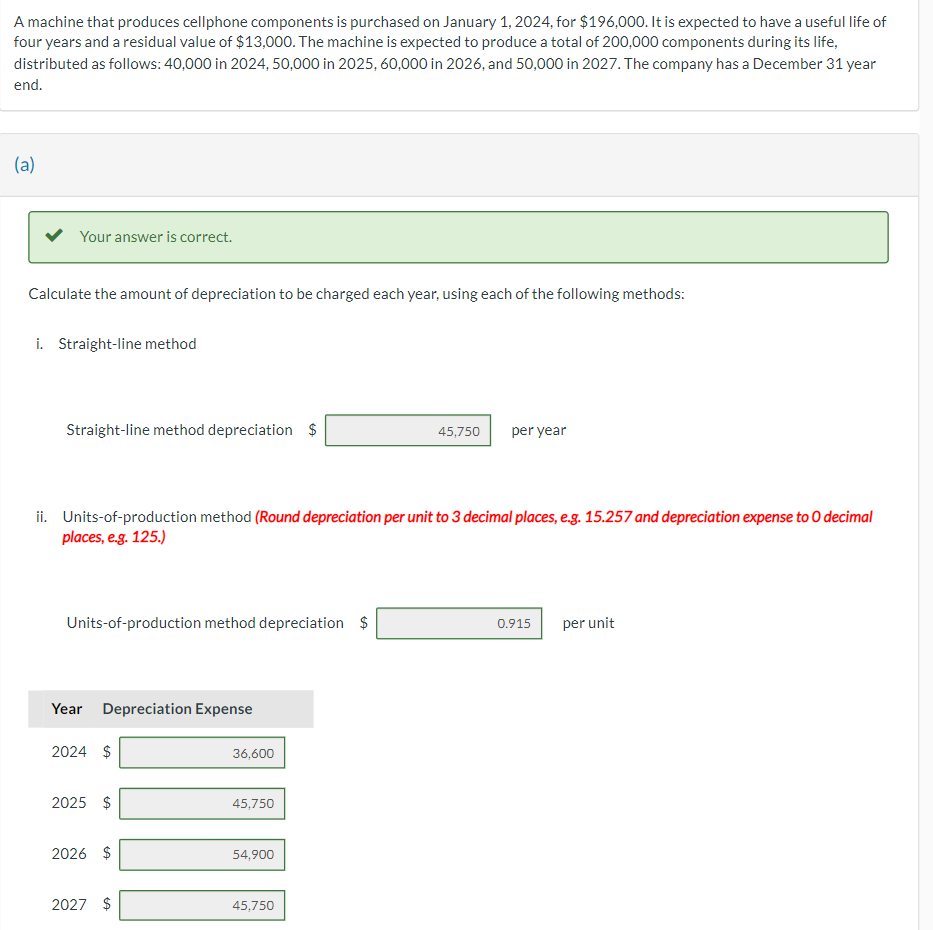

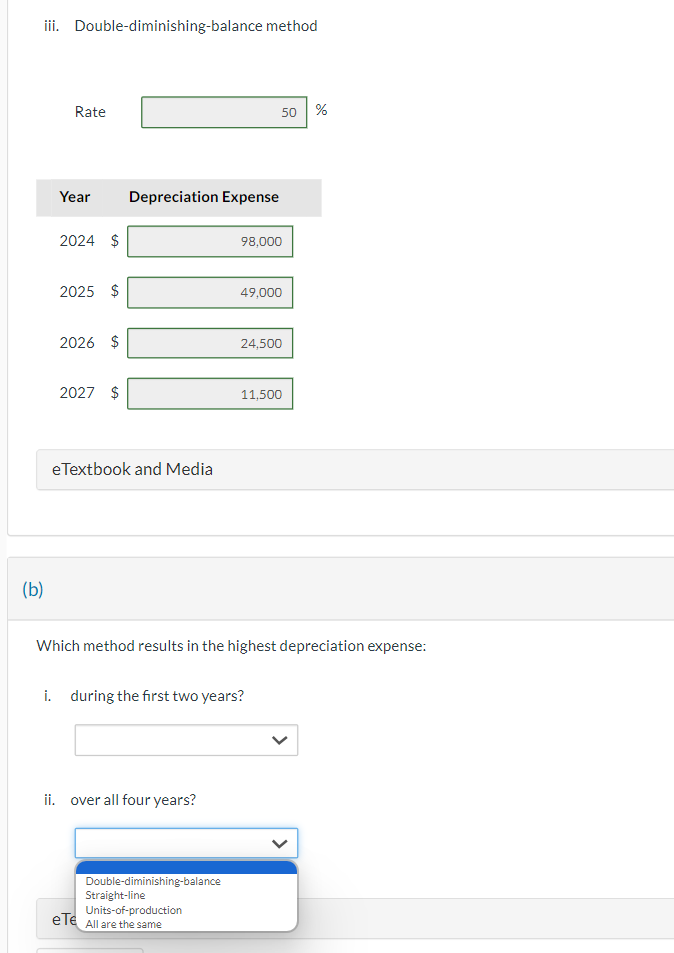

A machine that produces cellphone components is purchased on January 1,2024 , for $196,000. It is expected to have a useful life of four years and a residual value of $13,000. The machine is expected to produce a total of 200,000 components during its life, distributed as follows: 40,000 in 2024,50,000 in 2025,60,000 in 2026, and 50,000 in 2027. The company has a December 31 year end. (a) Your answer is correct. Calculate the amount of depreciation to be charged each year, using each of the following methods: i. Straight-line method Straight-line method depreciation \$_ peryear ii. Units-of-production method (Round depreciation per unit to 3 decimal places, e.g. 15.257 and depreciation expense to 0 decimal places, e.g. 125.) Units-of-production method depreciation \$ per unit iii. Double-diminishing-balance method Rate % eTextbook and Media (b) Which method results in the highest depreciation expense: i. during the first two years? ii. over all four years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts