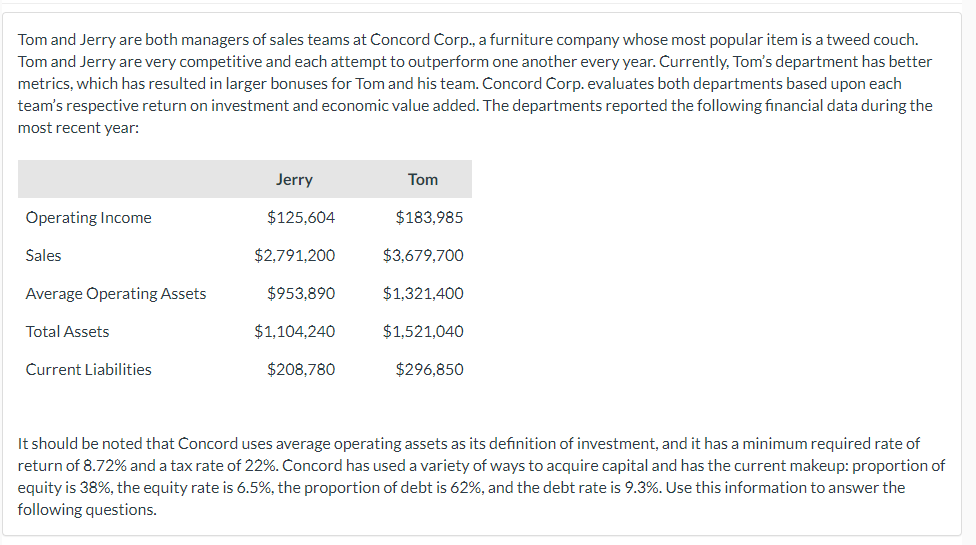

Question: please answer part b most recent year: Jerry Operating Income $125,604 Sales $2,791,200 Average lOperating Assets $953,890 Total Assets $1,104,240 Current Liabilities $208,780 It should

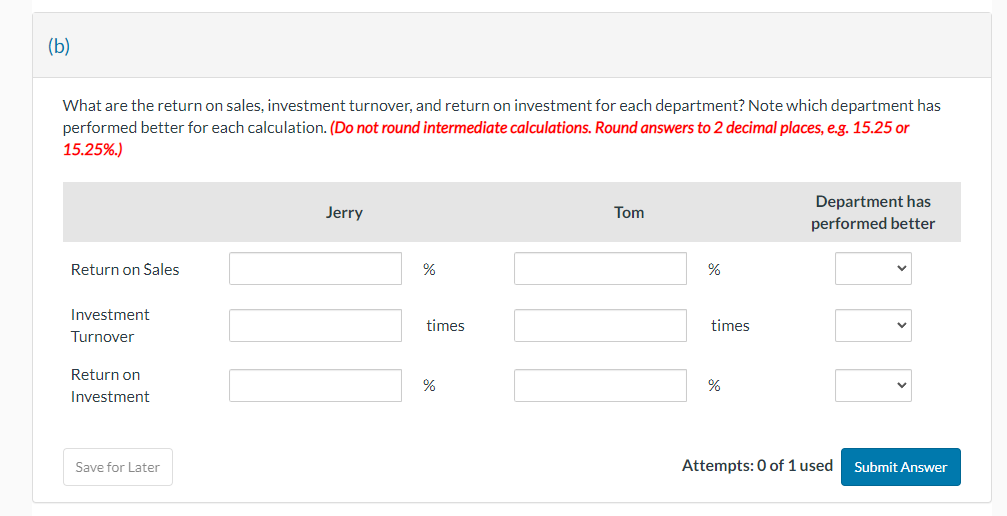

please answer part b

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock