Question: please answer part (e) ; it is the last photo in red which my answer is incorrect At the beginning of the current period, Skysong,

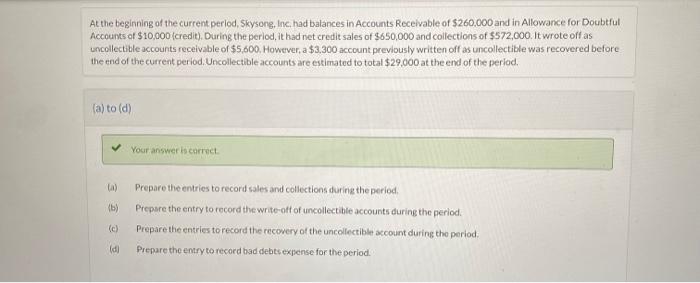

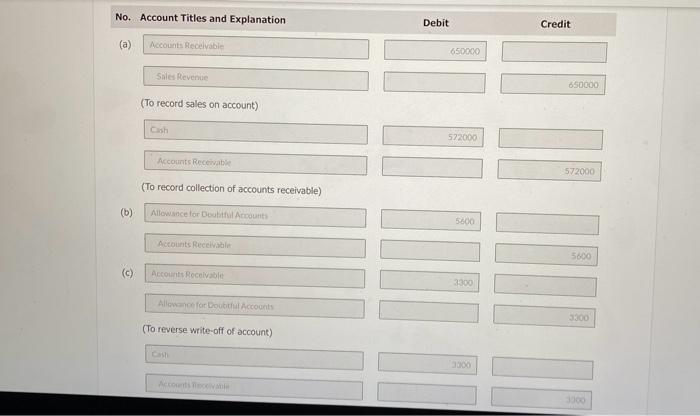

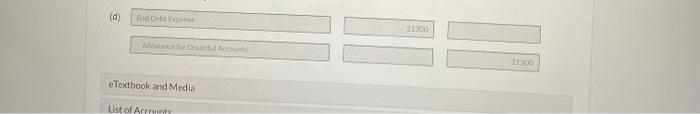

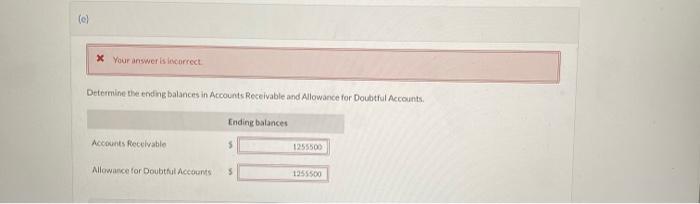

At the beginning of the current period, Skysong, Inc, had balances in Accounts Receivable of $260,000 and in Allowance for Doubtful Accounts of $10,000 (credit). During the period, it had ret credit sales of $550,000 and collections of $572,000. It wrote off as uncollectible accounts receivable of $5,600. However, a $3,300 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are estimated to total $29,000 at the end of the period. (a) to (d) Your answer bearsect. (a) Prepare the entries to record sales and collections during the period. (b) Prepse the entry to record the write-nff of uncollectible occounts during the period. (c) Prepare the entries to record the recowery of the uncollectible account during the period: (d) Prepare the entry to record bad debts expense for the period. Determine the ending balances in Accounts Receivable and Allowance for Doubtful Accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts