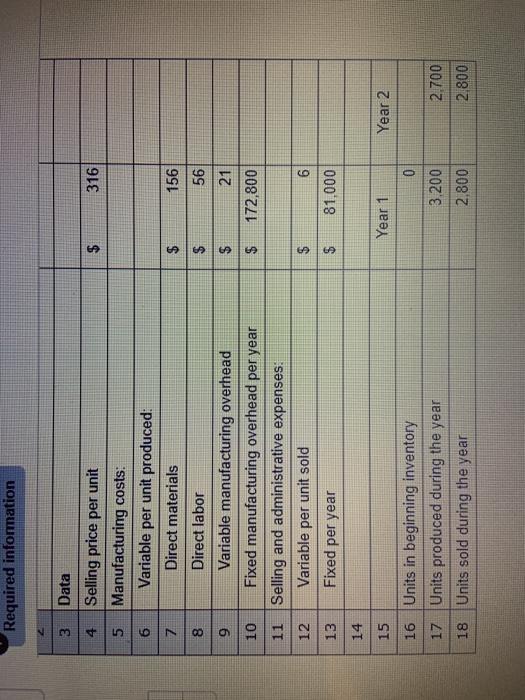

Question: Required information 2 $ 316 N 156 3 Data 4 Selling price per unit 5 Manufacturing costs: 6 Variable per unit produced: Direct materials 8

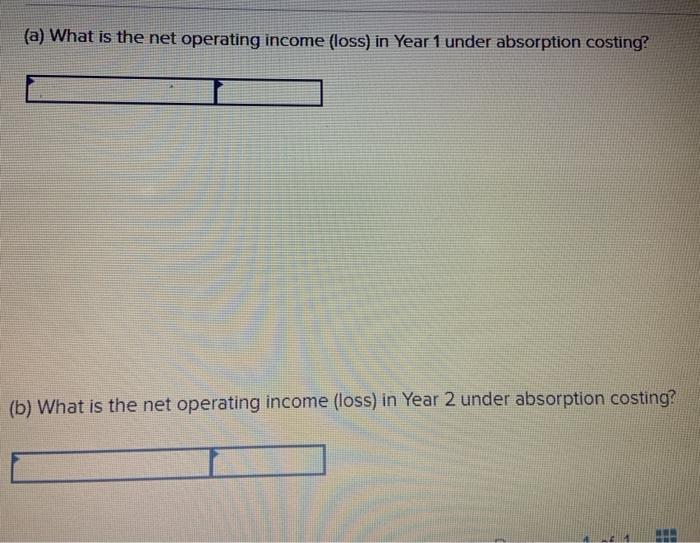

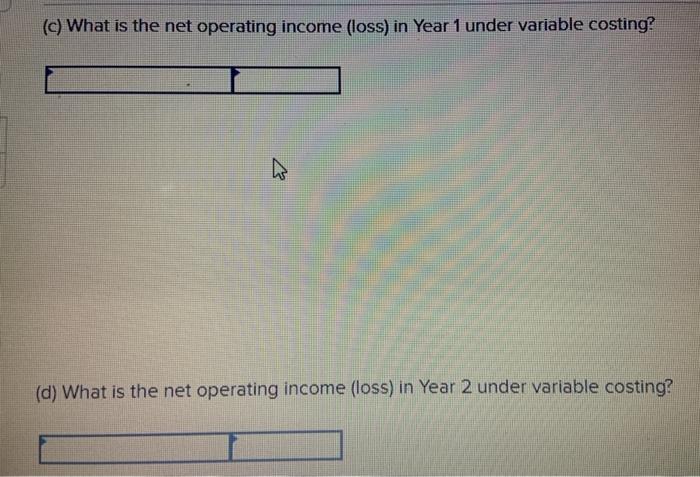

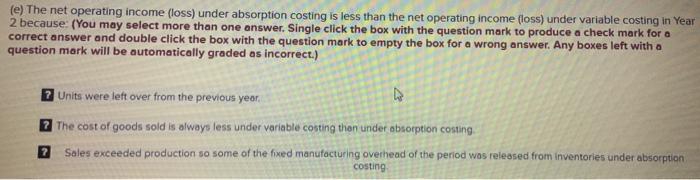

Required information 2 $ 316 N 156 3 Data 4 Selling price per unit 5 Manufacturing costs: 6 Variable per unit produced: Direct materials 8 Direct labor 9 Variable manufacturing overhead 10 Fixed manufacturing overhead per year 11 Selling and administrative expenses. 12 Variable per unit sold 13 Fixed per year $ $ 56 69 21 $ 172,800 $ 6 $ 81,000 14 Year 1 Year 2 0 15 16 Units in beginning inventory 17 Units produced during the year 18 Units sold during the year 3,200 2.700 2.800 2.800 (a) What is the net operating income (loss) in Year 1 under absorption costing? (b) What is the net operating income (loss) in Year 2 under absorption costing? (c) What is the net operating income (loss) in Year 1 under variable costing? (d) What is the net operating income (loss) in Year 2 under variable costing? (e) The net operating income (loss) under absorption costing is less than the net operating income (loss) under variable costing in Year 2 because (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with question mark will be automatically graded as incorrect.) Units were left over from the previous year 7 The cost of goods sold is always less under variable costing thon under absorption costing 2 Sales exceeded production so some of the fixed manufacturing overhead of the period was released from inventories under absorption costing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts