Question: Please answer parts 2&3 Implementation Shortfall Use the following information to answer questions 2-3: A firm PM puts a buy order to purchase of 100,000

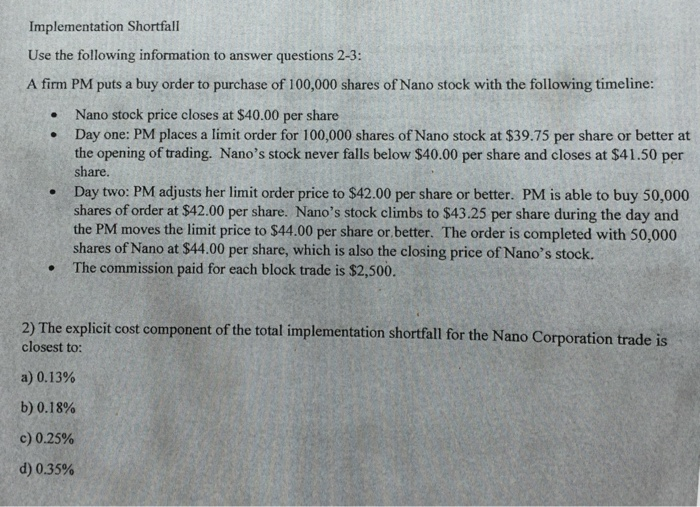

Implementation Shortfall Use the following information to answer questions 2-3: A firm PM puts a buy order to purchase of 100,000 shares of Nano stock with the following timeline: .Nano stock price closes at $40.00 per share . Day one: PM places a limit order for 100,000 shares of Nano stock at $39.75 per share or better at the opening of trading. Nano's stock never falls below $40.00 per share and closes at $41.50 per share. Day two: PM adjusts her limit order price to $42.00 per share or better. PM is able to buy 50,000 shares of order at $42.00 per share. Nano's stock climbs to $43.25 per share during the day and the PM moves the limit price to $44.00 per share or better. The order is completed with 50,000 shares of Nano at $44.00 per share, which is also the closing price of Nano's stock. . The commission paid for each block trade is $2,500 2) The explicit cost component of the total implementation shortfall for the Nano Corporation trade is closest to: a)0.13% b)0.18% c) 0.25% d) 0.35% 3) The total implementation shortfall for the Nano Corporation trade is closest to: a) 4.9% b) 75% c) 9.2% d) 10.1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts