Question: please answer parts a), b) and c) Save Homework: Homework Assignment #6 (Bond Valuation) Score: 0 of 1 pt 20 of 20 (19 complete) HW

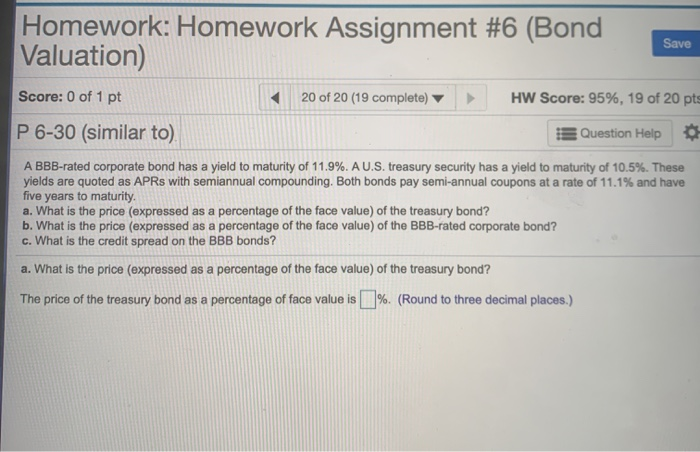

Save Homework: Homework Assignment #6 (Bond Valuation) Score: 0 of 1 pt 20 of 20 (19 complete) HW Score: 95%, 19 of 20 pts P 6-30 (similar to) Question Help A BBB-rated corporate bond has a yield to maturity of 11.9%. A U.S. treasury security has a yield to maturity of 10.5%. These yields are quoted as APRs with semiannual compounding. Both bonds pay semi-annual coupons at a rate of 11.1% and have five years to maturity. a. What is the price (expressed as a percentage of the face value) of the treasury bond? b. What is the price (expressed as a percentage of the face value) of the BBB-rated corporate bond? c. What is the credit spread on the BBB bonds? a. What is the price (expressed as a percentage of the face value) of the treasury bond? The price of the treasury bond as a percentage of face value is %. (Round to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts