Question: PLEASE ANSWER PARTS b) and c) Question: CTL shares are currently trading at a price of $23, while ZZT shares are trading at a price

PLEASE ANSWER PARTS b) and c)

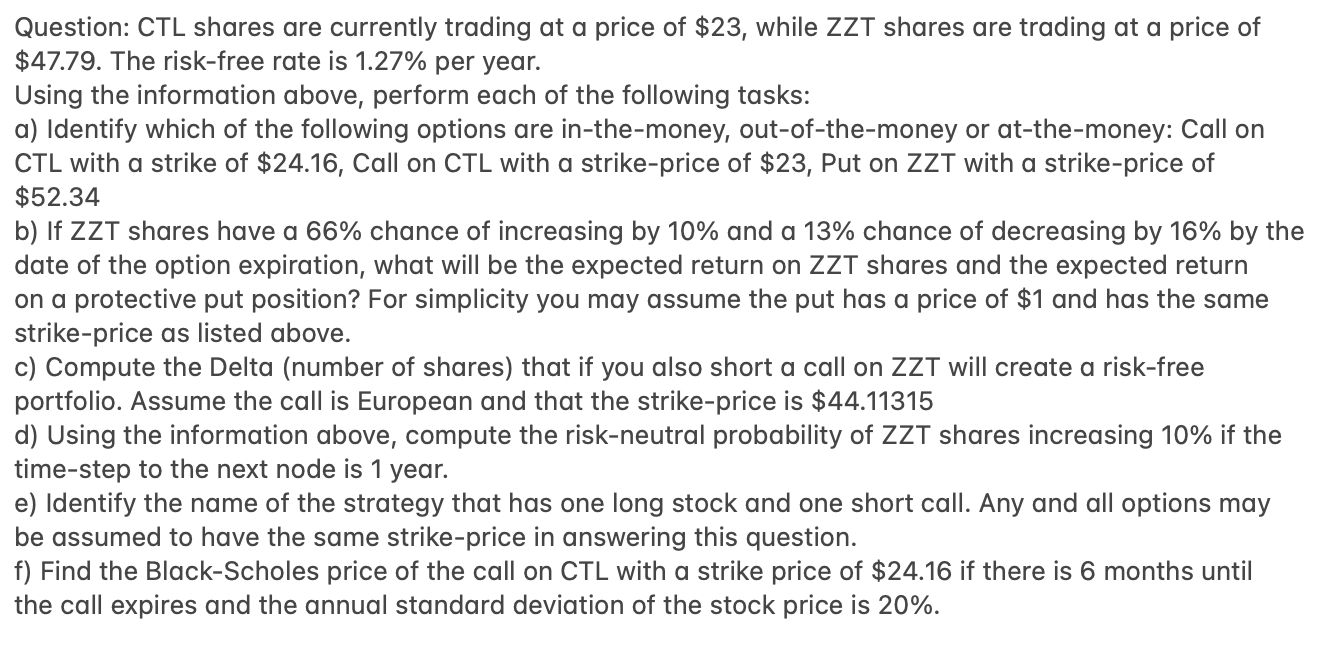

Question: CTL shares are currently trading at a price of $23, while ZZT shares are trading at a price of $47.79. The risk-free rate is 1.27% per year. Using the information above, perform each of the following tasks: a) Identify which of the following options are in-the-money, out-of-the-money or at-the-money: Call on CTL with a strike of $24.16, Call on CTL with a strike-price of $23, Put on ZZT with a strike-price of $52.34 b) If ZZT shares have a 66% chance of increasing by 10% and a 13% chance of decreasing by 16% by the date of the option expiration, what will be the expected return on ZZT shares and the expected return on a protective put position? For simplicity you may assume the put has a price of $1 and has the same strike-price as listed above. c) Compute the Delta (number of shares) that if you also short a call on ZZT will create a risk-free portfolio. Assume the call is European and that the strike-price is $44.11315 d) Using the information above, compute the risk-neutral probability of ZZT shares increasing 10% if the time-step to the next node is 1 year. e) Identify the name of the strategy that has one long stock and one short call. Any and all options may be assumed to have the same strike-price in answering this question. f) Find the Black-Scholes price of the call on CTL with a strike price of $24.16 if there is 6 months until the call expires and the annual standard deviation of the stock price is 20%. Question: CTL shares are currently trading at a price of $23, while ZZT shares are trading at a price of $47.79. The risk-free rate is 1.27% per year. Using the information above, perform each of the following tasks: a) Identify which of the following options are in-the-money, out-of-the-money or at-the-money: Call on CTL with a strike of $24.16, Call on CTL with a strike-price of $23, Put on ZZT with a strike-price of $52.34 b) If ZZT shares have a 66% chance of increasing by 10% and a 13% chance of decreasing by 16% by the date of the option expiration, what will be the expected return on ZZT shares and the expected return on a protective put position? For simplicity you may assume the put has a price of $1 and has the same strike-price as listed above. c) Compute the Delta (number of shares) that if you also short a call on ZZT will create a risk-free portfolio. Assume the call is European and that the strike-price is $44.11315 d) Using the information above, compute the risk-neutral probability of ZZT shares increasing 10% if the time-step to the next node is 1 year. e) Identify the name of the strategy that has one long stock and one short call. Any and all options may be assumed to have the same strike-price in answering this question. f) Find the Black-Scholes price of the call on CTL with a strike price of $24.16 if there is 6 months until the call expires and the annual standard deviation of the stock price is 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts