Question: please answer Problem 3 Suppose that in the previous problem, the company decides to use a hedge ratio of 0.6. How does the decision affect

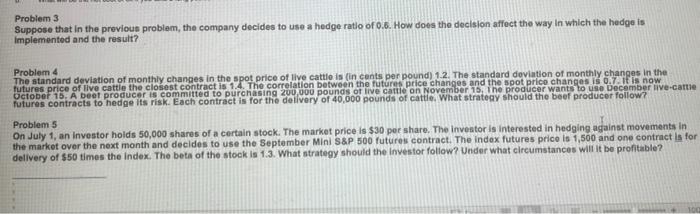

Problem 3 Suppose that in the previous problem, the company decides to use a hedge ratio of 0.6. How does the decision affect the way in which the hedge is Implemented and the result? Problem 4 The standard deviation of monthly changes in the spot price of live cattle is (in cents per pound) 1.2. The standard deviation of monthly changes in the futures price of live cattle the closest contract is 1.4. The correlation between the futures price changes and the spot price changes is 0.7. It is now October 16, A Deel producer is committed to purchasing 200,000 pounds of live catti on November 16, the producer wants to use December live-cattle futures contracts to hedge its risk. Each contract is for the delivery of 40,000 pounds of cattle. What strategy should the beef producer follow? Problem 5 On July 1, an Investor holds 50,000 shares of a certain stock. The market price is $30 per share. The investor is interested in hedging against movements in the market over the next month and decides to use the September Mini S&P 500 futures contract. The index futures price is 1,500 and one contract is for delivery of $50 times the Index. The beta of the stock is 1.3. What strategy should the Investor follow? Under what circumstances will it be profitable? Problem 3 Suppose that in the previous problem, the company decides to use a hedge ratio of 0.6. How does the decision affect the way in which the hedge is Implemented and the result? Problem 4 The standard deviation of monthly changes in the spot price of live cattle is (in cents per pound) 1.2. The standard deviation of monthly changes in the futures price of live cattle the closest contract is 1.4. The correlation between the futures price changes and the spot price changes is 0.7. It is now October 16, A Deel producer is committed to purchasing 200,000 pounds of live catti on November 16, the producer wants to use December live-cattle futures contracts to hedge its risk. Each contract is for the delivery of 40,000 pounds of cattle. What strategy should the beef producer follow? Problem 5 On July 1, an Investor holds 50,000 shares of a certain stock. The market price is $30 per share. The investor is interested in hedging against movements in the market over the next month and decides to use the September Mini S&P 500 futures contract. The index futures price is 1,500 and one contract is for delivery of $50 times the Index. The beta of the stock is 1.3. What strategy should the Investor follow? Under what circumstances will it be profitable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts