Question: Please answer problem 4. Thanks! 1. A contractor purchased a dozer for $180,000 and anticipates using it for nine years. The salvage value of the

Please answer problem 4. Thanks!

Please answer problem 4. Thanks!

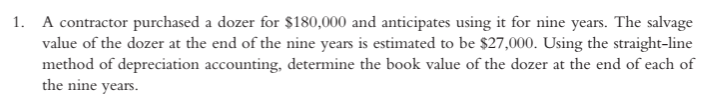

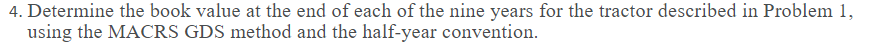

1. A contractor purchased a dozer for $180,000 and anticipates using it for nine years. The salvage value of the dozer at the end of the nine years is estimated to be $27,000. Using the straight-line method of depreciation accounting, determine the book value of the dozer at the end of each of the nine years. 4. Determine the book value at the end of each of the nine years for the tractor described in Problem 1, using the MACRS GDS method and the half-year convention. 1. A contractor purchased a dozer for $180,000 and anticipates using it for nine years. The salvage value of the dozer at the end of the nine years is estimated to be $27,000. Using the straight-line method of depreciation accounting, determine the book value of the dozer at the end of each of the nine years. 4. Determine the book value at the end of each of the nine years for the tractor described in Problem 1, using the MACRS GDS method and the half-year convention

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts