Question: Please answer question 2. Thanks! 1. A contractor purchased a dozer for $180,000 and anticipates using it for nine years. The salvage value of the

Please answer question 2. Thanks!

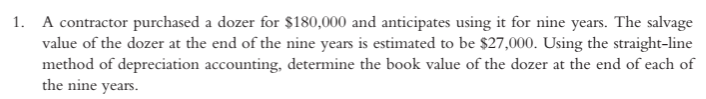

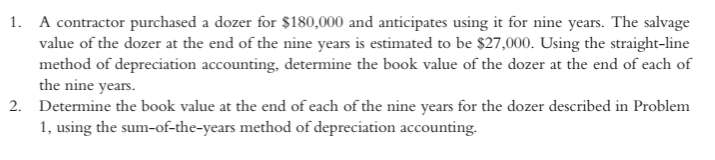

1. A contractor purchased a dozer for $180,000 and anticipates using it for nine years. The salvage value of the dozer at the end of the nine years is estimated to be $27,000. Using the straight-line method of depreciation accounting, determine the book value of the dozer at the end of each of the nine years. 1. A contractor purchased a dozer for $180,000 and anticipates using it for nine years. The salvage value of the dozer at the end of the nine years is estimated to be $27,000. Using the straight-line method of depreciation accounting, determine the book value of the dozer at the end of each of the nine years. 2. Determine the book value at the end of each of the nine years for the dozer described in Problem 1, using the sum-of-the-years method of depreciation accounting

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts