Question: Please answer problem 8 from chapter 7 (7-8) from the book Plant Design and Economics for Chemical Engineers by Max Peters (5th edition, or

Please answer problem 8 from chapter 7 (7-8) from the book " Plant Design and Economics for Chemical Engineers" by Max Peters (5th edition, or 4th). The question is slightly modified in that you have to include depreciation rate of 20% per year and income tax rate of 35%. Please show all steps clearly. thank you.

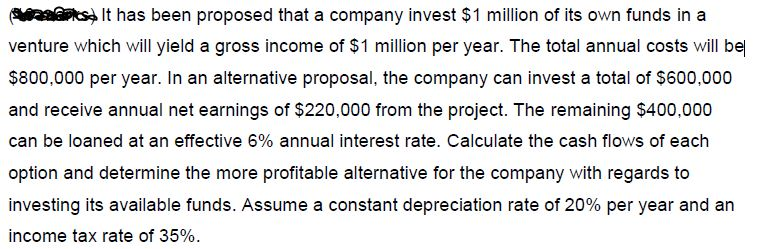

It has been proposed that a company invest $1 million of its own funds in a venture which will yield a gross income of $1 million per year. The total annual costs will bel $800,000 per year. In an alternative proposal, the company can invest a total of $600,000 and receive annual net earnings of $220,000 from the project. The remaining $400,000 can be loaned at an effective 6% annual interest rate. Calculate the cash flows of each option and determine the more profitable alternative for the company with regards to investing its available funds. Assume a constant depreciation rate of 20% per year and an income tax rate of 35%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts