Question: please answer Q5 !!No need to explain!! Please give me the answer as soon as possible! I'll give it a thumbs up!! msi Section 2

please answer Q5 !!No need to explain!! Please give me the answer as soon as possible! I'll give it a thumbs up!!

please answer Q5 !!No need to explain!! Please give me the answer as soon as possible! I'll give it a thumbs up!!

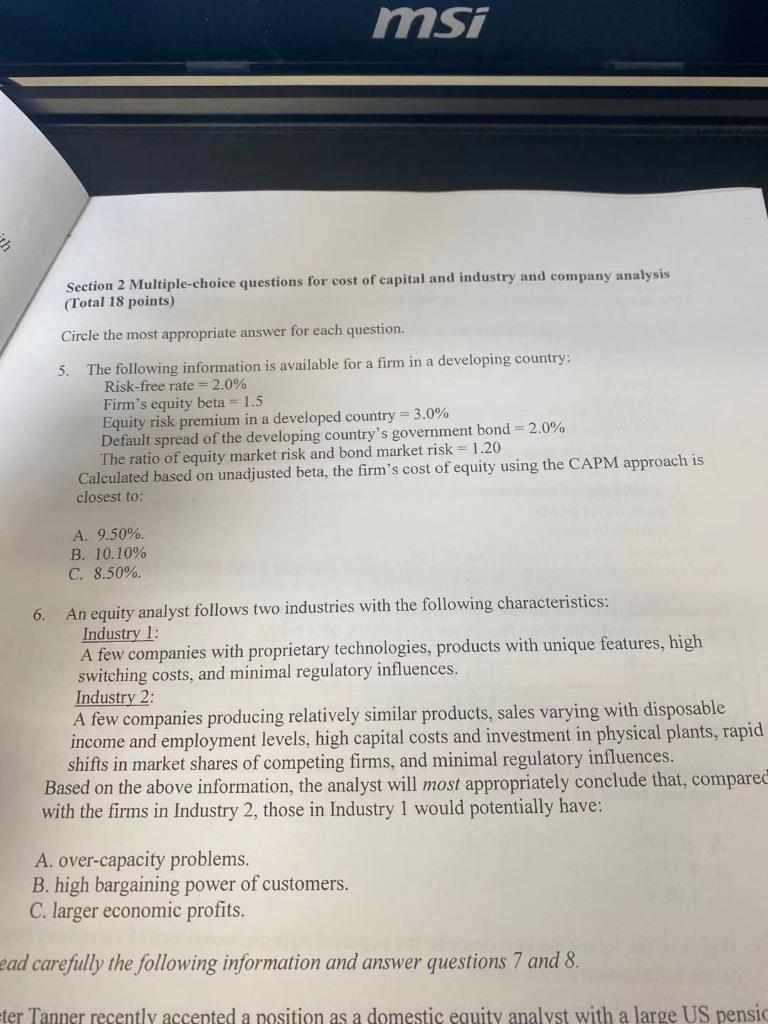

msi Section 2 Multiple-choice questions for cost of capital and industry and company analysis (Total 18 points) Circle the most appropriate answer for each question. 5. The following information is available for a firm in a developing country: Risk-free rate=2.0% Firm's equity beta = 1.5 Equity risk premium in a developed country = 3.0% Default spread of the developing country's government bond = 2.0% The ratio of equity market risk and bond market risk = 1.20 Calculated based on unadjusted beta, the firm's cost of equity using the CAPM approach is closest to: A. 9.50%. B. 10.10% C. 8.50%. 6. An equity analyst follows two industries with the following characteristics: Industry 1: A few companies with proprietary technologies, products with unique features, high switching costs, and minimal regulatory influences. Industry 2: A few companies producing relatively similar products, sales varying with disposable income and employment levels, high capital costs and investment in physical plants, rapid shifts in market shares of competing firms, and minimal regulatory influences. Based on the above information, the analyst will most appropriately conclude that, compared with the firms in Industry 2, those in Industry 1 would potentially have: A. over-capacity problems. B. high bargaining power of customers. C. larger economic profits. ead carefully the following information and answer questions 7 and 8. ter Tanner recently accented a position as a domestic equity analyst with a large US pensic

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts