Question: please answer Question 1 1. Many institutions have fixed future liabilities to meet (such as pension payments) and they fund these future liabilities using default-free

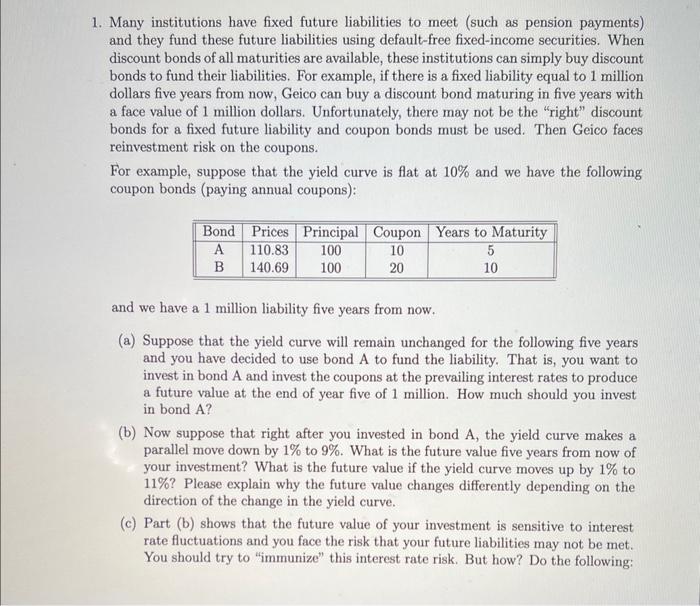

1. Many institutions have fixed future liabilities to meet (such as pension payments) and they fund these future liabilities using default-free fixed-income securities. When discount bonds of all maturities are available, these institutions can simply buy discount bonds to fund their liabilities. For example, if there is a fixed liability equal to 1 million dollars five years from now, Geico can buy a discount bond maturing in five years with a face value of 1 million dollars. Unfortunately, there may not be the "right" discount bonds for a fixed future liability and coupon bonds must be used. Then Geico faces reinvestment risk on the coupons. For example, suppose that the yield curve is flat at 10% and we have the following coupon bonds (paying annual coupons): and we have a 1 million liability five years from now. (a) Suppose that the yield curve will remain unchanged for the following five years and you have decided to use bond A to fund the liability. That is, you want to invest in bond A and invest the coupons at the prevailing interest rates to produce a future value at the end of year five of 1 million. How much should you invest in bond A ? (b) Now suppose that right after you invested in bond A, the yield curve makes a parallel move down by 1% to 9%. What is the future value five years from now of your investment? What is the future value if the yield curve moves up by 1% to 11% ? Please explain why the future value changes differently depending on the direction of the change in the yield curve. (c) Part (b) shows that the future value of your investment is sensitive to interest rate fluctuations and you face the risk that your future liabilities may not be met. You should try to "immunize" this interest rate risk. But how? Do the following

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts