Question: Please Solve 1. A 1. Many institutions have fixed future liabilities to meet (such as pension payments) and they fund these future liabilities using default-free

Please Solve 1. A

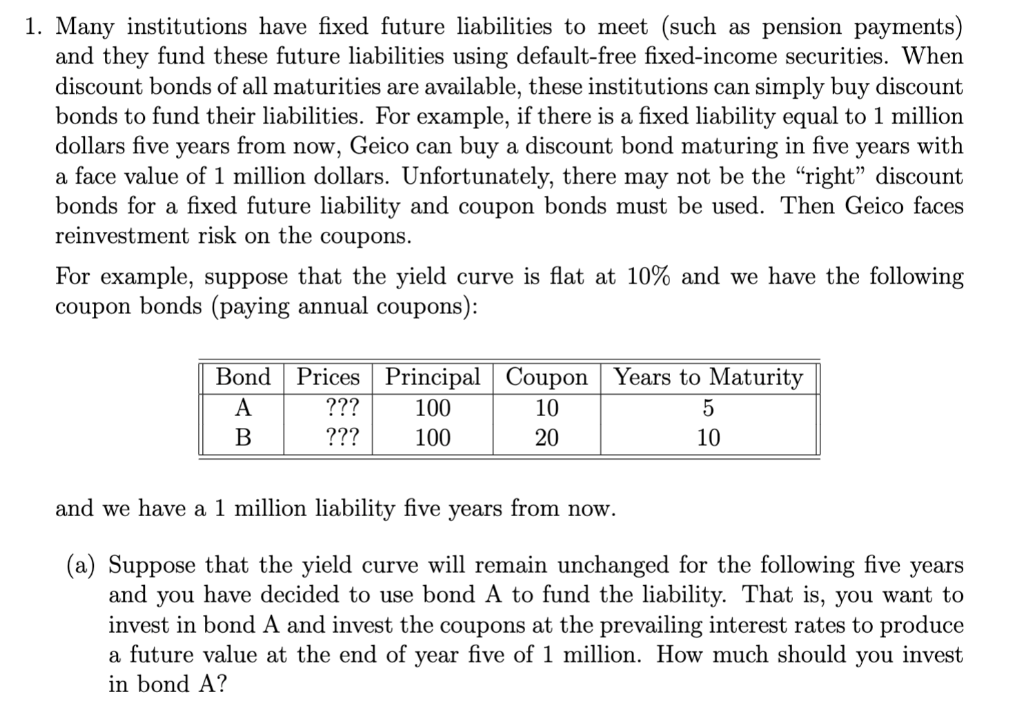

1. Many institutions have fixed future liabilities to meet (such as pension payments) and they fund these future liabilities using default-free fixed-income securities. When discount bonds of all maturities are available, these institutions can simply buy discount bonds to fund their liabilities. For example, if there is a fixed liability equal to 1 million dollars five years from now, Geico can buy a discount bond maturing in five years with a face value of 1 million dollars. Unfortunately, there may not be the "right" discount bonds for a fixed future liability and coupon bonds must be used. Then Geico faces reinvestment risk on the coupons. For example, suppose that the yield curve is flat at 10% and we have the following coupon bonds (paying annual coupons): and we have a 1 million liability five years from now. (a) Suppose that the yield curve will remain unchanged for the following five years and you have decided to use bond A to fund the liability. That is, you want to invest in bond A and invest the coupons at the prevailing interest rates to produce a future value at the end of year five of 1 million. How much should you invest in bond A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts