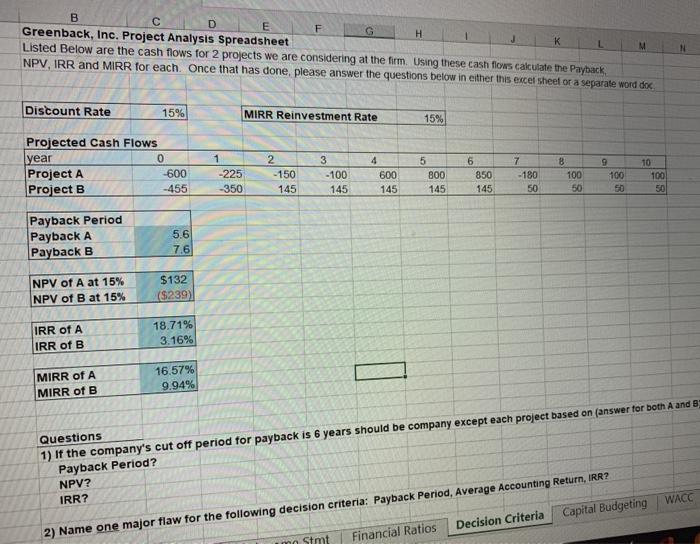

Question: please answer question 1 and 2 E F G H B Greenback, Inc. Project Analysis Spreadsheet Listed Below are the cash flows for 2 projects

E F G H B Greenback, Inc. Project Analysis Spreadsheet Listed Below are the cash flows for 2 projects we are considering at the firm. Using these cash flows calculate the Payback, NPV, IRR and MIRR for each. Once that has done, please answer the questions below in either this excel sheet or a separate word de K M Discount Rate 15% MIRR Reinvestment Rate 15% Projected Cash Flows year 0 Project A -600 Project B -455 1 -225 -350 2 - 150 145 3 -100 145 4 600 145 5 800 145 6 850 145 7 -180 50 8 100 50 9 100 50 10 100 50 Payback Period Payback A Payback B 5.6 7.6 NPV of A at 15% NPV of B at 15% $132 ($239) IRR of A IRR of B 18.71% 3.16% MIRR of A MIRR of B 16.57% 9.94% Questions 1) If the company's cut off period for payback is 6 years should be company except each project based on (answer for both A and B Payback Period? NPV? IRR? WACC Capital Budgeting Decision Criteria 2) Name one major flaw for the following decision criteria: Payback Period, Average Accounting Return, IRR? mo Stmt Financial Ratios

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts