Question: Please answer question #1, SHOWING ALL WORK ACCORDINGLY ON ALL SECTIONS. Thank you! Noteworthy, Inc., produces and sells small electronic keyboards. Assume that you have

Please answer question #1, SHOWING ALL WORK ACCORDINGLY ON ALL SECTIONS. Thank you!

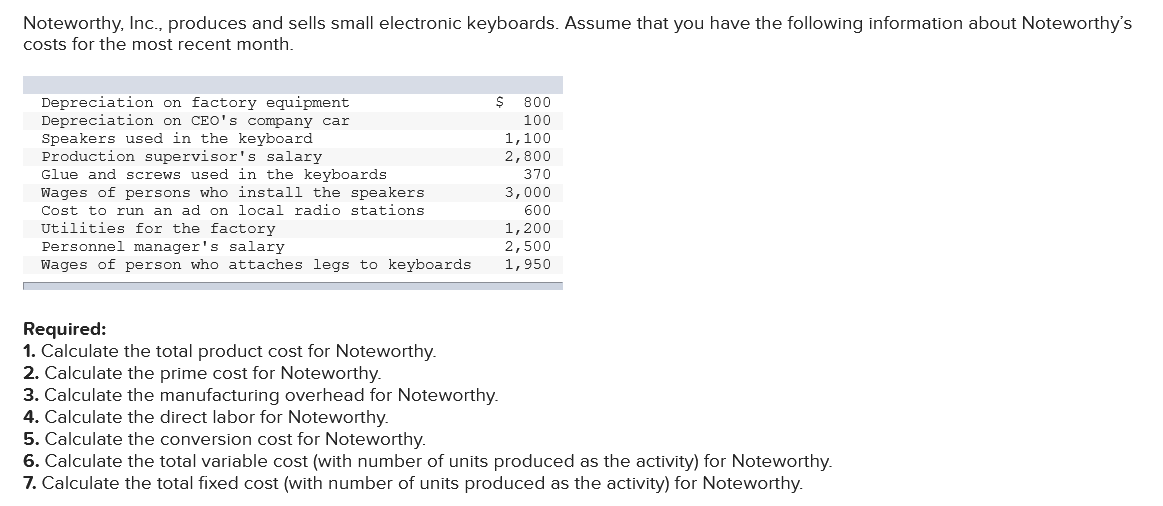

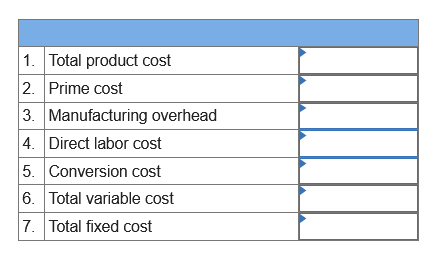

Noteworthy, Inc., produces and sells small electronic keyboards. Assume that you have the following information about Noteworthy's costs for the most recent month. Depreciation on factory equipment Depreciation on CEO's company car Speakers used in the keyboard Production supervisor's salary Glue and screws used in the keyboards Wages of persons who install the speakers Cost to run an ad on local radio stations Utilities for the factory Personnel manager's salary Wages of person who attaches legs to keyboards $ 800 100 1,100 2,800 370 3,000 600 1,200 2,500 1,950 Required: 1. Calculate the total product cost for Noteworthy. 2. Calculate the prime cost for Noteworthy. 3. Calculate the manufacturing overhead for Noteworthy. 4. Calculate the direct labor for Noteworthy. 5. Calculate the conversion cost for Noteworthy. 6. Calculate the total variable cost (with number of units produced as the activity) for Noteworthy. 7. Calculate the total fixed cost (with number of units produced as the activity) for Noteworthy. 1. Total product cost 2. Prime cost 3. Manufacturing overhead 4. Direct labor cost 5. Conversion cost 6. Total variable cost 7. Total fixed cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts