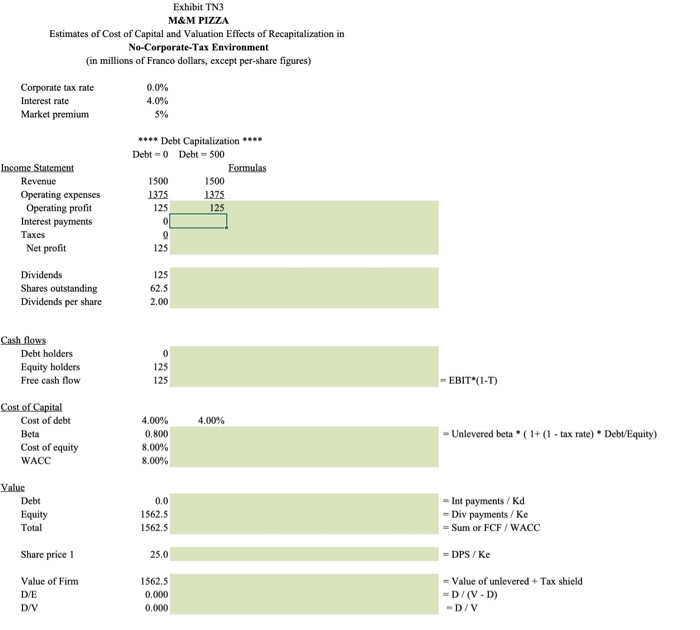

Question: 1.Use Exhibit TN3 spreadsheet. The company changes its capital structure by issuing 500 million Franco dollars of debt in a no-corporate-tax environment. Fill out the

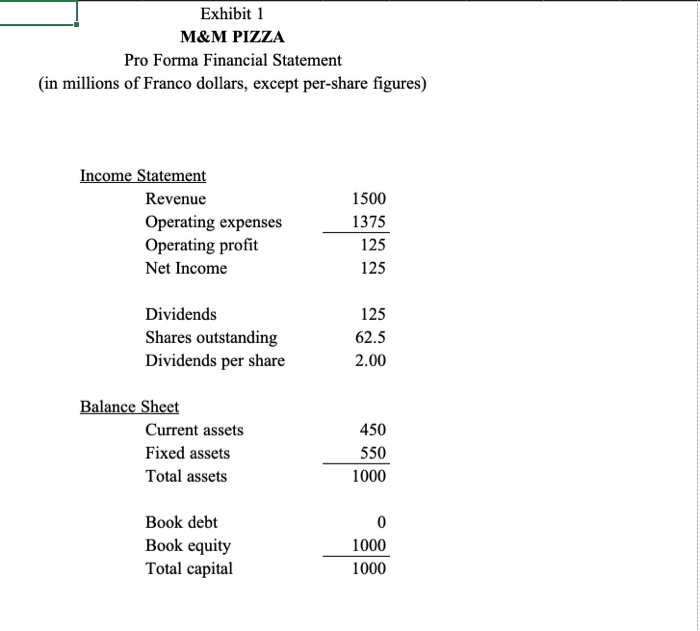

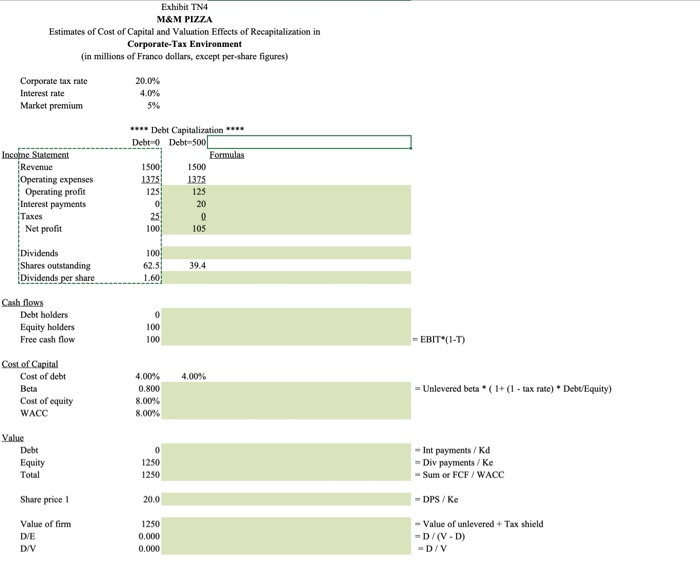

Exhibit 1 M&M PIZZA Pro Forma Financial Statement (in millions of Franco dollars, except per-share figures) Income Statement Revenue Operating expenses Operating profit Net Income 1500 1375 125 125 Dividends Shares outstanding Dividends per share 125 62.5 2.00 Balance Sheet Current assets Fixed assets Total assets 450 550 1000 Book debt Book equity Total capital 0 1000 1000 Exhibit TN3 M&M PIZZA Estimates of Cost of Capital and Valuation Effects of Recapitalization in No-Corporate-Tax Environment (in millions of Franco dollars, except per-share figures) Corporate tax rate Interest rate Market premium 0.0% 4.0% 5% 1500 Income Statement Revenue Operating expenses Operating profit Interest payments Taxes Net profit **** Debt Capitalization **** Debt = 0 Debt-500 Formulas 1500 1375 1375 125 125 0 0 125 Dividends Shares outstanding Dividends per share 125 62.5 2.00 Cash flows Debt holders Equity holders Free cash flow 0 125 125 - EBIT*(1-T) 4.00% Cost of Capital Cost of debt Beta Cost of equity WACC 4.00% 0.800 8.00% 8.00% Unlevered beta * (1+(1 - tax rate) Debt/Equity) Value Debt Equity Total 0.0 1562.5 1562.5 - Int payments / Ka - Div payments / Ke = Sum or FCF/WACC = DPS/Ke Share price 25.0 Value of Firm D/E D/V 1562.5 0.000 0.000 - Value of unlevered + Tax shield -D/(VD) -D/V Exhibit TN4 M&M PIZZA Estimates of Cost of Capital and Valuation Effects of Recapitalization in Corporate Tax Environment (in millions of Franco dollars, except per-share figures) Corporate tax rate 20.0% Interest rate 4.0% Market premium 5% Income Statement Revenue Operating expenses Operating profit Interest payments Taxes Net profit **** Debt Capitalization **** Debt Debt-500 Formulas 1500 1500 1375 1375 125 125 0 20 25 0 105 100 Dividends Shares outstanding Dividends per share 100 62.5 1.60 39.4 Cash flows Debt holders Equity holders Free cash flow 0 100 100 - EBIT*(1-T) 4.00% Cost of Capital Cost of debt Beta Cost of equity WACC 4.00% 0.800 8.00% 8.00% = Unlevered beta *(1+ (1 - tax rate) * Debt'Equity) Value Debt Equity Total 0 1250 1250 - Int payments/Kd - Div payments/ke Sum or FCF/WACC Share price 20.0 DPS/ke Value of firm DVE DAV 1250 0.000 0.000 - Value of unlevered + Tax shield -D/(VD) D/V Exhibit 1 M&M PIZZA Pro Forma Financial Statement (in millions of Franco dollars, except per-share figures) Income Statement Revenue Operating expenses Operating profit Net Income 1500 1375 125 125 Dividends Shares outstanding Dividends per share 125 62.5 2.00 Balance Sheet Current assets Fixed assets Total assets 450 550 1000 Book debt Book equity Total capital 0 1000 1000 Exhibit TN3 M&M PIZZA Estimates of Cost of Capital and Valuation Effects of Recapitalization in No-Corporate-Tax Environment (in millions of Franco dollars, except per-share figures) Corporate tax rate Interest rate Market premium 0.0% 4.0% 5% 1500 Income Statement Revenue Operating expenses Operating profit Interest payments Taxes Net profit **** Debt Capitalization **** Debt = 0 Debt-500 Formulas 1500 1375 1375 125 125 0 0 125 Dividends Shares outstanding Dividends per share 125 62.5 2.00 Cash flows Debt holders Equity holders Free cash flow 0 125 125 - EBIT*(1-T) 4.00% Cost of Capital Cost of debt Beta Cost of equity WACC 4.00% 0.800 8.00% 8.00% Unlevered beta * (1+(1 - tax rate) Debt/Equity) Value Debt Equity Total 0.0 1562.5 1562.5 - Int payments / Ka - Div payments / Ke = Sum or FCF/WACC = DPS/Ke Share price 25.0 Value of Firm D/E D/V 1562.5 0.000 0.000 - Value of unlevered + Tax shield -D/(VD) -D/V Exhibit TN4 M&M PIZZA Estimates of Cost of Capital and Valuation Effects of Recapitalization in Corporate Tax Environment (in millions of Franco dollars, except per-share figures) Corporate tax rate 20.0% Interest rate 4.0% Market premium 5% Income Statement Revenue Operating expenses Operating profit Interest payments Taxes Net profit **** Debt Capitalization **** Debt Debt-500 Formulas 1500 1500 1375 1375 125 125 0 20 25 0 105 100 Dividends Shares outstanding Dividends per share 100 62.5 1.60 39.4 Cash flows Debt holders Equity holders Free cash flow 0 100 100 - EBIT*(1-T) 4.00% Cost of Capital Cost of debt Beta Cost of equity WACC 4.00% 0.800 8.00% 8.00% = Unlevered beta *(1+ (1 - tax rate) * Debt'Equity) Value Debt Equity Total 0 1250 1250 - Int payments/Kd - Div payments/ke Sum or FCF/WACC Share price 20.0 DPS/ke Value of firm DVE DAV 1250 0.000 0.000 - Value of unlevered + Tax shield -D/(VD) D/V

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts