Question: Please answer question #1, SHOWING ALL WORK ACCORDINGLY ON ALL SECTIONS. Thank you! Hamilton Company applies manufacturing overhead costs to products based on direct labor

Please answer question #1, SHOWING ALL WORK ACCORDINGLY ON ALL SECTIONS. Thank you!

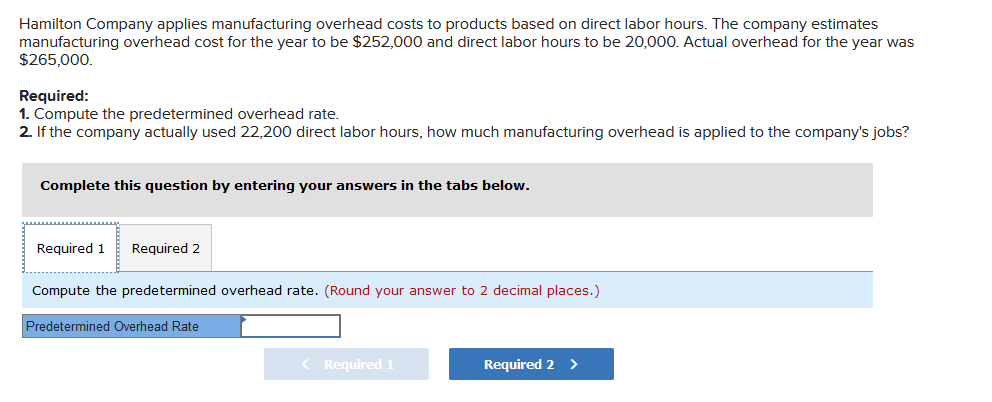

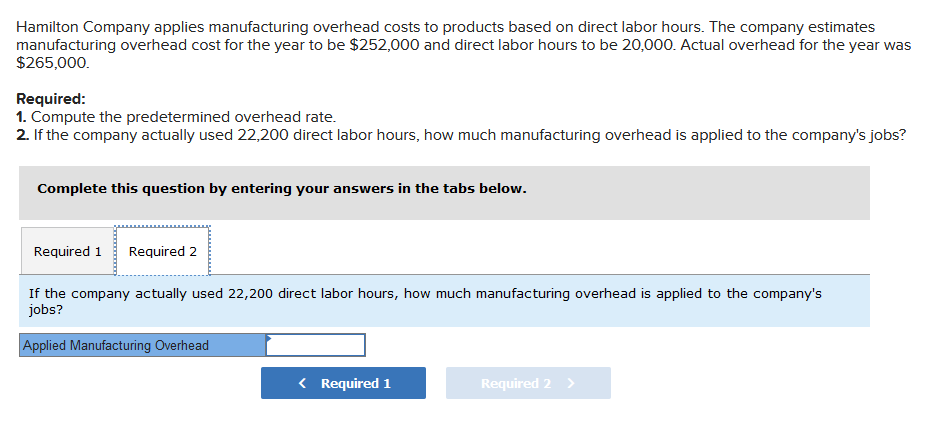

Hamilton Company applies manufacturing overhead costs to products based on direct labor hours. The company estimates manufacturing overhead cost for the year to be $252,000 and direct labor hours to be 20,000. Actual overhead for the year was $265,000. Required: 1. Compute the predetermined overhead rate. 2. If the company actually used 22,200 direct labor hours, how much manufacturing overhead is applied to the company's jobs? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the predetermined overhead rate. (Round your answer to 2 decimal places.) Predetermined Overhead Rate Hamilton Company applies manufacturing overhead costs to products based on direct labor hours. The company estimates manufacturing overhead cost for the year to be $252,000 and direct labor hours to be 20,000. Actual overhead for the year was $265,000. Required: 1. Compute the predetermined overhead rate. 2. If the company actually used 22,200 direct labor hours, how much manufacturing overhead is applied to the company's jobs? Complete this question by entering your answers in the tabs below. Required 1 Required 2 If the company actually used 22,200 direct labor hours, how much manufacturing overhead is applied to the company's jobs? Applied Manufacturing Overhead

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts