Question: please answer question 1 subparts I. Efficient Two Asset Portfolios Assume that the expected return on asset 1 is 5% andl the expect The standard

please answer question 1 subparts

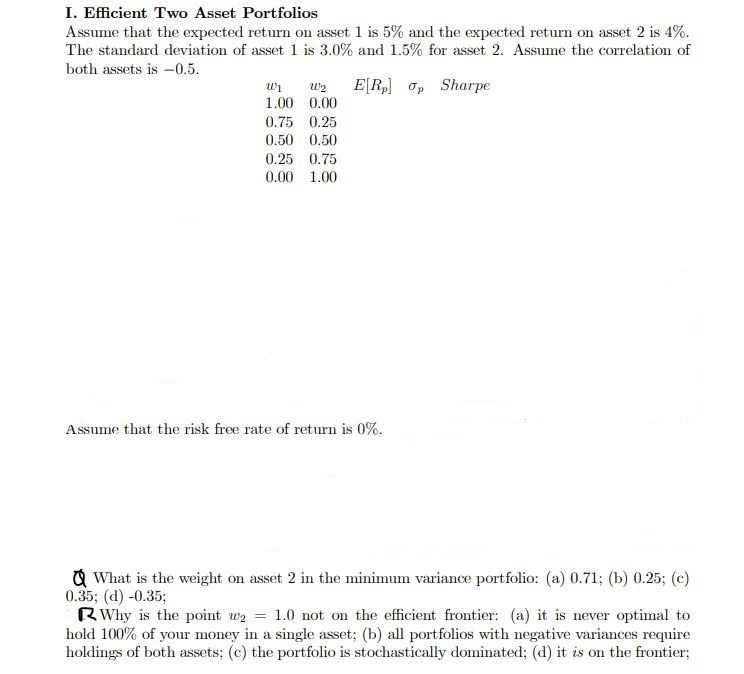

I. Efficient Two Asset Portfolios Assume that the expected return on asset 1 is 5% andl the expect The standard deviation of asset 1 is 3.0% and 1.5% for asset 2. Assume the correlation of both assets is -0.5 d return on asset 2 is 4% un w2 ElRp] p Sharpe 1.00 0.00 0.75 0.25 0.50 0.50 0.25 0.75 0.00 1.00 Assume that the risk free rate of return is 0% Q Wha is the weight on asset 2 in the m variance portfolio: (a) 0.71; (b) 0.25; (c) 0.35; (d) -0.35; RWhy is the point 1.0 not on the efficient frontier: (a) it is never optimal to hold 100% of your money in a single asset; (b) all portfolios with negative variances require holdings of both assets; (c) the portfolio is stochastically dominated; (d) it is on the frontier

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts