Question: Please answer question 13. Formulas attached just in case 13) (4 points) A poll of 1,505 adults in the United States found that 55% believe

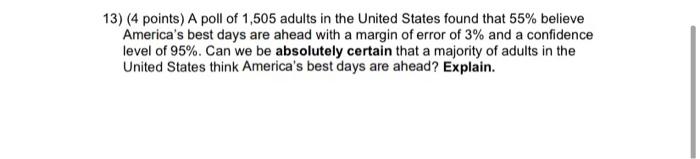

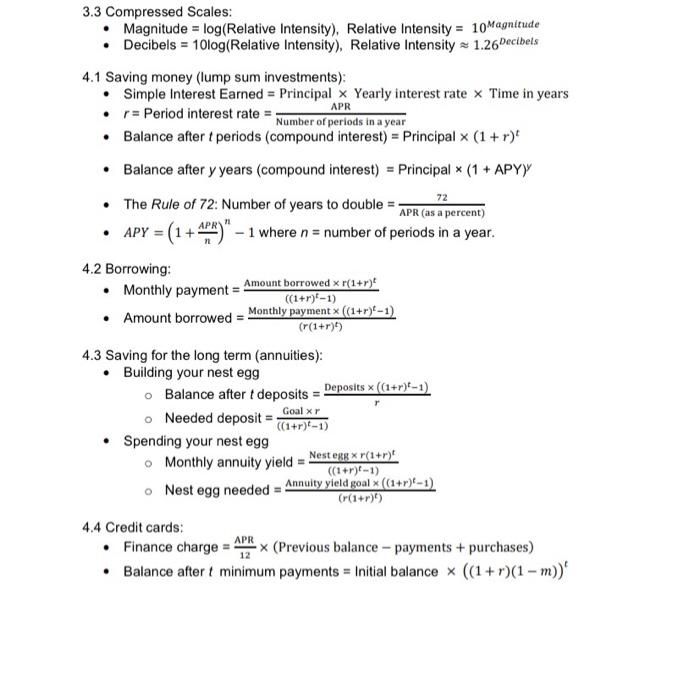

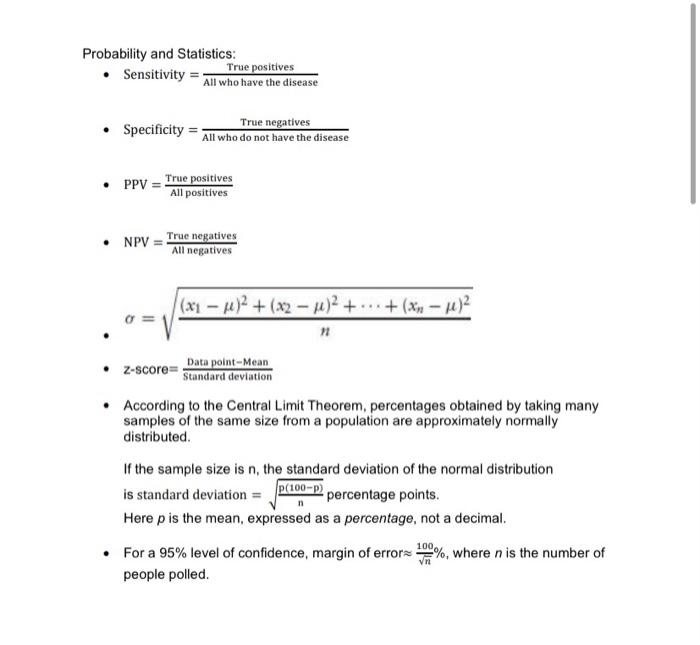

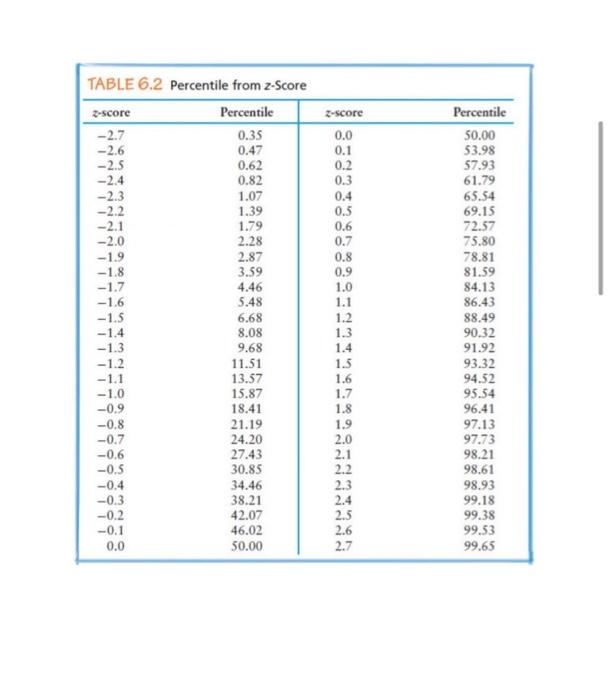

13) (4 points) A poll of 1,505 adults in the United States found that 55% believe America's best days are ahead with a margin of error of 3% and a confidence level of 95%. Can we be absolutely certain that a majority of adults in the United States think America's best days are ahead? Explain. 72 APR 71 3.3 Compressed Scales: Magnitude = log(Relative Intensity), Relative Intensity = 10Magnitude Decibels = 10log(Relative Intensity), Relative Intensity = 1.26Decibels 4.1 Saving money (lump sum investments): Simple Interest Earned = Principal x Yearly interest rate x Time in years r= Period interest rate : APR Number of periods in a year Balance after t periods (compound interest) = Principal x (1 + r) Balance after y years (compound interest) = Principal *(1 + APYY The Rule of 72: Number of years to double APR (as a percent) APY = (1 +428)" 1 where n= number of periods in a year. 4.2 Borrowing: Monthly payment Amount borrowed x r(1+r) ((1+r)-1) Amount borrowed = Monthly payment x ((1+r)-1) (r(1+r) 4.3 Saving for the long term (annuities): Building your nest egg Balance after t deposits - Deposits x ((1+r)-1) Needed deposit = Goalxr. ((1+r)-1) Spending your nest egg Monthly annuity yield = Nestess x r(1+r)! ((1+r)-1) o Nest egg needed = Annuity yield goal x ((1+r)-1) (+(1+r)) 4.4 Credit cards: Finance charge = -x (Previous balance - payments + purchases) Balance after t minimum payments = Initial balance * ((1+r)(1 m))' APR Probability and Statistics: Sensitivity = True positives All who have the disease True negatives Specificity = All who do not have the disease PPV = True positives All positives NPV = True negatives All negatives (x1 )2 + (x2 - 1)2 + ... + (X) )2 0 = n z-score Data point-Mean Standard deviation According to the Central Limit Theorem, percentages obtained by taking many samples of the same size from a population are approximately normally distributed If the sample size is n, the standard deviation of the normal distribution is standard deviation = p(100-P percentage points. Here p is the mean, expressed as a percentage, not a decimal. For a 95% level of confidence, margin of errorz 10%, where n is the number of people polled. 2-score TABLE 6.2 Percentile from z-Score 2-score Percentile - 2.7 0.35 -2.6 0.47 -2.5 0.62 -2.4 0.82 -2.3 1.07 -2.2 1.39 -2.1 1.79 -2.0 2.28 -1.9 2.87 -1.8 3.59 -1.7 4.46 -1.6 5.48 -1.5 6.68 -1.4 8.08 -1.3 9.68 -1.2 11.51 -1.1 13.57 -1.0 15.87 -0.9 18.41 -0.8 21.19 -0.7 24.20 -0.6 27.43 -0.5 30.85 -0.4 34.46 -0.3 38.21 -0.2 42.07 -0.1 46.02 0.0 50.00 0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0 1.1 1.2 1.3 1.4 1.5 1.6 1.7 1.8 1.9 2.0 2.1 2.2 2.3 Percentile 50.00 53.98 57.93 61.79 65.54 69.15 72.57 75.80 78.81 81.59 84.13 86.43 88.49 90.32 91.92 93.32 94.52 95.54 96.41 97.13 97.73 98.21 98.61 98.93 99.18 99.38 99.53 99.65 2.4 2.5 2.6 2.7 13) (4 points) A poll of 1,505 adults in the United States found that 55% believe America's best days are ahead with a margin of error of 3% and a confidence level of 95%. Can we be absolutely certain that a majority of adults in the United States think America's best days are ahead? Explain. 72 APR 71 3.3 Compressed Scales: Magnitude = log(Relative Intensity), Relative Intensity = 10Magnitude Decibels = 10log(Relative Intensity), Relative Intensity = 1.26Decibels 4.1 Saving money (lump sum investments): Simple Interest Earned = Principal x Yearly interest rate x Time in years r= Period interest rate : APR Number of periods in a year Balance after t periods (compound interest) = Principal x (1 + r) Balance after y years (compound interest) = Principal *(1 + APYY The Rule of 72: Number of years to double APR (as a percent) APY = (1 +428)" 1 where n= number of periods in a year. 4.2 Borrowing: Monthly payment Amount borrowed x r(1+r) ((1+r)-1) Amount borrowed = Monthly payment x ((1+r)-1) (r(1+r) 4.3 Saving for the long term (annuities): Building your nest egg Balance after t deposits - Deposits x ((1+r)-1) Needed deposit = Goalxr. ((1+r)-1) Spending your nest egg Monthly annuity yield = Nestess x r(1+r)! ((1+r)-1) o Nest egg needed = Annuity yield goal x ((1+r)-1) (+(1+r)) 4.4 Credit cards: Finance charge = -x (Previous balance - payments + purchases) Balance after t minimum payments = Initial balance * ((1+r)(1 m))' APR Probability and Statistics: Sensitivity = True positives All who have the disease True negatives Specificity = All who do not have the disease PPV = True positives All positives NPV = True negatives All negatives (x1 )2 + (x2 - 1)2 + ... + (X) )2 0 = n z-score Data point-Mean Standard deviation According to the Central Limit Theorem, percentages obtained by taking many samples of the same size from a population are approximately normally distributed If the sample size is n, the standard deviation of the normal distribution is standard deviation = p(100-P percentage points. Here p is the mean, expressed as a percentage, not a decimal. For a 95% level of confidence, margin of errorz 10%, where n is the number of people polled. 2-score TABLE 6.2 Percentile from z-Score 2-score Percentile - 2.7 0.35 -2.6 0.47 -2.5 0.62 -2.4 0.82 -2.3 1.07 -2.2 1.39 -2.1 1.79 -2.0 2.28 -1.9 2.87 -1.8 3.59 -1.7 4.46 -1.6 5.48 -1.5 6.68 -1.4 8.08 -1.3 9.68 -1.2 11.51 -1.1 13.57 -1.0 15.87 -0.9 18.41 -0.8 21.19 -0.7 24.20 -0.6 27.43 -0.5 30.85 -0.4 34.46 -0.3 38.21 -0.2 42.07 -0.1 46.02 0.0 50.00 0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0 1.1 1.2 1.3 1.4 1.5 1.6 1.7 1.8 1.9 2.0 2.1 2.2 2.3 Percentile 50.00 53.98 57.93 61.79 65.54 69.15 72.57 75.80 78.81 81.59 84.13 86.43 88.49 90.32 91.92 93.32 94.52 95.54 96.41 97.13 97.73 98.21 98.61 98.93 99.18 99.38 99.53 99.65 2.4 2.5 2.6 2.7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts