Question: What does gated globe mean by the authors? Summary the first section of the article. The forward march of globalisation has paused since the financial

What does "gated globe" mean by the authors? Summary the first section of the article.

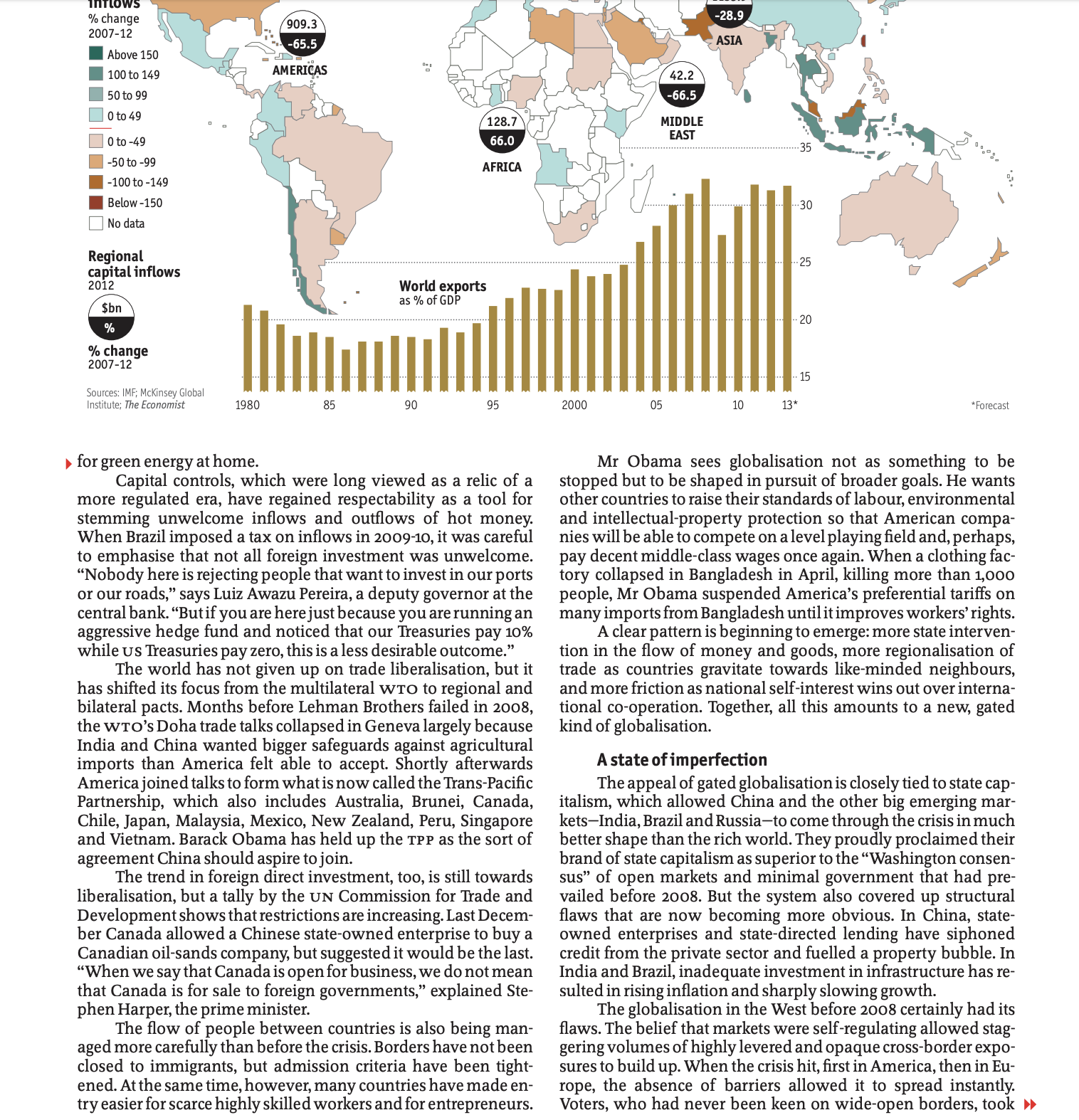

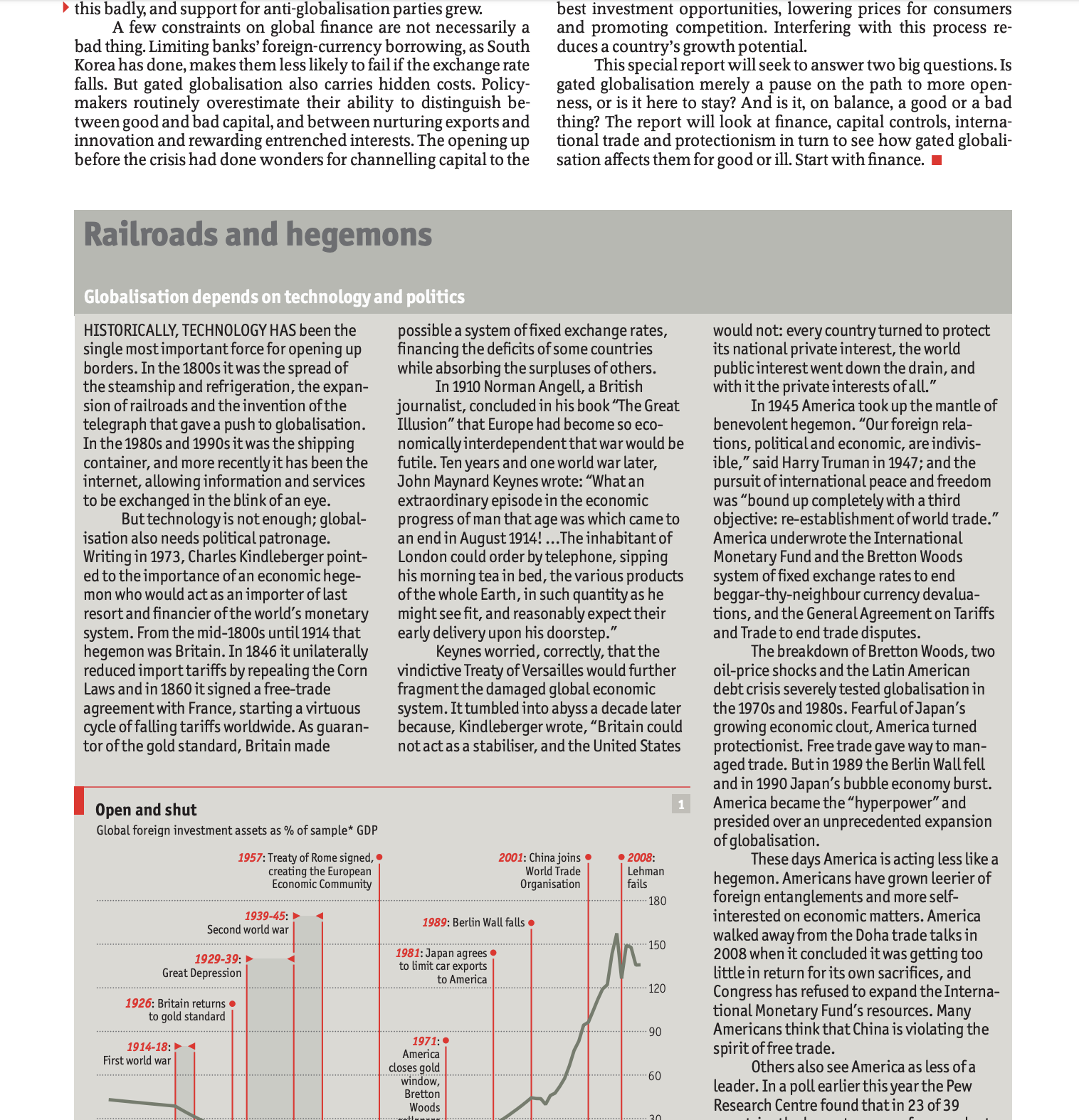

The forward march of globalisation has paused since the financial crisis, giving way to a more conditional, interventionist and nationalist model. Greg Ip examines the consequences. FIVE YEARS AGO George W. Bush gathered the leaders of the largest rich and developing countries in Washington for the first summit of the G20 In the face of the worst financial crisis since the Great Depression, the leaders promised not to repeat that era's descent into economic isolation ism, proclaiming their commitment to an open global economy and the rejection of protectionism. They succeeded only in part. Although they did not retreat into the extreme protectionism of the 1930s, the world economy has certainly be come less open. After two de- cades in which people, capital and goods were moving ever more freely across borders, walls have been going up, albeit ones with gates. Governments increase ingly pick and choose whom they trade with, what sort of capi- tal they welcome and how much CONTENTS freedom they allow for doing business abroad. Virtually all countries still 3 The history of globalisation Railroads and hegemon: embrace the principles of inter- national trade and investment. 4 Financial fragmentation They want to enjoy the benefits Too much of a good thing of globalisation, but as much as 6 Capital possible they now also want to Just in case insulate themselves from its downsides, be they volatile capi- 8 Trade tal flows or surging imports. In my backyard Globalisation has clearly 10 Protectionism paused. A simple measure of The hidden persuaders trade intensity, world exports as a share of world GDP, rose steadily 12 Political pressures from 1986 to 2008 but has been flat since. Global capital flows, which in A question of trust 2007 topped $11 trillion, amounted to barely a third of that figure last year. 14 The outlook Cross-border direct investment is also well down on its 2007 peak. What kind of capitalism? Much of this is cyclical. The recent crises and recessions in the rich world have subdued the animal spirits that drive international invest- ment. But much of it is a matter of deliberate policy. In finance, for in- stance, where the ease of cross-border lending had made it possible for places like America and some southern European countries to run up ever larger current-account deficits, banks now face growing pressure to ACKNOWLEDGMENTS bolster domestic lending, raise capital and ring-fence foreign units Many people generously gave of World leaders congratulate themselves on having avoided protec their time and knowledge for the tionism since the crisis, and on conventional measures they are right: ac- preparation of this report. Apart cording to the World Trade Organisation (WTO), explicit restrictions on from those mentioned in the text, imports have had hardly any impact on trade since 2008. But hidden pro- the author would particularly like to thank Mansueto Almeida, Welber tectionism is flourishing, often under the guise of export promotion or in- Barral, Andrew Batson, Ajith Nivard dustrial policy. India, for example, imposes local-content requirements Cabraal, Paulo Cardamone, Sage on government purchases of information and communications technol- Chandler, Ilan Goldfajn, Davis ogy and solar-power equipment. Brazil, which a decade ago compelled Hodge, Doug Irwin, Daisy King, Susan Lund, Antonio Megale, Mei its state-controlled oil giant, Petrobras, to buy more of its equipment from A list of sources is at local companies, has been tightening restrictions steadily since. And Economist.com/specialreports Jianping, Neelkanth Mishra, Kevin both America and Europe imposed, or threatened to impose, tariffs on An audio interview with Nealer, Michael Pettis, Matthew the author is at Slaughter, Madeleine Sumption and Chinese solar panels, alleging widespread government support. At the Economist.com/audiovideo/ Shang-Jin Wei. same time, though, Western countries themselves offer hefty subsidies specialreportso change -28.9 2007-12 909.3 Above 150 -65.5 ASIA 100 to 149 AMERICAS 42.2 50 to 99 -66.5 0 to 49 128.7 MIDDLE 0 to -49 66.0 EAST . 35 -50 to -99 AFRICA -100 to -149 . . Below -150 .30 No data Regional .. 25 capital inflows 2012 World exports $bn % -. 20 % change 2007-12 -. 15 Sources: IMF; Mckinsey Global Institute; The Economist 1980 85 90 95 2000 05 10 13* Forecast for green energy at home. Mr Obama sees globalisation not as something to be Capital controls, which were long viewed as a relic of a stopped but to be shaped in pursuit of broader goals. He wants more regulated era, have regained respectability as a tool for other countries to raise their standards of labour, environmental stemming unwelcome inflows and outflows of hot money. When Brazil imposed a tax on inflows in 2009-10, it was careful and intellectual-property protection so that American compa- nies will be able to compete on a level playing field and, perhaps, to emphasise that not all foreign investment was unwelcome. pay decent middle-class wages once again. When a clothing fac- "Nobody here is rejecting people that want to invest in our ports or our roads," says Luiz Awazu Pereira, a deputy governor at the tory collapsed in Bangladesh in April, killing more than 1,000 people, Mr Obama suspended America's preferential tariffs on central bank. "But if you are here just because you are running an aggressive hedge fund and noticed that our Treasuries pay 10% many imports from Bangladesh until it improves workers' rights. A clear pattern is beginning to emerge: more state interven- while us Treasuries pay zero, this is a less desirable outcome." tion in the flow of money and goods, more regionalisation of The world has not given up on trade liberalisation, but it has shifted its focus from the multilateral WTO to regional and trade as countries gravitate towards like-minded neighbours, bilateral pacts. Months before Lehman Brothers failed in 2008, and more friction as national self-interest wins out over interna- tional co-operation. Together, all this amounts to a new, gated the WTO's Doha trade talks collapsed in Geneva largely because India and China wanted bigger safeguards against agricultural kind of globalisation. imports than America felt able to accept. Shortly afterwards A state of imperfection America joined talks to form what is now called the Trans-Pacific Partnership, which also includes Australia, Brunei, Canada, The appeal of gated globalisation is closely tied to state cap- italism, which allowed China and the other big emerging mar- Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam. Barack Obama has held up the TPP as the sort of kets-India, Brazil and Russia-to come through the crisis in much better shape than the rich world. They proudly proclaimed their agreement China should aspire to join. The trend in foreign direct investment, too, is still towards brand of state capitalism as superior to the "Washington consen- sus" of open markets and minimal government that had pre- liberalisation, but a tally by the UN Commission for Trade and vailed before 2008. But the system also covered up structural Development shows that restrictions are increasing. Last Decem flaws that are now becoming more obvious. In China, state- ber Canada allowed a Chinese state-owned enterprise to buy a owned enterprises and state-directed lending have siphoned Canadian oil-sands company, but suggested it would be the last. credit from the private sector and fuelled a property bubble. In 'When we say that Canada is open for business, we do not mean dequate investm that Canada is for sale to foreign governments," explained Ste- sulted in rising inflation and sharply slowing growth. phen Harper, the prime minister. The globalisation in the West before 2008 certainly had its The flow of people between countries is also being man- flaws. The belief that markets were self-regulating allowed stag- aged more carefully than before the crisis. Borders have not been , but admission criteria have been tight- gering volumes of highly levered and opaque cross-border expo- ened. At the same time, however, many countries have made en- sures to build up. When the crisis hit, first in America, then in Eu try easier for scarce highly skilled workers and for entrepreneurs. rope, the absence of barriers allowed it to spread instantly. Voters, who had never been keen on wide-open borders, tookthis badly, and support for anti-globalisation parties grew. best investment opportunities, lowering prices for consumers A few constraints on global finance are not necessarily a bad thing. Limiting banks' foreign-currency borrowing, as South and promoting competition. Interfering with this process re- Korea has done, makes them less likely to fail if the exchange rate duces a country's growth potential. falls. But gated globalisation also carries hidden costs. Policy- This special report will seek to answer two big questions. Is gated globalisation merely a pause on the path to more open- makers routinely overestimate their ability to distinguish be- ness, or is it here to stay? And is it, on balance, a good or a bad tween good and bad capital, and between nurturing exports and innovation and rewarding entrenched interests. The opening up thing? The report will look at finance, capital controls, interna- before the crisis had done wonders for channelling capital to the tional trade and protectionism in turn to see how gated globali- sation affects them for good or ill. Start with finance. Railroads and hegemons Globalisation depends on technology and politics HISTORICALLY, TECHNOLOGY HAS been the single most important force for opening up possible a system of fixed exchange rates, financing the deficits of some countries would not: every country turned to protect its national private interest, the world borders. In the 1800s it was the spread of while absorbing the surpluses of others. the steamship and refrigeration, the expan- In 1910 Norman Angell, a British public interest went down the drain, and with it the private interests of all." sion of railroads and the invention of the journalist, concluded in his book "The Great In 1945 America took up the mantle of telegraph that gave a push to globalisation. Illusion" that Europe had become so eco- benevolent hegemon. "Our foreign rela- In the 1980s and 1990s it was the shipping container, and more recently it has been the nomically interdependent that war would be futile. Ten years and one world war later, tions, political and economic, are indivis- internet, allowing information and services ible," said Harry Truman in 1947; and the John Maynard Keynes wrote: "What an pursuit of international peace and freedom to be exchanged in the blink of an eye. But technology is not enough; global- extraordinary episode in the economic was "bound up completely with a third progress of man that age was which came to an end in August 1914! ... The inhabitant of objective: re-establishment of world trade." isation also needs political patronage. Writing in 1973, Charles Kindleberger point- America underwrote the International London could order by telephone, sipping Monetary Fund and the Bretton Woods ed to the importance of an economic hege- mon who would act as an importer of last his morning tea in bed, the various products of the whole Earth, in such quantity as he system of fixed exchange rates to end beggar-thy-neighbour currency devalua resort and financier of the world's monetary might see fit, and reasonably expect their tions, and the General Agreement on Tariffs system. From the mid-1800s until 1914 that early delivery upon his doorstep." and Trade to end trade disputes. hegemon was Britain. In 1846 it unilaterally reduced import tariffs by repealing the Corn Keynes worried, correctly, that the vindictive Treaty of Versailles would further The breakdown of Bretton Woods, two Laws and in 1860 it signed a free-trade oil-price shocks and the Latin American fragment the damaged global economic debt crisis severely tested globalisation in agreement with France, starting a virtuous ling tariffs worldwide. As guaran- system. It tumbled into abyss a decade later the 1970s and 1980s. Fearful of Japan's because, Kindleberger wrote, "Britain could tor of the gold standard, Britain made not act as a stabiliser, and the United States growing economic clout, America turned protectionist. Free trade gave way to man- aged trade. But in 1989 the Berlin Wall fell Open and shut 1 and in 1990 Japan's bubble economy burst. America became the "hyperpower" and Global foreign investment assets as % of sample* GDP presided over an unprecedented expansion 1957: Treaty of Rome signed, 2001: China joins . . 2008: of globalisation. creating the European World Trade These days America is acting less like a Economic Community rganisation Lehman fails hegemon. Americans have grown leerier of .. 18 foreign entanglements and more self- 1939-45: Second world war 1989: Berlin Wall falls . interested on economic matters. America walked away from the Doha trade talks in 1929-39:! 1981: Japan agrees 150 to limit car exports 2008 when it concluded it was getting too Great Depression to America -120 little in return for its own sacrifices, and 1926: Britain returns . Congress has refused to expand the Interna- to gold standard tional Monetary Fund's resources. Many 1971: . Americans think that China is violating the 1914-18: First world war America spirit of free trade. closes gold window, 60 Others also see America as less of a Brettor leader. In a poll earlier this year the Pew Woods Research Centre found that in 23 of 39Since 2008 global financial integration has gone into reverse IN 2005 ITALY'S UniCredit bought HVB, Germany's sec- ond-largest lender, in what at the time was the continent's biggest cross-border bank merger. At a stroke this gave UniCredit a commanding presence in Germany, Austria and Poland. It was widely hailed as a foretaste of deals to come thanks to Europe's single currency. "We will become the first truly European bank," declared Alessandro Profumo, Unicredit's chief at the time. So it was something of a shock when in 2011 Germany's bank regula- tor, BaFin, sought to limit the amount of cash UniCredit could transfer to its Italian parent, fearing that the German unit's finan- cial health might be compromised. This seemed to violate the spirit of free capital movement within Europe, and officials in Brussels complained mously between 2000 and 2007, with 80% of the increase com- ing from Europe, according to Mckinsey. Those flows enabled Finance, the sector that globalised the most in the years debtor countries such as America, Spain and Greece to finance leading up to the crisis, is threatening to go into reverse. Between 1990 and 2007 cross-border bank flows increased about tenfold, housing booms and government deficits without paying puni- tive interest rates. But a large part of those flows reflected banks' to around $5 trillion, according to the Mckinsey Global Institute, own leverage as they both borrowed and lent heavily abroad. the consultancy's research arm. Last year the figure was less than Tellingly, the event that touched off the crisis in the summer a third of that. The decline extended across all regions, though of 2007 was an announcement by France's BNP Paribas that it offered most. This has happened for two reasons. The first is the banks' was suspending redemptions to an investment fund heavily in vested in American mortgage securities. Eventually a number of own efforts to deleverage, either to shed money-losing opera- ions and assets or to meet stiffer capital requirements. The sec- banks across Europe needed government bailouts because of losses sustained on mortgages in America and elsewhere. ond is the realisation that cross-border banks were an important The cost of bailing domestic banks out of foreign misad- channel for transmitting the mortgage crisis in America and the ventures exposed one risk of financial globalisation; the losses sovereign-debt crisis in peripheral Europe to other countries. To sustained by domestic creditors and savers when foreign banks limit such spillovers and save taxpayers having to bail banks out went bust showed up another. In 2008, when Landsbanki, an of their foreign misadventures, regulators around the world are Icelandic bank, went bust, British and Dutch depositors had to seeking to ring-fence their banking systems. be bailed out by their own governments because Iceland would The case for integration guarantee only Icelandic deposits. Sir Mervyn King, the former Before the crisis, the logic of financial globalisation seemed governor of the Bank of England, famously commented that impeccable. Businesses were increasingly operating across bor- "global banks are international in life but national in death." Regulators around the world, working through the Finan- ders and needed banks that could travel with them. America cial Stability Board, an international committee of central bank- and Britain, which excelled at finance, were anxious to market ers, regulators and finance ministers, have since tried to reduce their expertise abroad. A more integrated global economy also the threat of a big bank collapse and the need for a bailout, but needed a financial system to funnel capital from countries with a many of these efforts have undermined banks' incentive and surplus of savings to those with a surplus of investment oppor tunities. Banks had long played that role within countries, taking ability to do business across borders. For example, domestic reg- in deposits in one market and deploying them in another. It ulators used to allow foreign banks to rely on the capital, liquid- ity and regulatory oversight of the foreign parent. Now many of made sense to do the same thing across borders. them are pressing units of foreign banks, and foreign units of do- Recipients of such flows benefited in other ways, too. More mestic banks, to maintain sufficient liquidity and capital inde- efficient foreign banks could force local ones to raise their game. That was why China, for example, listed its state-owned banks pendent of the parent, sometimes by organising themselves as on stock exchanges and permitted foreigners to hold minority subsidiaries rather than branches. stakes. In short order Goldman Sachs, Bank of America, UBS and In America the Federal Reserve will soon require foreign Royal Bank of Scotland took up the offer, though some of them banks above a certain size to collect all their local units into a sin- gle, separately capitalised holding company that meets the same have since sold stakes. In Europe the logic was especially powerful. The benefits of capital and liquidity requirements as American banks do. Until now the Fed has relied on foreign regulators to ensure that the a single currency strongly suggested that there should be a single parent bank can support its units in America. The proposal has banking market as well, so that the interest rates which business- es and households paid were determined by the European Cen- prompted a flurry of opposition. Nor is it just banks that have to abide by tighter rules. Amer- tral Bank (ECB), not the relative health of their local banks. ica's Commodity Futures Trading Commission (CFTC) has ruled Financial globalisation did just what it was meant to, per- that anyone trading swaps with an American bank's foreign unit haps a little too well. Cross-border bank flows expanded enor- must generally go through a central clearing house. Gary Gensrope by 60% since 2010. In some countries regulators have quietly pressed banks to increase domestic lending to boost their economies, at the ex- pense of foreign operations. In others they have been more ex- plicit. Britain's Funding for Lending scheme, launched in 2012, of- fers banks cheap central-bank financing for increasing lending to British households. America's Volcker rule would exempt that country's debt, but not that of other sovereigns, from restrictions on banks' proprietary trading. In retrospect, much of the rise in cross-border lending was foolish. It made both European and American banks more vul- nerable to a sudden drop in asset prices and increased the risk of a credit crunch. Mckinsey's work shows that cross-border bank lending is far more volatile than other capital flows such as bonds, equities and direct investment. Research by the Bank of England shows that over the past decade lending by foreign banks was far more cyclical than by domestic banks. Less financial globalisation should also reduce the risk that contagion from one country's banking problems will cause eco- nomic damage elsewhere. That is the lesson of the Asian bank ler, the CFTC's chairman, rattles off a litany of financial disasters ing crisis of 1997-98. In many countries loans in 1997 exceeded de- nvolving offshore affiliates: AIG had run its derivatives out of posits by 20%, says Mr van Steenis, with the gap made up by London; Lehman's London affiliate had 130,000 outstanding wholesale funding, often from abroad. When that funding dis- swaps contracts, many guaranteed by its American parent; Citi- appeared, many banks teetered on the verge of collapse, prompt- ing the authorities in the countries concerned to put a cap on the group had set up many off-balance-sheet vehicles in the Cay- use of such funding. This had the positive effect that Asian banks man Islands; and JPMorgan Chase earlier this year suffered huge suffered very little contagion from either the American mortgage osses on trades in London. "Risk...comes crashing back to our shores from overseas when a run starts in any part of a modern crisis or the European sovereign-debt crisis. global financial institution," says Mr Gensler. The penalties of self-reliance The CFTC has agreed to exempt foreign swaps customers that operate under similar rules abroad, and the Fed has yet to is- But reduced cross-border links come at a price. If a country suffers a domestic shock, it will have to bear more of the conse- sue its final foreign banking rule. But for the most part American quences itself. Although regulators fret over shocks to a bank's regulators, like their counterparts overseas, have stuck to their foreign parent or withdrawal of that parent's support, Peter guns. "We will not let the pursuit of international consistency force us to lower our standards," said Jack Lew, the Treasury Sec- Sands, the boss of Standard Chartered, a British bank, observes that "there are lots of examples of shocks in the market when the retary, in July. Even when regulatory initiatives are not explicitly discrim support of the parent is needed." International banks provided inatory, they make cross-border banking harder. Benoit Coeure, vital funding to South Korea during its crisis in 1997 and to Dubai a member of the ECB's governing board, notes that Basel 3, a set in 2009 when a state-owned developer almost defaulted. "Inter- national flows of funds in the banking system can be a source of of new international capital and liquidity standards for banks, is being implemented differently across countries: capital is mea contagion but also of resilience," says Mr Sands. sured differently under American and international accounting Financial fragmentation also challenges one of the great promises of globalisation: that savings-poor countries will be rules, and even within Europe, Britain, France and Germany have proposed different bank holding-company structures. "If able to find the wherewithal to finance essential investment by borrowing abroad. In theory, if capital is free to seek the highest you have an idiosyncratic local legal environment, then market participants will find it safer just to play on their home turf be- potential return, domestic saving and investment should not be correlated. In 1980 Martin Feldstein and Charles Horioka docu- cause of the legal uncertainty that goes with international activ- ities, and we'll lose the benefit of international financial integra- mented that in fact they are, suggesting that national borders > tion," he says. Such changes have undermined the case for global banks. Huw van Steenis at Morgan Stanley comments that "if I'm a Ger- Getting back to normal 2 man bank, one of my edges is I have really cheap funding in Ger- Correlation between saving and investment many because I have more deposits than loans. If that advantage 1.00=perfect correlation goes away, one of their unique selling points goes, too." Morgan 1.00 Stanley estimates that banks' cross-border claims within the euro zone have fallen from nearly $4 trillion in mid-2008 to Non-euro-area OECD .. 0.75 about half that amount now

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts