Question: PLEASE ANSWER QUESTION 13 from the info in 12 Chapter 14 Questions and Problems 12. Book Value vs. Market Value: Dinklage Corp. has 8 million

PLEASE ANSWER QUESTION 13 from the info in 12

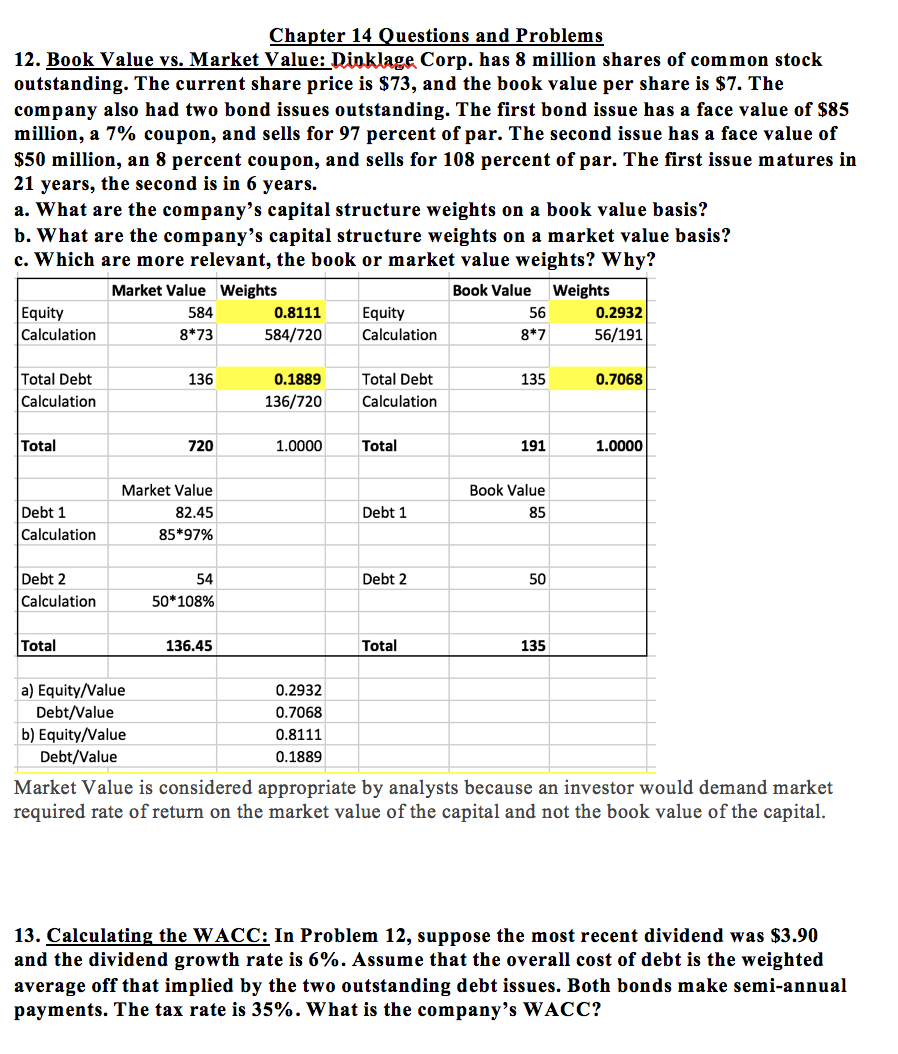

Chapter 14 Questions and Problems 12. Book Value vs. Market Value: Dinklage Corp. has 8 million shares of common stock outstanding. The current share price is $73, and the book value per share is $7. The company also had two bond issues outstanding. The first bond issue has a face value of $85 million, a 7% coupon, and sells for 97 percent of par. The second issue has a face value of $50 million, an 8 percent coupon, and sells for 108 percent of par. The first issue matures in 21 years, the second is in 6 years. a. What are the company's capital structure weights on a book value basis? b. What are the company's capital structure weights on a market value basis? c. Which are more relevant, the book or market value weights? Why? Market Value Weights Book Value Weights Equity 584 0.8111 Equity 56 0.2932 Calculation 8*73 584/720 Calculation 8*7 56/191 136 135 0.7068 Total Debt Calculation 0.1889 136/720 Total Debt Calculation Total 720 1.0000 Total 191 1.0000 Book Value Market Value 82.45 85*97% Debt 1 Calculation Debt 1 Debt 2 50 Debt 2 Calculation 54 50*108% Total 136.45 Total 135 a) Equity/Value 0.2932 Debt/Value 0.7068 b) Equity/Value 0.8111 Debt/Value 0.1889 Market Value is considered appropriate by analysts because an investor would demand market required rate of return on the market value of the capital and not the book value of the capital. 13. Calculating the WACC: In Problem 12, suppose the most recent dividend was $3.90 and the dividend growth rate is 6%. Assume that the overall cost of debt is the weighted average off that implied by the two outstanding debt issues. Both bonds make semi-annual payments. The tax rate is 35%. What is the company's WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts