Question: Please answer question 13,14,15 thank you different part Answer the following questions. A company is analyzing an independent project, S, whose cash flows are shown

Please answer question 13,14,15 thank you different part

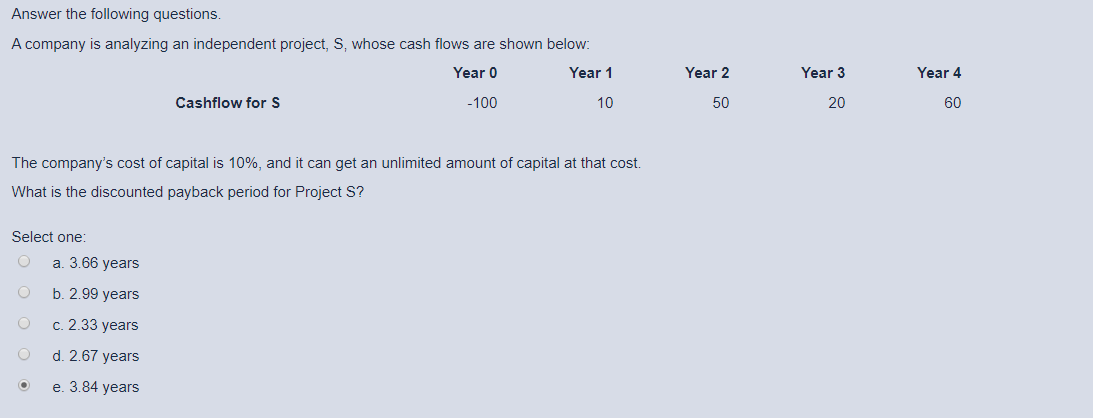

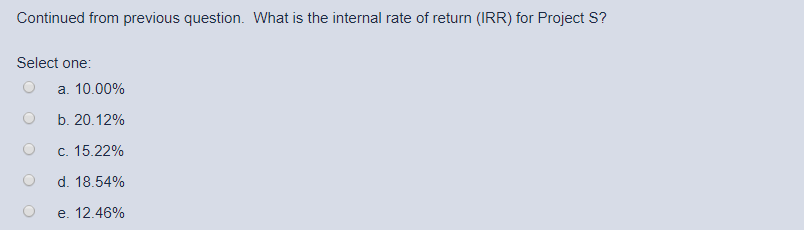

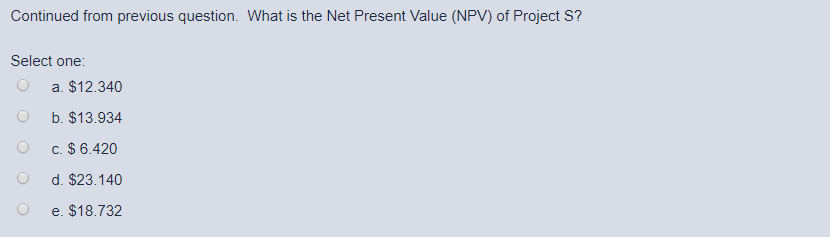

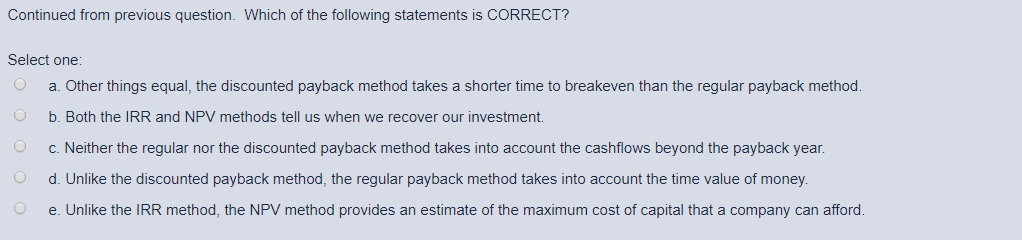

Answer the following questions. A company is analyzing an independent project, S, whose cash flows are shown below: Year o Year 1 Year 2 Year 3 Year 4 Cashflow for S -100 10 50 20 60 The company's cost of capital is 10%, and it can get an unlimited amount of capital at that cost. What is the discounted payback period for Project S? Select one: a. 3.66 years b. 2.99 years O c. 2.33 years d. 2.67 years O e. 3.84 years Continued from previous question. What is the internal rate of return (IRR) for Project S? Select one: a. 10.00% b. 20.12% C. 15.22% d. 18.54% e. 12.46% Continued from previous question. What is the Net Present Value (NPV) of Project S? Select one: a. $12.340 b. $13.934 c. $ 6.420 O d. $23.140 e. $18.732 Continued from previous question. Which of the following statements is CORRECT? Select one: a. Other things equal, the discounted payback method takes a shorter time to breakeven than the regular payback method. b. Both the IRR and NPV methods tell us when we recover our investment. c. Neither the regular nor the discounted payback method takes into account the cashflows beyond the payback year. d. Unlike the discounted payback method, the regular payback method takes into account the time value of money. e. Unlike the IRR method, the NPV method provides an estimate of the maximum cost of capital that a company can afford

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts