Question: PLEASE ANSWER Question 17 3 pts What is the value of the following growing perpetuity if the payment in year 1 is $125, the interest

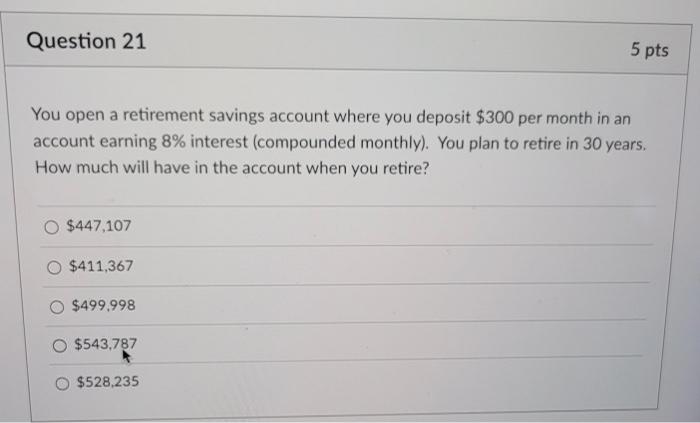

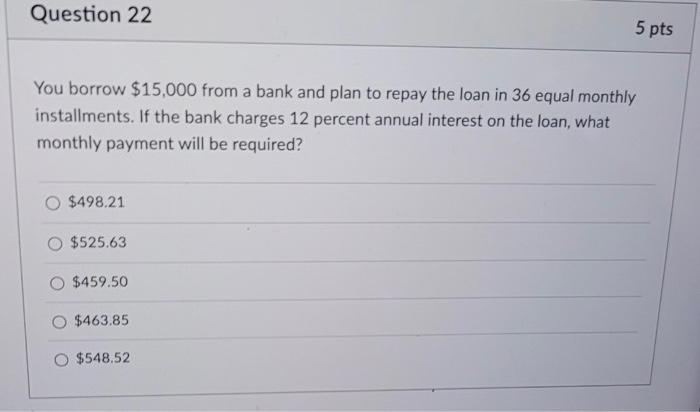

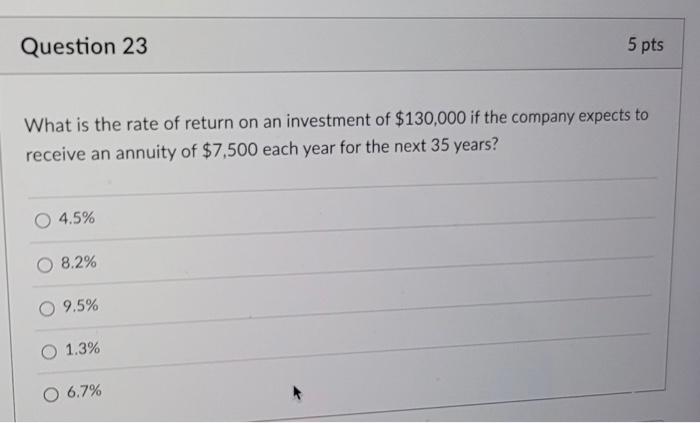

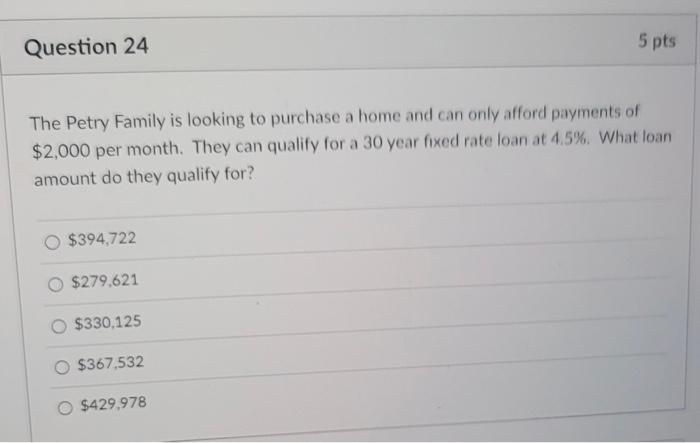

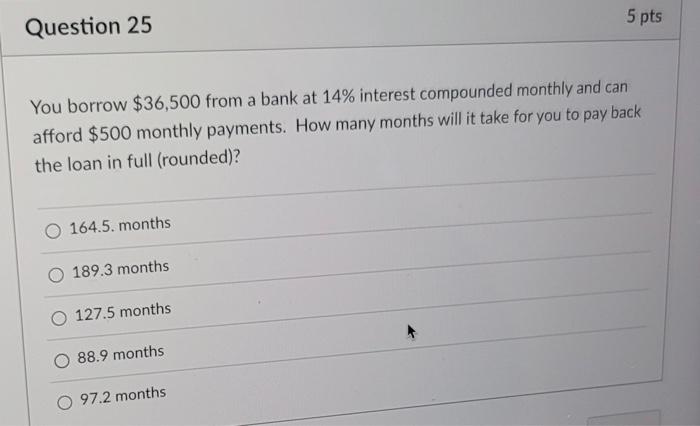

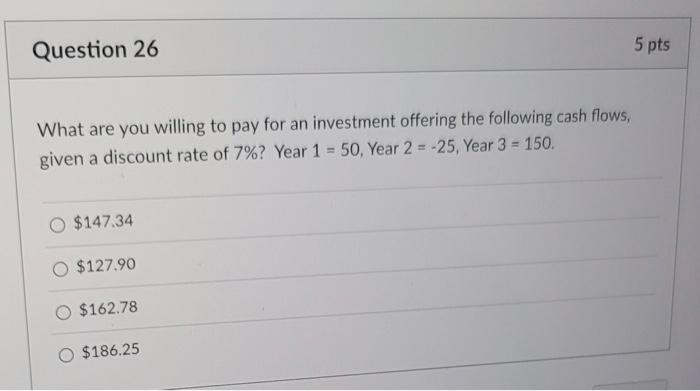

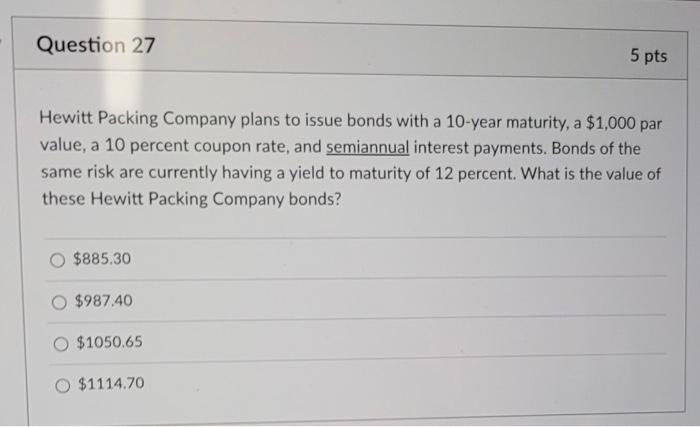

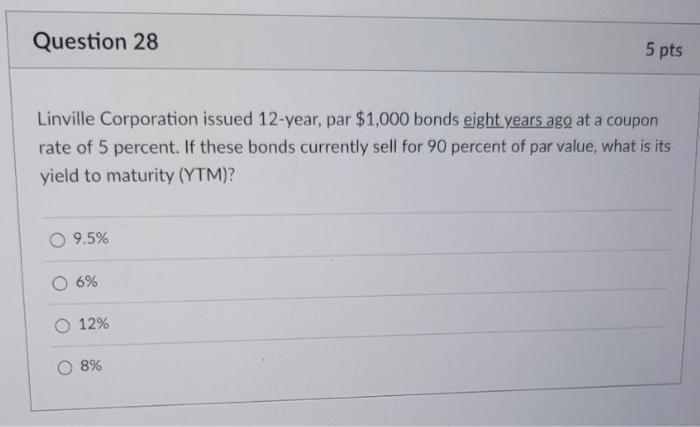

Question 17 3 pts What is the value of the following growing perpetuity if the payment in year 1 is $125, the interest rate is 7%, and the growth rate per period is 3% (Rounded)? O 3125 2200 O 1537 2500 4122 Question 21 5 pts You open a retirement savings account where you deposit $300 per month in an account earning 8% interest (compounded monthly). You plan to retire in 30 years. How much will have in the account when you retire? O $447,107 O $411,367 $499,998 O $543,787 $528,235 Question 22 5 pts You borrow $15,000 from a bank and plan to repay the loan in 36 equal monthly installments. If the bank charges 12 percent annual interest on the loan, what monthly payment will be required? $498.21 O $525.63 $459.50 $463.85 $548.52 Question 23 5 pts What is the rate of return on an investment of $130,000 if the company expects to receive an annuity of $7,500 each year for the next 35 years? 4.5% 8.2% 9.5% O 1.3% O 6.7% Question 24 5 pts The Petry Family is looking to purchase a home and can only afford payments of $2,000 per month. They can qualify for a 30 year fixed rate loan at 4.5%. What loan amount do they qualify for? $394,722 $279.621 $330,125 $367,532 $429,978 5 pts Question 25 You borrow $36,500 from a bank at 14% interest compounded monthly and can afford $500 monthly payments. How many months will it take for you to pay back the loan in full (rounded)? O 164.5. months 189.3 months 127.5 months O 88.9 months 97.2 months Question 26 5 pts What are you willing to pay for an investment offering the following cash flows, given a discount rate of 7%? Year 1 = 50, Year 2 = -25, Year 3 - 150. $147.34 $127.90 $162.78 O $186.25 Question 27 5 pts Hewitt Packing Company plans to issue bonds with a 10-year maturity, a $1,000 par value, a 10 percent coupon rate, and semiannual interest payments. Bonds of the same risk are currently having a yield to maturity of 12 percent. What is the value of these Hewitt Packing Company bonds? $885.30 $987.40 $1050.65 $1114.70 Question 28 5 pts Linville Corporation issued 12-year, par $1,000 bonds eight years ago at a coupon rate of 5 percent. If these bonds currently sell for 90 percent of par value, what is its yield to maturity (YTM)? O 9.5% 6% 12% 8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts