Question: please answer question 2 parts A,B,C B&B has a new baby powder ready to market. If the firm goes directly to the market with the

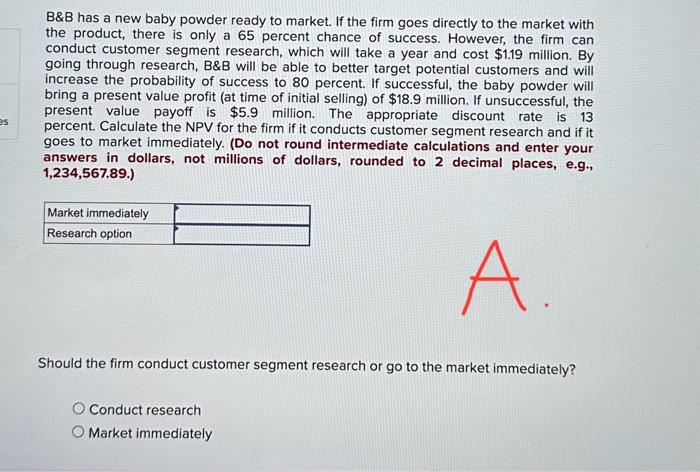

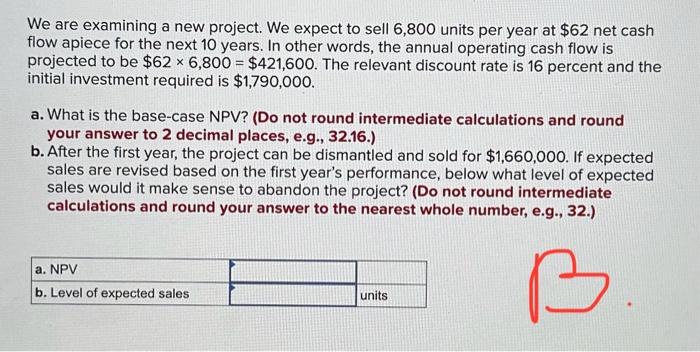

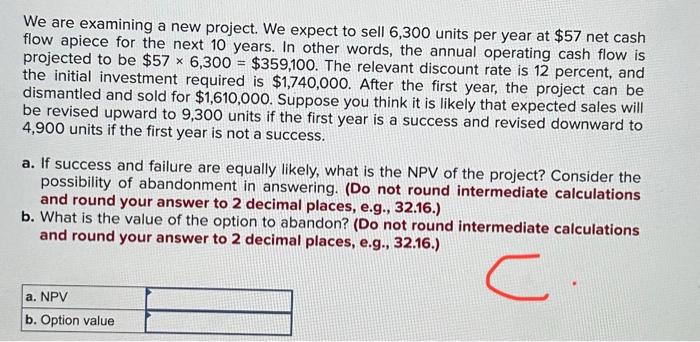

B\&B has a new baby powder ready to market. If the firm goes directly to the market with the product, there is only a 65 percent chance of success. However, the firm can conduct customer segment research, which will take a year and cost $1.19 million. By going through research, B&B will be able to better target potential customers and will increase the probability of success to 80 percent. If successful, the baby powder will bring a present value profit (at time of initial selling) of $18.9 million. If unsuccessful, the present value payoff is $5.9 million. The appropriate discount rate is 13 percent. Calculate the NPV for the firm if it conducts customer segment research and if it goes to market immediately. (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89. Should the firm conduct customer segment research or go to the market immediately? Conduct research Market immediately We are examining a new project. We expect to sell 6,800 units per year at $62 net cash flow apiece for the next 10 years. In other words, the annual operating cash flow is projected to be $626,800=$421,600. The relevant discount rate is 16 percent and the initial investment required is $1,790,000. a. What is the base-case NPV? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. After the first year, the project can be dismantled and sold for $1,660,000. If expected sales are revised based on the first year's performance, below what level of expected sales would it make sense to abandon the project? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) We are examining a new project. We expect to sell 6,300 units per year at $57 net cash flow apiece for the next 10 years. In other words, the annual operating cash flow is projected to be $576,300=$359,100. The relevant discount rate is 12 percent, and the initial investment required is $1,740,000. After the first year, the project can be dismantled and sold for $1,610,000. Suppose you think it is likely that expected sales will be revised upward to 9,300 units if the first year is a success and revised downward to 4,900 units if the first year is not a success. a. If success and failure are equally likely, what is the NPV of the project? Consider the possibility of abandonment in answering. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the value of the option to abandon? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts