Question: please answer question 2. step by step. Problem 2(16pts) We want to form an index using the five stocks presented in the below table: A.

please answer question 2. step by step.

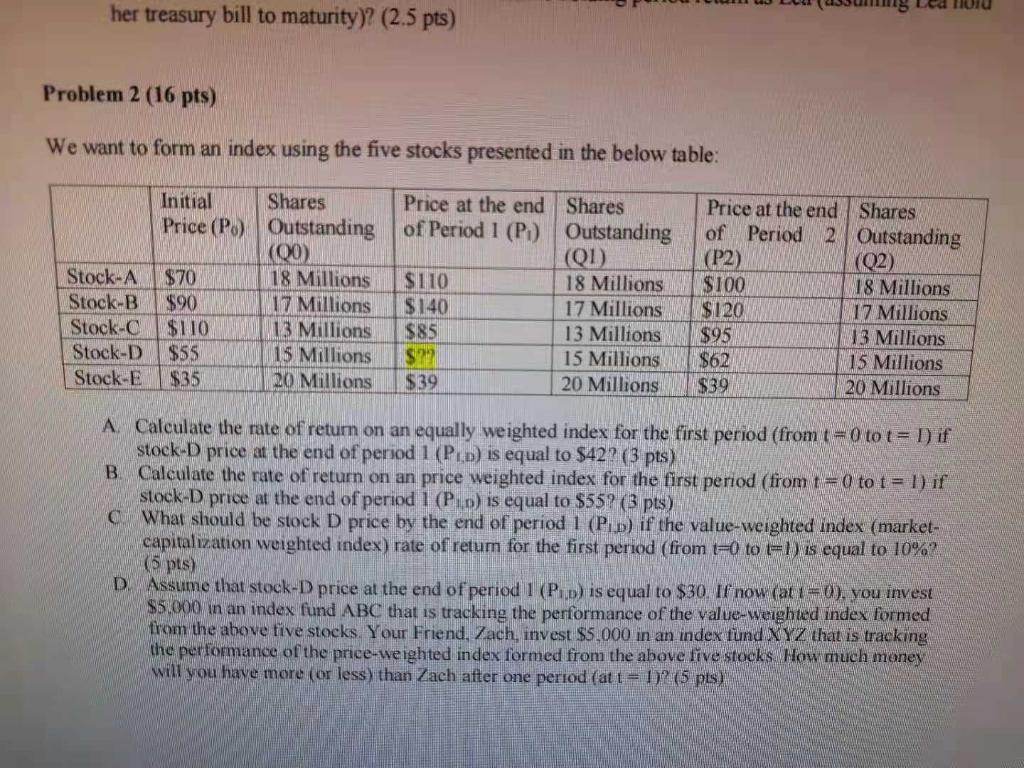

Problem 2(16pts) We want to form an index using the five stocks presented in the below table: A. Calculate the rate of return on an equally weighted index for the first period (from t=0 to t=1 ) if stock-D price at the end of period 1(P1,D) is equal to $42?(3pts) B. Calculate the rate of return on an price weighted index for the first period (from t=0 to t=1 ) if stock-D price at the end of period 1(P,p) is equal to $55 ? (3 pts) C. What should be stock D price by the end of period 1(P1) if the value-weighted index (marketcapitalization weighted index) rate of retum for the first period (from t=0 to t=1 ) is equal to 10% ? (5pts) D. Assume that stock-D price at the end of period 1(P,b) is equal to $30. If now (at t=0 ), you invest $5,000 in an index fund ABC that is tracking the performance of the value-weighted index formed from the above five stocks. Your Friend, Zach, invest $5,000 in an index fund XYZ that is tracking the performance of the price-weighted index formed from the above five stocks. How much money will you have more (or less) than Zach after one period (at t=1)2(5pts) Problem 2(16pts) We want to form an index using the five stocks presented in the below table: A. Calculate the rate of return on an equally weighted index for the first period (from t=0 to t=1 ) if stock-D price at the end of period 1(P1,D) is equal to $42?(3pts) B. Calculate the rate of return on an price weighted index for the first period (from t=0 to t=1 ) if stock-D price at the end of period 1(P,p) is equal to $55 ? (3 pts) C. What should be stock D price by the end of period 1(P1) if the value-weighted index (marketcapitalization weighted index) rate of retum for the first period (from t=0 to t=1 ) is equal to 10% ? (5pts) D. Assume that stock-D price at the end of period 1(P,b) is equal to $30. If now (at t=0 ), you invest $5,000 in an index fund ABC that is tracking the performance of the value-weighted index formed from the above five stocks. Your Friend, Zach, invest $5,000 in an index fund XYZ that is tracking the performance of the price-weighted index formed from the above five stocks. How much money will you have more (or less) than Zach after one period (at t=1)2(5pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts