Question: please answer question 2 steps 1-3 Question 2: Vehicle Purchasing (115.4) 1 Suppose you are planning to buy a car. How much income will be

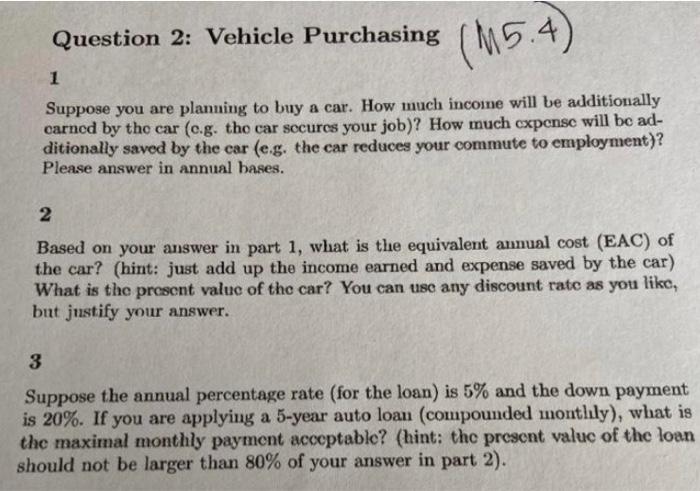

Question 2: Vehicle Purchasing (115.4) 1 Suppose you are planning to buy a car. How much income will be additionally carned by the car (c.g. the car socures your job)? How much cxpcnsc will be ad- ditionally saved by the car (eg, the car reduces your commute to employment)? Please answer in annual bases. 2 Based on your answer in part 1, what is the equivalent annual cost (EAC) of the car? (hint: just add up the income earned and expense saved by the car) What is the present value of the car? You can use any discount rate as you like, but justify your answer. 3 Suppose the annual percentage rate (for the loan) is 5% and the down payment is 20%. If you are applying a 5-year auto loan (compounded monthly), what is the maximal monthly payment acceptable? (hint: the present value of the loan should not be larger than 80% of your answer in part 2). Question 2: Vehicle Purchasing (115.4) 1 Suppose you are planning to buy a car. How much income will be additionally carned by the car (c.g. the car socures your job)? How much cxpcnsc will be ad- ditionally saved by the car (eg, the car reduces your commute to employment)? Please answer in annual bases. 2 Based on your answer in part 1, what is the equivalent annual cost (EAC) of the car? (hint: just add up the income earned and expense saved by the car) What is the present value of the car? You can use any discount rate as you like, but justify your answer. 3 Suppose the annual percentage rate (for the loan) is 5% and the down payment is 20%. If you are applying a 5-year auto loan (compounded monthly), what is the maximal monthly payment acceptable? (hint: the present value of the loan should not be larger than 80% of your answer in part 2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts