Question: Please answer question 3, 12, 14, 19, 24, and 25. L e pa LU LUSU based on your trade-in value of the vehicle at the

Please answer question 3, 12, 14, 19, 24, and 25.

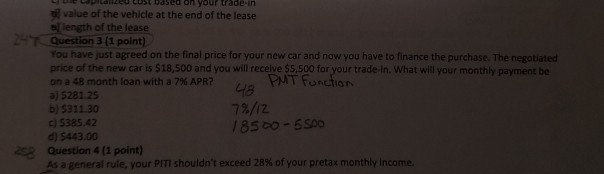

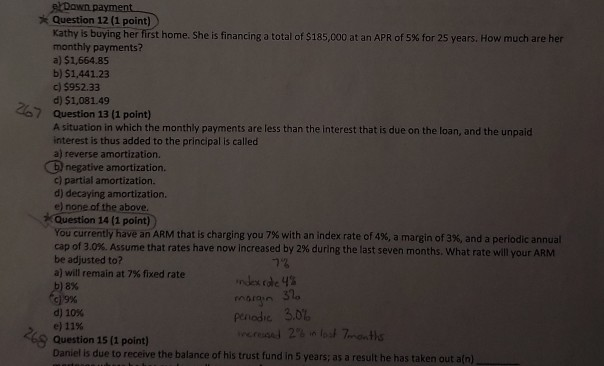

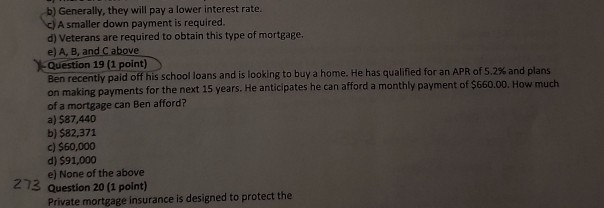

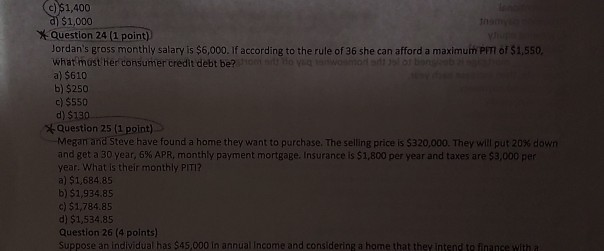

L e pa LU LUSU based on your trade-in value of the vehicle at the end of the lease l length of the lease Question 3 (1 point) You have just agreed on the final price for your new car and now you have to finance the purchase. The negotiated price of the new car is $18,500 and you will receive $5,500 for your trade in. What will your monthly payment be on a 48 month loan with a 7% APR? wo PMT Function al 5281 25 b) 5311.30 7%/12 c) 5385.42 18500 - 5500 d) 5443.00 Question 4 (1 point) As a general rule, your PITI shouldn't exceed 28% of your pretax monthly income. s Down payment Question 12 (1 point) Kathy is buying her first home. She is financing a total of $185,000 at an APR of 5% for 25 years. How much are her monthly payments? a) $1,664.85 b) $1,441.23 c) $952.33 d) $1,081.49 Question 13 (1 point) A situation in which the monthly payments are less than the interest that is due on the loan, and the unpaid interest is thus added to the principal is called a) reverse amortization. negative amortization. c) partial amortization. d) decaying amortization. e) none of the above. Question 14 (1 point) You currently have an ARM that is charging you 7% with an index rate of 4%, a margin of 3%, and a periodic annual cap of 3.0%. Assume that rates have now increased by 2% during the last seven months. What rate will your ARM be adjusted to? a) will remain at 7% fixed rate b) 8% indexrote 48 g 9% margin 31 d) 10% penodic 3.0% e) 11% 569 Question 15 (1 point) increased 2 6 in lost months Daniel is due to receive the balance of his trust fund in 5 years, as a result he has taken out an) 7% b) Generally, they will pay a lower interest rate. c) A smaller down payment is required. d) Veterans are required to obtain this type of mortgage. e) A, B, and C above -Question 19 (1 point) Ben recently paid off his school loans and is looking to buy a home. He has qualified for an APR of 5.2% and plans on making payments for the next 15 years. He anticipates he can afford a monthly payment of $660.00. How much of a mortgage can Ben afford? a) $87,440 b) $82,371 c) $60,000 d) $91,000 e) None of the above 213 Question 20 (1 point) Private mortgage insurance is designed to protect the c) $1,400 a) $1,000 * Question 24 (1 point) Jordan's gross monthly salary is $6,000. If according to the rule of 36 she can afford a maximum PTI of $1,550, What must her consumer credit debt be? do y a) $610 b) $250 c) $550 d) $180 *Question 25 (1 point) Megan and Steve have found a home they want to purchase. The selling price is $320,000. They will put 20% down and get a 30 year, 6% APR, monthly payment mortgage. Insurance is $1,800 per year and taxes are $3,000 per year. What is their monthly PITI? a) $1,684.85 b) $1,934.85 c) $1,784.85 d) $1,534.85 Question 26 (4 points) Suppose an individual has $45,000 in annual income and considering a home that they intend to finance with a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts