Question: please answer question 20 that refers back to question 19 Question 20 5 pts What gross amount would the mortgage company receive from the origination

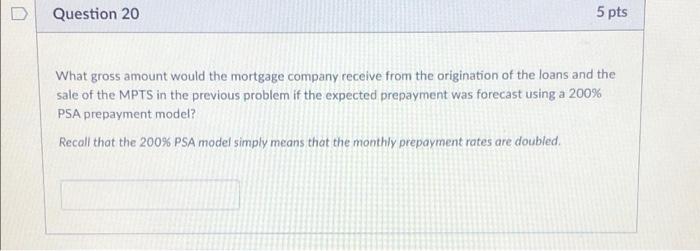

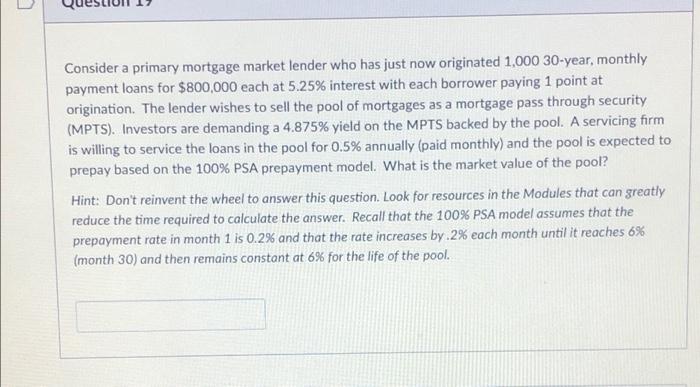

Question 20 5 pts What gross amount would the mortgage company receive from the origination of the loans and the sale of the MPTS in the previous problem if the expected prepayment was forecast using a 200% PSA prepayment model? Recall that the 200% PSA model simply means that the monthly prepayment rates are doubled. Consider a primary mortgage market lender who has just now originated 1,000 30-year, monthly payment loans for $800,000 each at 5.25% interest with each borrower paying 1 point at origination. The lender wishes to sell the pool of mortgages as a mortgage pass through security (MPTS). Investors are demanding a 4.875% yield on the MPTS backed by the pool. A servicing firm is willing to service the loans in the pool for 0.5% annually (paid monthly) and the pool is expected to prepay based on the 100% PSA prepayment model. What is the market value of the pool? Hint: Don't reinvent the wheel to answer this question. Look for resources in the Modules that can greatly reduce the time required to calculate the answer. Recall that the 100% PSA model assumes that the prepayment rate in month 1 is 0.2% and that the rate increases by.2% each month until it reaches 6% (month 30) and then remains constant at 6% for the life of the pool. Question 20 5 pts What gross amount would the mortgage company receive from the origination of the loans and the sale of the MPTS in the previous problem if the expected prepayment was forecast using a 200% PSA prepayment model? Recall that the 200% PSA model simply means that the monthly prepayment rates are doubled. Consider a primary mortgage market lender who has just now originated 1,000 30-year, monthly payment loans for $800,000 each at 5.25% interest with each borrower paying 1 point at origination. The lender wishes to sell the pool of mortgages as a mortgage pass through security (MPTS). Investors are demanding a 4.875% yield on the MPTS backed by the pool. A servicing firm is willing to service the loans in the pool for 0.5% annually (paid monthly) and the pool is expected to prepay based on the 100% PSA prepayment model. What is the market value of the pool? Hint: Don't reinvent the wheel to answer this question. Look for resources in the Modules that can greatly reduce the time required to calculate the answer. Recall that the 100% PSA model assumes that the prepayment rate in month 1 is 0.2% and that the rate increases by.2% each month until it reaches 6% (month 30) and then remains constant at 6% for the life of the pool

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts