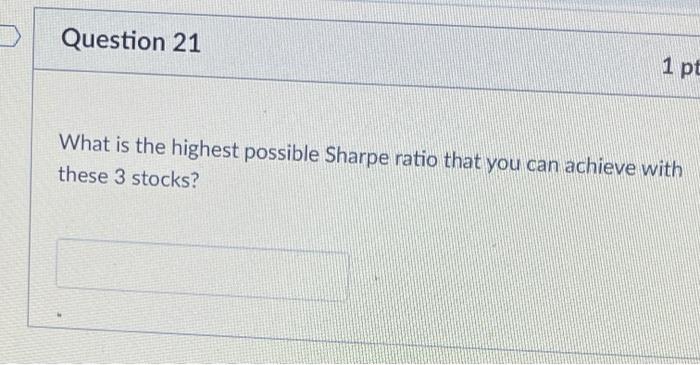

Question: please answer question 21 using question 16 info Question 21 1 pt What is the highest possible Sharpe ratio that you can achieve with these

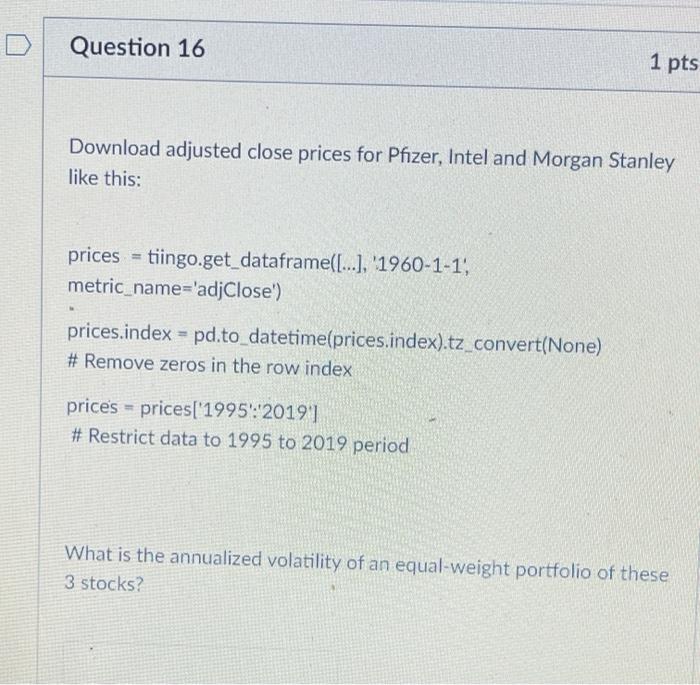

Question 21 1 pt What is the highest possible Sharpe ratio that you can achieve with these 3 stocks? Question 16 1 pts Download adjusted close prices for Pfizer, Intel and Morgan Stanley like this: prices = tiingo.get_dataframe{[...], 1960-1-1, metric_name='adjClose') prices.index = pd.to_datetime(prices.index).tz_convert(None) # Remove zeros in the row index price's - prices['1995':'2019'] # Restrict data to 1995 to 2019 period What is the annualized volatility of an equal weight portfolio of these 3 stocks? Question 21 1 pt What is the highest possible Sharpe ratio that you can achieve with these 3 stocks? Question 16 1 pts Download adjusted close prices for Pfizer, Intel and Morgan Stanley like this: prices = tiingo.get_dataframe{[...], 1960-1-1, metric_name='adjClose') prices.index = pd.to_datetime(prices.index).tz_convert(None) # Remove zeros in the row index price's - prices['1995':'2019'] # Restrict data to 1995 to 2019 period What is the annualized volatility of an equal weight portfolio of these 3 stocks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts