Question: Please answer question 2(a) based in the information given in i,ii & iii and also based on the marks given 2. (a) Casabella has RM10,000

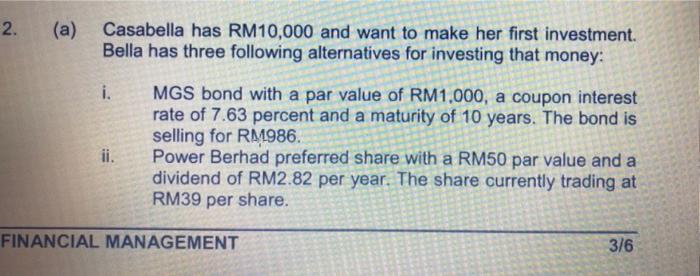

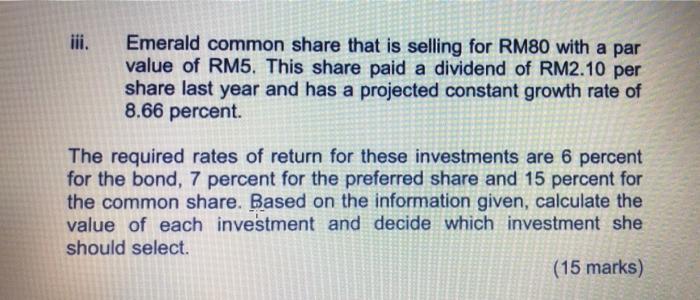

2. (a) Casabella has RM10,000 and want to make her first investment. Bella has three following alternatives for investing that money: i. MGS bond with a par value of RM1,000, a coupon interest rate of 7.63 percent and a maturity of 10 years. The bond is selling for RM986. Power Berhad preferred share with a RM50 par value and a dividend of RM2.82 per year. The share currently trading at RM39 per share. ii. FINANCIAL MANAGEMENT 3/6 iii. Emerald common share that is selling for RM80 with a par value of RM5. This share paid a dividend of RM2.10 per share last year and has a projected constant growth rate of 8.66 percent. The required rates of return for these investments are 6 percent for the bond, 7 percent for the preferred share and 15 percent for the common share. Based on the information given, calculate the value of each investment and decide which investment she should select. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts